Adatheo Hart is an investment banker and media executive who has written an article for a financial m协会 about a potential opportunity with Adobe (NASDAQ: ADBE). The article highlights Adobe’s inverse relationship with its earnings, where negative earnings outcomes typically lead to selling pressures, and suggests an opportunity to exploit short-term volatility by buying 2% out-of-the-money put options one day before the earnings report on June 12. The author argues that this is a short-term trading strategy that relies on historical data showing that Adobe’s earnings patterns often lead to short-term selling pressure. The article also discusses the potential risks and reward of such a trade, as well as the performance history of Adobe’s post-earnings decline and the advantages of investing in the Trefis High Quality (HQ) Portfolio, which has historically beaten the S&P 500 and the Nasdaq over the past four years.

The first section of the article introduces the article’s main theme, emphasizing the inverse relationship between Adobe’s earnings and its stock price momentum. It states that Adobe has been experiencing negative earnings releases, which have typically led to short-term selling pressures on its stock, making it a prime target for short-term traders looking to capitalize on the straddling opportunities that emerge from time to time. The author explains that this is not a guaranteed win but one that requires patience and an understanding of short-term market dynamics. The key point here is to note the owner’s purchase of these out-of-the-money put options with a risk-reward ratio and historical tracking.

The second section of the article focuses on the technical aspects of the trade, specifically discussing the potential upside and downside outcomes. The writer explains that buying a 2% out-of-the-money put option gives the trader the ability to exit the trade at a moving average with the day following the earnings release. The author highlights that the options are structured to profit from subtle changes in the stock price, particularly declines that are more than 7% but not as severe as a 20% drop. This is a relatively small risk but offers a surprising upside potential of over 1,500% if the market sells on the earnings announcement.

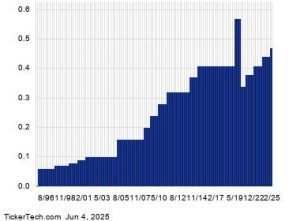

The third section of the article delves into the historical context of Adobe’s earnings behavior, using its post-earnings decline as a narrative backdrop. The writer surveys the past five years of Adobe’s quarterly earnings, noting that 20 out of those 20 earnings actually resulted in negative returns for the following day. Only six of these occurred, with the rest either at or below zero or even slightly positive. The author explains that this results in a pattern of short-term selling pressure that is more pronounced than long-term trends, though it still –averages a 7% decline over time. The writer provides a list of key metrics, including the 14% drop when the earnings were above the median, 6% when below, and a median gain of 3.9%, while the drop resulted in a median decline of -7.4%. These numbers illustrate the significant risk-reward profile of Adobe’s earnings behavior.

The fourth section addresses the risks associated with executing the trade. The writer points out that the potential upside is limited by the fact that profits are capped at the cost of the put options, which are 12.5% each. The writer also explains that the loss, while significant, is capped at 12.5% regardless of the outcome, further reducing the potential vulnerabilities. Additionally, the writer questions the limits on this cap and raises the concern that the market might not react as it expects, failing to deliver on its promises. This is a key point because it highlights the importance of understanding the limitations of a strategy and setting realistic expectations.

The fifth section discusses the risks associated with executing short-term options trading in general, not just this specific trade. The writer explains that even a modest decline inAdobe’s stock might not result in a meaningful profit, while a sharp drop could take the put option to its full payout, with a potential loss of $12.50. The writer also notes that the loss or gain is capped regardless of whether the stock increases or decreases, reducing the overall risk of a trade. The writer concludes that the risk is not something to overlook but rather a necessary part of trading in risky markets.

The sixth section reviews the article’s conclusion and—to the reader—premise. The writer emphasizes the importance of investing in established, well-performing long-term portfolios, particularly those that track the S&P 500 or the Nasdaq, over short-term, volatile opportunities. The writer suggests that over the long term, the Trefis High Quality (HQ) Portfolio, which has historically outperformed the market, is preferable to individual short-term trades. The HQ Portfolio’s performance history includes significant outflows, with annual returns of over 500%, making it a viable investment strategy in the long run. The writer also notes that this performance is largely due to the portfolio’s diversification and focus on less volatile sectors.

In conclusion, the article suggests that Adobe’s earnings behavior, particularly the inverse relationship with stock price momentum, can be exploited for short-term trading gains. However, it is important to understand the risks, limitations, and long-term benefits of such a strategy before making any trading decisions. The writer emphasizes the importance of risk management, as even modest declines in the stock price could result in significant losses. The article’s focus on Adobe’s history and the potential risks and rewards makes it a compelling snapshot of short-term trading opportunities in the stock market.

In summary, while short-term volatility can be exploited, it is crucial to approach such strategies with due diligence, as they are not foolproof and may not reflect market reality. The writer encourages investors to consider a diversified portfolio, particularly the Trefis High Quality (HQ) Portfolio, which has proven to be a reliable investing strategy in the long run. For now, the choice is whether to focus on Adobe, whose earnings inverse relationship with stock price momentum can offer short-term gains, or to seek a more stable, long-term investment strategy, such as the HQ Portfolio.