The confluence of historically high home prices, rising mortgage rates, and escalating home insurance premiums presents a formidable challenge for prospective homebuyers. This increased financial burden doesn’t guarantee adequate coverage or compensation in the face of increasingly frequent and severe climate-related events. Insurance companies, grappling with the escalating risks posed by these events, are responding by raising premiums or even withdrawing coverage altogether, leaving homeowners vulnerable and questioning the viability of their investment.

The impact of climate change on homeownership is not felt equally across generations. Younger generations, particularly Gen Z, express significantly greater concern about climate change affecting their home values and encounter more difficulties securing affordable and available home insurance. A stark generational divide emerges in the ability to obtain insurance, with a substantially higher percentage of Gen Z respondents reporting climate-related impacts on their access to coverage compared to Baby Boomers. This disparity highlights the growing vulnerability of younger homeowners to the financial consequences of climate change.

The increasing risks associated with climate change are quantifiable and alarming. Analysis of single-family homes across the country reveals a significant number exposed to multiple natural disaster threats, including hurricanes, wildfires, floods, severe storms, and extreme winter weather. While high-risk areas like Miami are expected, the vulnerability of rural locations underscores the widespread nature of the challenge. This widespread risk necessitates a multi-pronged approach to resilience planning, encompassing building codes, insurance practices, and community preparedness.

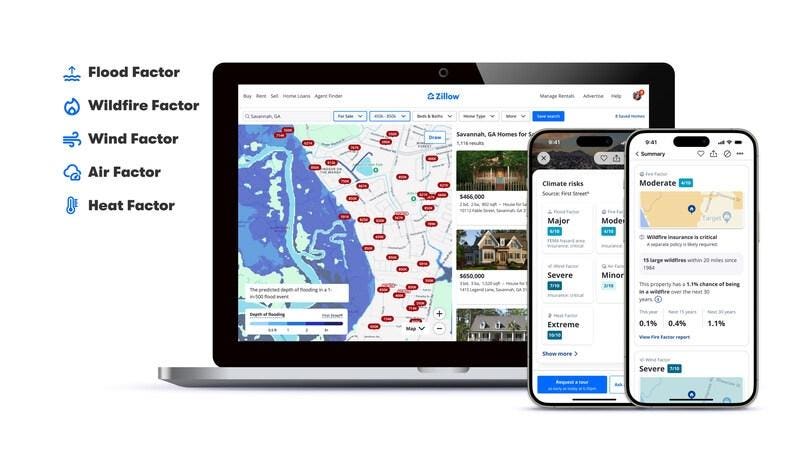

The real estate industry is responding to the growing demand for climate risk transparency. Real estate platforms are now integrating climate risk data into property listings, empowering buyers with crucial information about potential threats. These platforms provide risk scores, interactive maps, and insurance requirements, enabling informed decision-making and potentially influencing property valuations. This transparency is reshaping the real estate market, impacting not only buyers and sellers but also real estate agents and brokers who must now navigate the complexities of climate risk assessment.

However, despite the growing awareness and availability of data, the insurance industry has struggled to keep pace. Rather than developing innovative solutions to provide adequate coverage, insurers have retreated from high-risk areas, leaving homeowners in vulnerable positions. The withdrawal of insurers from markets like California and Florida, coupled with the limited coverage for flood damage under standard homeowners’ policies, exposes a significant insurance gap. This gap necessitates innovative insurance solutions to address the evolving risks posed by climate change.

Addressing these challenges requires a multi-faceted approach involving collaboration between various stakeholders. Understanding the business models of insurance companies and quantifying the value of investing in resilience measures is crucial. Accurate risk modeling and data analysis are essential for informed decision-making by insurance companies, banks, and policymakers. Building codes must be updated to reflect the increasing severity of climate events, and communities must prioritize disaster preparedness. Furthermore, innovative insurance solutions are needed to bridge the existing coverage gaps and ensure that homeowners are adequately protected against the growing financial risks associated with climate change. The interplay between climate risk, insurance availability and affordability, and building practices demands a comprehensive and evolving strategy to protect homeowners and communities.