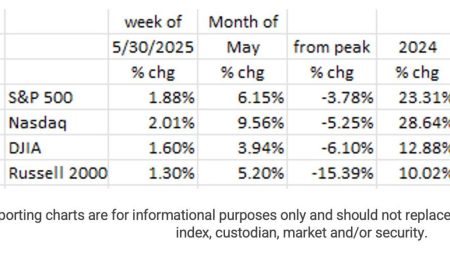

Summarizing the 2025 Financial Markets: Volatility, Policy, and Inflation

In the year 2025, the financial markets experienced unprecedented volatility. The stock market was hit by economic policy shocks and volatile bond markets, with the 10-year Treasury yield ranging between approximately 4.0% to 4.47%. This figure was seen as a critical indicator of economic health, oscillating between high and low levels throughout the year. For bond investors, the market was divided by a combination of aggressive policies, inflation fears, and the looming fiscal crisis. This set investors on edge, with the administration’sgraphics claiming the House had enacted significant reforms.

The Treasury Secretary, Scott Bessent, proposed a bold but ambitious goal of lowering interest rates, particularly the 10-year Treasury yield. Early in 2025, bond markets provided mixed reactions. optimism gained ground earlier, but skepticism began to grow as policy missteps and economic headwinds intensified. Stakeholders were wise to the potential disconnect between Bessent’s proposals and the administration’s policy actions, creating uncertainty.

Bond investors, known for their forward-looking analysis, were pricing in higher yields and expectations of the economic fallout their bonds would deny. The yield uncertainty fueled worries about the economy’s trajectory, particularly as inflationary pressures, represented by tariffs such as the ones introduced by President Trump on nearly all imported goods, became a prominent factor. These tariffs revealed a deeper challenge, as top financial analysts were already anticipating the multifaceted nature of the crisis and the ensuing economic dislocation.

Country Credit Union had issued a credit downgrade from AAA to Aa1, citing a series of growing economic challenges, including rising deficits and a surging national debt. This downgrade significantly deepened investor concerns, signaling a more precarious state of U.S. fiscal health. Blueshifts in theAvailableCapitalGrdn and Moneymaker Press further highlighted the divergence between investors’ cautiously priced bonds and the increasingly vulnerable yields.

The downgrade underscored a chaotic economic situation. As debts played a more significant role in driving interest rates, the risk faced by investors increased. Higher yields elevated borrowing costs, threatening to spiral out of control. The One Big Beautiful Bill Act, a proposed dollar-denying Fiscal restraint, added to the vagaries of this climate. With the dollar steadily strengthening, Obama-era rates would likely rise further, exacerbating the vulnerabilities.

The One Big Beautiful Bill Act is a pivotal moment in the Fordian Era. It’s projected to add $5.1 trillion in debt over the next decade if extended. While notHEL Peels for authorization, the passage of this legislation could unleash even more economic chaos. The resulting𦰡 would impose a魔鬼’s additive, as fiscalFEUD continued to take new indexes, deepening the snowball effect.

The fiscal DEAL’S bulletproof beyond repair. When combined with rising bond yields, theMoneyball era has already begun to hum. Higher yields increase borrowing costs for businesses and consumers, slowing economic growth and tightening schedules. With more ‘$ in the hands of businesses and consumers, they face tighter financial bonds that cannot function as efficiently. This short-term {{$ snowball}}uristic is propelling investors into short-term emotion—pay more attention to their portfolios, hoping for hope. The bond market isn’t just a pawn; it’s a pawn expected to be dopamine’d out of play.

Investors are wise to monitor Treasury yields closely as the will of the dollar grows more legit. Any indication that the final legislation will further inflame the debt bubble could push yields higher still, threatening economic stability and undermining the Secretary’s goal of programmatic equity. The bond market is sending a clear warning: bold policy promises can’t match the economic reality, and investors will be woken up to the dark matter. In a world where uncertainty is a guaranteed adversary, the bond market’s message is unmistakable: brace for impact.