AbbVie’s recognition as a Top Socially Responsible Dividend Stock by Dividend Channel underscores its compelling investment proposition, combining robust financial performance with a commitment to environmental, social, and governance (ESG) principles. This dual focus appeals to investors seeking both attractive returns and alignment with their values. The company’s strong 3.9% dividend yield, coupled with its consistently high DividendRank, positions it as an appealing option for income-seeking investors. Furthermore, its inclusion in prominent ESG-focused funds, such as the iShares USA ESG Select ETF (SUSA), signifies external validation of its socially responsible practices. This recognition highlights AbbVie’s dedication to operating in a way that benefits not only its shareholders but also the wider community and the environment.

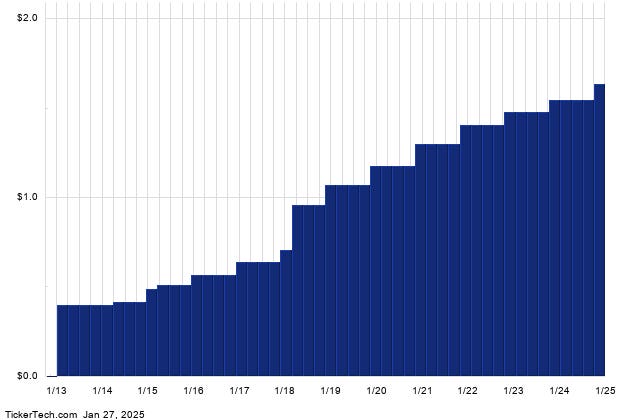

The Dividend Channel’s recognition emphasizes the importance of AbbVie’s dividend history as a key indicator of its future performance. A consistent and growing dividend payout, as demonstrated by AbbVie’s track record, suggests financial stability and a commitment to returning value to shareholders. The company’s annualized dividend of $6.56 per share, paid quarterly, represents a substantial income stream for investors. The most recent dividend ex-date of January 15, 2025, further reinforces the company’s ongoing commitment to its dividend program. This reliable dividend payout, combined with its positive social and environmental impact, positions AbbVie as an attractive investment for those seeking both financial and ethical returns.

AbbVie’s inclusion in the iShares USA ESG Select ETF (SUSA) further solidifies its position as a socially responsible investment. This ETF tracks a market-cap-weighted index of U.S. companies that demonstrate positive ESG characteristics. AbbVie’s significant weighting within the fund, representing 1.06% of the underlying holdings and a total investment of $52,909,043, underscores its prominence within the ESG investment landscape. This inclusion provides further validation for investors seeking companies that prioritize ethical and sustainable business practices. It signifies that AbbVie has undergone rigorous screening and analysis by asset managers and meets the stringent criteria for inclusion in a leading ESG-focused fund.

The evaluation of AbbVie’s social responsibility encompasses several key areas, including environmental impact, social practices, and governance structures. Environmentally, the company’s efforts to minimize the environmental footprint of its products and services, along with its focus on resource efficiency and energy conservation, are considered. Socially, the company’s commitment to human rights, fair labor practices, and diversity within its workforce are assessed. Furthermore, its impact on society, including its involvement in activities related to potentially controversial areas such as weapons, gambling, tobacco, and alcohol, is scrutinized. This holistic approach to evaluating social responsibility provides investors with a comprehensive view of the company’s commitment to ethical and sustainable practices.

Operating within the Drugs & Pharmaceuticals sector, AbbVie faces unique challenges and opportunities related to social responsibility. The company’s focus on developing and providing innovative medicines requires careful consideration of its environmental impact, ethical sourcing of materials, and responsible clinical trials. Furthermore, ensuring access to affordable medications and addressing global health challenges are key aspects of the company’s social mission. AbbVie’s commitment to addressing these challenges, while also competing with industry giants like Eli Lilly and Novo-Nordisk, demonstrates its dedication to balancing profitability with ethical and sustainable practices. This commitment positions the company favorably within the pharmaceutical sector, attracting investors who prioritize both financial performance and social responsibility.

In conclusion, AbbVie’s recognition as a Top Socially Responsible Dividend Stock by Dividend Channel highlights its unique position within the investment landscape. The company’s strong dividend yield, consistent dividend history, and inclusion in prominent ESG-focused funds provide compelling reasons for investors seeking both financial returns and alignment with their values. Furthermore, AbbVie’s ongoing commitment to environmental sustainability, social responsibility, and ethical governance further strengthens its appeal as a long-term investment. By balancing profitability with a commitment to positive social and environmental impact, AbbVie demonstrates that financial success and social responsibility are not mutually exclusive, but rather complementary aspects of a sustainable and successful business model.