Donald Trump’s second administration has been marked by significant policy decisions, notably the implementation of tariffs on goods from Mexico and Canada. While public opinion remains divided on these actions, the collective response of the global bond market holds substantial implications for the US and global economies. This market, valued at over $140 trillion in 2023, exerts a powerful influence that transcends individual opinions and stock market fluctuations. The bond market’s reaction, especially concerning US government bonds, acts as a critical barometer of economic health and future expectations.

The bond market’s influence stems from its role in determining interest rates on government debt. Unlike other financial instruments, the government doesn’t dictate the interest rates on its bonds; these are determined by market forces – the investors who buy and sell them. These investors, ranging from individuals to large corporations and investment funds, collectively set the price of borrowing for the government. The resulting interest rates not only dictate the cost of government debt but also influence borrowing costs for consumers and businesses, affecting mortgages, auto loans, and corporate financing.

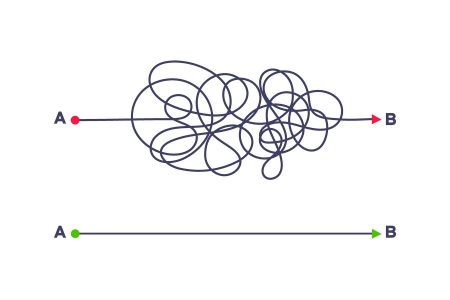

Recent policy decisions, such as extended tax cuts and the imposition of tariffs, have raised concerns within the bond market about potential inflationary pressures. Investors, anticipating rising inflation, demand higher returns on their investments to maintain their purchasing power. This expectation translates into higher yields on long-term government bonds, creating a ripple effect throughout the economy. Rising bond yields make government borrowing more expensive, increasing the cost of servicing existing debt and necessitating the issuance of more bonds to raise necessary funds. This increased supply further pushes down bond prices and drives up yields, creating a potentially destabilizing cycle.

The rising cost of government borrowing has significant long-term consequences. Even a seemingly small increase in Treasury borrowing costs can add hundreds of billions of dollars to interest expenses over a decade. Furthermore, higher bond yields translate to higher interest rates for consumers and businesses, increasing borrowing costs for essential goods and services. This can further fuel inflation, creating a feedback loop that could compel the Federal Reserve to raise interest rates to control inflation. This complex interplay between fiscal policy, bond market reactions, and monetary policy underscores the significant influence of the bond market on the broader economy.

Trump’s desire for the Federal Reserve to cut interest rates, while potentially beneficial in some scenarios, appears misaligned with current economic conditions. Such a move, under the current circumstances, could exacerbate inflationary pressures and further destabilize the economy. Achieving a rate cut against the prevailing economic headwinds would likely require a significant restructuring of the Federal Reserve’s leadership, challenging the central bank’s independence. This potential conflict between the administration’s desires and the Federal Reserve’s mandate adds another layer of complexity to the economic outlook.

The intricate relationship between government policy, bond market dynamics, and the overall economic landscape necessitates a careful and considered approach to policymaking. The bond market, through its collective response to policy decisions, serves as a powerful check on government actions and a crucial indicator of economic health. Ignoring its signals could lead to unintended consequences, including escalating debt costs, rising inflation, and potential economic instability. Understanding the bond market’s influence and its potential reactions to policy changes is crucial for navigating the complexities of the current economic environment. The market’s sensitivity to inflation, its impact on borrowing costs, and its interconnectedness with monetary policy highlight its critical role in shaping the economic future.