Oracle’s future appears bright, fueled by its strategic positioning in the burgeoning field of artificial intelligence and its robust cloud infrastructure. The company’s projected growth trajectory suggests a potential 15% compound annual growth rate (CAGR) in its stock price over the next five years, reaching a target of $370 per share. This optimistic outlook is underpinned by several factors, including anticipated growth in cloud services, AI-driven automation efficiencies, and a potentially favorable regulatory environment under the Trump administration. The current valuation, while seemingly high, appears justified considering the anticipated growth and potential for market expansion.

Oracle’s involvement in the ambitious “Stargate” project, a collaborative effort to develop a groundbreaking supercomputer, further solidifies its position at the forefront of AI innovation. This project, involving key players such as Arm, Microsoft, Nvidia, OpenAI, and SoftBank, promises to revolutionize various industries and establish the United States as a global leader in advanced computing. The potential applications of this technology, including early cancer detection and vaccine development, highlight the transformative power of AI and its potential to drive significant societal benefits.

A key catalyst for Oracle’s growth is the anticipated relaxation of AI regulations under the Trump administration. The rescinding of a previous executive order mandating stringent oversight of AI systems could pave the way for faster deployment of AI-driven projects and accelerated innovation. This less restrictive environment could provide Oracle with a competitive edge in the US market. However, this regulatory landscape contrasts sharply with the stricter regulations in the European Union, potentially creating complexities for Oracle as it navigates international markets. Furthermore, the reduced regulatory oversight presents inherent risks, increasing the potential for errors in AI systems with potentially negative consequences, which could ultimately damage Oracle’s market position if not carefully managed.

Oracle’s financial projections reflect its strong growth prospects. Wall Street analysts predict a robust three-year revenue growth rate of 12.1%, exceeding its historical 10-year average. Similarly, earnings per share are projected to grow at 13.7% over the next three years, significantly higher than the historical 10-year average. This anticipated growth is largely attributed to the company’s cloud infrastructure, Oracle Cloud Infrastructure (OCI), which has experienced substantial revenue growth, and its growing portfolio of AI services. The surge in remaining performance obligations, a key indicator of future revenue, further underscores the strong demand for Oracle’s cloud and AI offerings. The company’s ambitious revenue forecasts for Fiscal 2026 and 2029, heavily influenced by AI and cloud services, further reinforce the market’s bullish sentiment towards the stock.

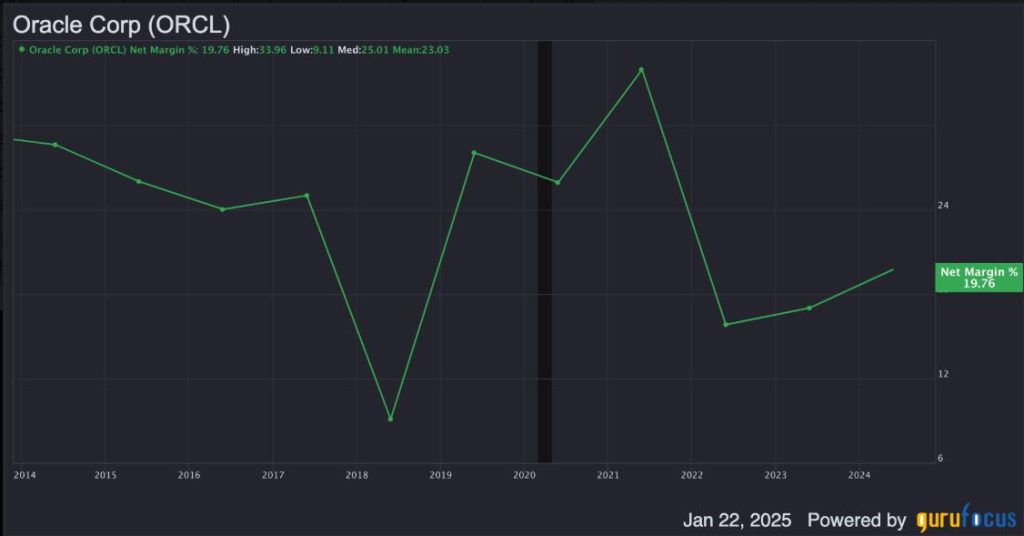

To arrive at the projected $370 price target, a valuation model was constructed based on several key assumptions. Projecting a 13% CAGR in revenue over the next five years, driven by cloud services and AI, Oracle is anticipated to generate $101.1 billion in revenue by January 2030. Assuming a net margin expansion to 23.5%, driven by automation benefits and improved operational efficiencies from AI-driven data center investments, the projected net income reaches $23.76 billion. Factoring in a continued decline in outstanding shares, the estimated earnings per share (EPS) for January 2030 is $11.31. Applying a price-to-earnings ratio of 32.5, a midpoint between the current high valuation and the historical average, yields the $370 price target, representing a 15% CAGR from the current stock price.

While the bull case for Oracle appears compelling, it’s crucial to acknowledge potential risks that could temper the growth trajectory. The highly competitive AI landscape, coupled with the potential for errors in AI systems, particularly in sensitive sectors like healthcare and finance, could negatively impact investor sentiment and lead to a market correction. Furthermore, the sustainability of the relaxed regulatory environment in the US remains uncertain, as future administrations could reinstate stricter oversight, potentially dampening the current enthusiasm for Oracle stock. Additionally, the risk of overspending on AI infrastructure during the current build-out phase and a potential slowdown in AI demand in the future could also impact Oracle’s financial performance. Finally, while the expectation of improved macroeconomic conditions under the Trump administration contributes to the positive outlook, the possibility of moderate economic results needs to be considered to maintain a balanced perspective on Oracle’s valuation. Despite these potential headwinds, Oracle’s strategic focus on AI and cloud computing, coupled with the anticipated favorable regulatory environment, positions it for significant growth potential in the coming years.