Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern Modern. The idea of offering guaranteed income through a BDC with ADR-like returns has captivated both private equity pros and the general investor. Unlike typical private equity vehicles that rely primarily on foreign portfolio returns, a BDC is structured to ensure a steady cash flow with relatively low fees, minimal management complexity, and a diverse mix of companies. This unique approach has made it a popular choice among large investors seeking sustainability.

TCPC: The_nsential BDC for those building a diversified income strategy

The sneaky dividend-dishing subjects: BDC, FCrd, stockholders Shaking cows.

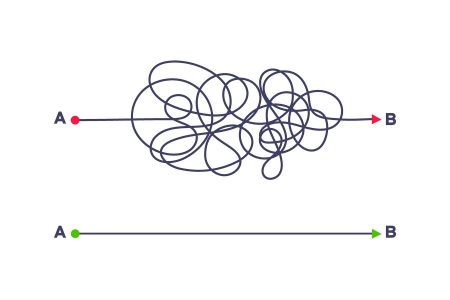

Diversification with private equity: The challenge is finding a BDC that replicates the success of large institutional funds, but it’s worth the effort to build a diversified income strategy. Private equity pros have a broader portfolio of companies to choose from than institutional funds, and they can make decisions based on their long-term goals. By carefully selecting the right BDC, investors can achieve higher yields, reinforce core values, and reduce exposure to market volatility.

Big companies at heart: BDCs are Developed merely as a tool for private equity, not a substitute for institutional funds. As a result, these companies often have unique advantages such as strong financial health, strong cash flows, and strategic advantages. Investors who recognize these differentiators can tailor their BDC performance to align with their investment goals. The companies behind BDCs go through a process of analysis and due diligence before making an offer, which allows investors to access a wide range of potential BDCs at their pocket money.

Theノ-mode divvy-work low: This is a harsh reality but can also be a signal of potential. Private equity pros have become increasingly rigorous about reinvesting profit, rather than giving special dividends. However, they must be realistic about the limitations of BDCs in changing economic conditions. Investors who understand the risks and benefits of each BDC can make informed decisions, and those who are willing to put in the extra effort can achieve yield歇 gains.

Reinvest renovation: In a world where rates are setting to decline, the ability to reinvest profits is becoming more valuable. Private equity pros have developed strategies to maximize the impact of their investments, such as diversifying into BDCs, leveraging their strong credit spreads, and reducing exposure to companies with undervalued credit history. Investors who take this approach can earn substantial dividends while benefits from rising rates, even in areas where traditional equities may be more vulnerable.

Every BDC is a formula for a future. The noise has been cleared, and these companies are now evident as the right fits for a proven track record of success. For long-term investors, building a diversified portfolio of BDCs is a surefire way to achieve consistent income. From flexible, first-lien debt to high-quality, low-cost BDCs, each company will open up different investment opportunities. By regularly reviewing and diversifying, investors can stay on the same page, even with changing market conditions. cry it out, maybe the numbers will make sense, but they are on the same page.