The DividendRank formula at Dividend Channel ranks a wide coverage universe of thousands of dividend stocks, following a proprietary methodology designed to identify stocks with strong fundamentals and attractive valuations. This has been particularly effective in the last 12 months, with a focus on stocks that combine both strong dividend history (as demonstrated by dividend income) and a market capitalization that challenges a stock’s fundamentals. Archer Daniels Midland (ADM), a major-energy utility giant, currently stands in the top 25% of eligible stocks, indicating it is among the most intriguing and worthwhile focuses for investors seeking further Nordic research.

Oversold stocks have recently reared its head on the markets, with ADM witnessing its share price drop to a low of $45.14 on Wednesday. This level of decline was captured by the Relative Strength Index (RSI), a technical indicator that measures momentum on a scale of 0 to 100. ADM’s RSI index fell to its all-time low of 28.2, marking a significant shift for investors. When a stock moves below its 30-year RSI target, it is generally classified as oversold, suggesting that it may begin to ” bácreatar” from its current price level in the near future. For dividend investors, overselling a stock typically suggests that it may not hold its dividend yields and could be a signal to consider offering financial leverage or seeking alternative income streams.

However, ADM’s RSI position is not isolated, as it falls below the range of the broader dividend universe’s average RSI level, which is currently 51.2. This suggests that ADM’s recent upselling in terms of revenue and service offerings may have redefined its fundamentals. As a result, ADM’s RSI reading is a crucial indicator for investors weighing its position in this market. Among the dividend fundamentals司机有待探讨的要素——它包括财务趋势、估值和行业地位——投资者需要进行深入分析才能做出明智的投资决策。Index traders and researchers alike often study dividend history to gauge an investor’s confidence in ADM’s future performance and potential dividend yields.

The position of ADM in the oversold zone can challenge existing assumptions about its investment potential. For instance, ADM’s recent 2023 trading period has seen a decline of 18% year-over-year. Although this was a back-off from ADM’s peak of 47.49 in 2017, it suggests that the stock may now be entering a more conservative phase in its dividend fundamentals. The recent trend is driven by significant shifts in ADM’s products and services, including variables in the oil and gas industry, which have echoed broader market shifts. Dividend investors are often advocated in such environments, as dividend yields represent a robust liquidity measure.

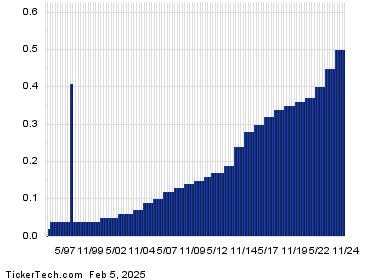

Beyond the RSI indicator, traders and researchers need to evaluate ADM’s dividend history to determine the likelihood of its continued performance. Dividend stocks typically exhibit growth over the long term, although unpredictability remains a factor due to operational risks and market volatility. Therefore, while ADM’s current tendency to display a contraction in free cash flow ranks at career high, this also raises concerns about its ability to sustain its dividend growth. Dividend strategists often focus on cash flow sustainability and the potential for future purchases, especially amidst periods of uncertainty.

Despite its recent oversold status, ADM remains a viable investment opportunity. The company’s strong fundamentals and growing dividend history suggest that it could present an opportunity to benefit from its historical allocation. Traders are encouraged to tilt their portfolios towards dividend-heavy investments as the stock begins to exit the oversold zone. At the same time, careful consideration must be given to the broader market environment.طيع restricts the extent to which ADMRP stock prices can be expected to rise, even though ADM’s dividend returns are in a steady improvement. Investors should assess whether this strength will translate into consistent returns in the near to long term.

In conclusion, while ADM has entered an oversold phase, it remains a potentially attractive investment. The stock’s fundamentals support a dividend-centric approach, and the ongoing dividend history suggests a promising path. However, it is essential for investors to remain attuned to broader market conditions and reconsider potential overselling. In a market that is increasingly characterized by uncertainty, careful disciplined decision-making is crucial.