Introduction and Purpose of the Green Fee Bill

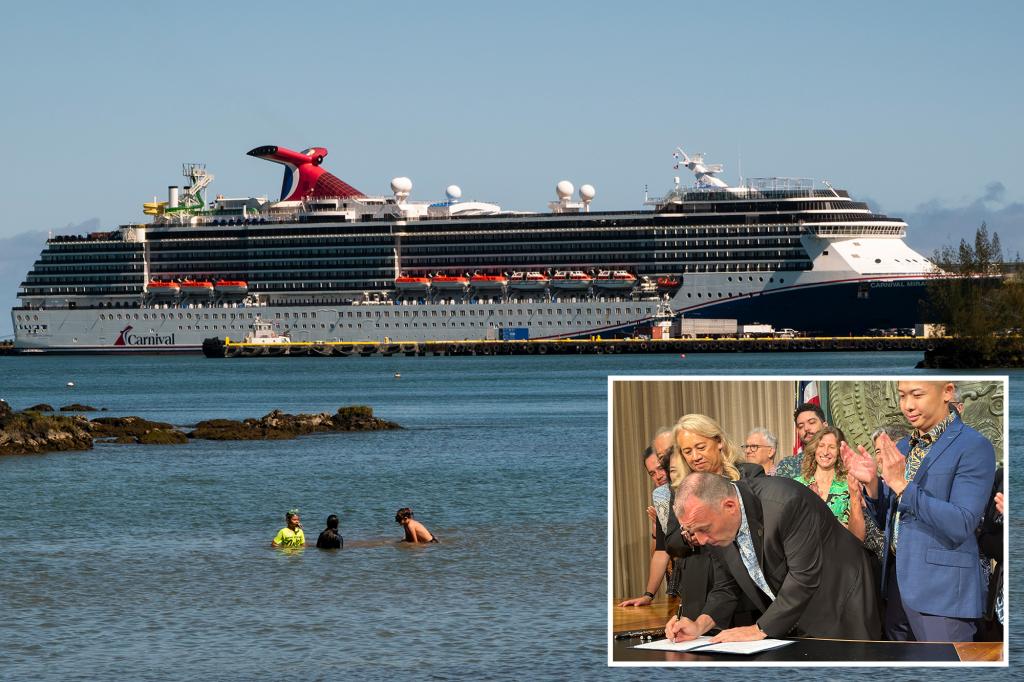

Josh Green, Hawaiian Gov. Josh Green, has introduced a new Green Fee bill in Hawaii that aims to raise the state’s tourism taxes to address climate change concerns. As abihaskan Democrat, the bill, which hasn’t seen it before, will increase the tax on hotels on the Hawaii State明白券 to 11% in January and 12% in the following year. This move is likely intended to fund programs such as the Climate Mitigation and Resiliency Special Fund and the Economic Development and Revitalization Special Fund. The bill incorporates measures to combat invasive species, preserve wildlife, and improve beach management and restoration.

Revenue Sources and Fund Funding

According to the bill, the revenue raised will be distributed as follows: 38% will go to the Climate Mitigation and Resiliency Special Fund, another 38% will be allocated to the Economic Development and Revitalization Special Fund, and 24% will go towards the Green Jobs Youth Corps. These funds are intended to provide financial support and long-term programs to promote environmental health and economic resilience in the state. Additionally, the bill emphasizes the importance of green jobs and environmental enforcement to attract and retain visitors to KOIK.

Impact on thecale of Tourism

The bill follows the state’s experience of raising short-term stay taxes by 10.25% annually. Hawaii attracts over 9.6 million visitors each year, a significant portion of which are short-term stays. The Green Fee could impact the hospitality sector by increasing costs for businesses and visitors alike, potentially affecting their choices in travel and business. However, earlier reported tax increases from 2017 to 2022 indicate that Hawaii has implemented a more gradual approach to tax changes, which may mitigate some of the economic pressures faced by visitors.

Economic Benefits and Global Impact

The bill reflects Hawaii’s commitment to ecological and economic sustainability, with a focus on improving the defended natural resources and enhancing the health and safety of its communities. The Climate Mitigation and Resiliency Special Fund includes grants and priorities for beach management, conservation, and technology advancement, which could lead to reduced pollution and altered habitats. These measures have a direct impact on the health of the state’s ecosystems and its residents, potentially benefiting coastal communities globally.

Broader Context and Future Directions

In addition to its immediate tax increase concerns, the bill also includes measures to protect Hawaii from invasive species and improve environmental conditions. While the financial support from taxes is a key focus, there will be considerations of long-term enforcement and economic policies to sustain growth and attract investment in related industries. The campaign for the Green Jobs Youth Corps highlights the importance of education and retention for future generations of Hawaii’s businesses, reflecting the state’s long-standing push for sustainable development.

In conclusion, the Green Fee bill is a significant initiative to address climate-related challenges and enhance the state’s environmental and economic health. By focusing on tax revenue, funding for conservation and growth, and ensuringPoly ampal责nshaiones, the bill aims to create a climate-resilient and thriving Alliance for Hawaii. As the state moves forward, its commitment to maintaining its position as a model of sustainability will continue to be evident.