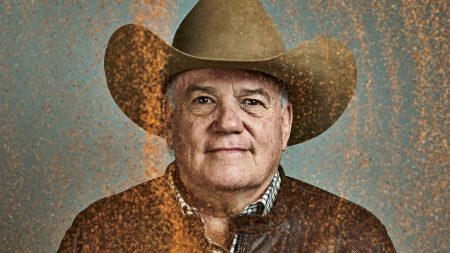

Venture Global’s recent initial public offering (IPO), the largest of the year so far, marks a significant milestone for the liquefied natural gas (LNG) exporter, despite facing lukewarm investor reception. The company raised $1.75 billion by selling a mere 3% of its equity, valuing the company at an impressive $50 billion. This successful IPO, while experiencing a post-offering stock dip, solidifies Venture Global’s presence in the public market and highlights the remarkable wealth creation achieved by its co-founders, Robert Pender and Mike Sabel, whose combined holdings now reach an estimated $20 billion.

Venture Global’s success is rooted in the strategic development of two major LNG projects on the Louisiana coast: Calcasieu Pass and Plaquemines Parish. These facilities are poised to export a substantial 30 million tons of LNG annually, positioning the company as the second largest LNG exporter in the United States, trailing only Cheniere Energy. Pender and Sabel, retaining 84% ownership and all supervoting shares, have skillfully navigated the complex landscape of project development, financing, and execution over the past decade. Their leadership has driven impressive financial performance, with Venture Global reporting substantial net income figures – $1.9 billion in 2022, $2.7 billion in 2023, and $600 million in the first nine months of 2024, accompanied by a remarkable $7.9 billion in revenue in 2023.

The company’s success story, however, is not without controversy. Venture Global adopted a non-traditional approach to LNG plant design, opting for 18 smaller, modular processing trains at Calcasieu Pass, a departure from the industry standard of fewer, larger trains. While this modular approach promised faster construction, it also led to an extended commissioning process, causing friction with contracted buyers like Shell and BP, who were anticipating timely delivery of LNG cargoes. This delay coincided with a surge in global LNG prices following Russia’s invasion of Ukraine, creating a lucrative opportunity for Venture Global.

Instead of fulfilling its contractual obligations, Venture Global capitalized on the volatile market by selling its LNG on the spot market, generating an estimated $6 billion in profit. This decision sparked outrage among its contracted buyers, who argued that these profits rightfully belonged to them. Shell, in particular, publicly criticized Venture Global’s actions, accusing the company of deceitful practices and warning of the potential damage to the industry. Several companies, including Shell, BP, Repsol, and Galp, have initiated arbitration proceedings, seeking compensation for the perceived breach of contract, amounting to $6 billion in claims.

Venture Global’s financial strategy further complicates its narrative. While the company boasts a robust $48 billion market capitalization, it also carries a significant debt burden of $27 billion, resulting in a total enterprise value of $75 billion. This valuation, representing approximately 55 times the company’s average net income over the past two years, raises concerns about its long-term financial health, especially when compared to industry leader Cheniere Energy. Cheniere, with a similar market capitalization and debt level, but a more established track record and less contentious relationships with its customers, appears to be a more financially sound investment.

Despite the controversies and financial complexities, Venture Global maintains ambitious growth plans, with three additional Gulf Coast megaprojects in the pipeline, estimated to cost over $100 billion. However, the company acknowledges the challenge of securing financing for these ventures, casting uncertainty over its future expansion. While Pender and Sabel’s control over the company remains secure due to their supervoting shares, the company’s aggressive market tactics and high valuation raise questions about its ability to attract the necessary capital to execute its ambitious growth strategy.

The long-term success of Venture Global hinges on its ability to navigate several crucial challenges. The ongoing arbitration proceedings with its disgruntled customers pose a significant financial and reputational risk. The company’s high valuation, especially in comparison to its more established competitors, requires sustained growth and profitability to justify investor confidence. Finally, the company needs to secure substantial funding for its future projects, which may prove difficult given its recent controversial actions and high debt levels. The coming years will be critical for Venture Global as it strives to balance its ambitious growth plans with the need to rebuild trust with its customers and investors. The company’s ability to successfully navigate these challenges will determine whether its audacious gamble on the LNG market ultimately pays off.