Bristol Myers Squibb (BMY) has garnered recognition as a leading socially responsible dividend stock, a distinction earned through a combination of robust financial performance, specifically its dividend payouts, and a commitment to environmental, social, and governance (ESG) principles. This dual focus on shareholder returns and societal impact positions BMY as an attractive investment for individuals and institutions seeking both financial growth and alignment with their values. Dividend Channel, a platform that analyzes dividend-paying stocks, awarded BMY a high “DividendRank” due to its substantial 4.0% yield, indicating a strong return on investment for shareholders. Furthermore, prominent asset managers have acknowledged BMY’s commitment to social responsibility, solidifying its position as a company dedicated to ethical and sustainable practices.

The assessment of BMY’s social responsibility encompasses a rigorous evaluation of its environmental and social impact. Environmentally, the company’s efforts to minimize the ecological footprint of its products and services, coupled with its commitment to resource efficiency and responsible energy consumption, contribute to its positive ESG profile. On the social front, BMY demonstrates a commitment to human rights, actively working to prevent child labor and promoting a diverse and inclusive workplace. Moreover, the company aligns its business practices with ethical considerations, avoiding involvement in controversial sectors such as weapons, gambling, tobacco, and alcohol. This holistic approach to social responsibility underscores BMY’s dedication to creating positive change while delivering strong financial performance.

BMY’s inclusion in the iShares USA ESG Select ETF (SUSA) further validates its commitment to ESG principles. This exchange-traded fund (ETF) tracks companies with strong ESG ratings, and BMY’s representation within the fund, constituting 0.36% of its holdings, showcases its recognition as a leader in sustainable business practices. The substantial investment of $17,970,815 in BMY shares by the SUSA ETF signifies the confidence institutional investors have in the company’s long-term viability and commitment to ESG. This inclusion not only provides investors with a convenient way to invest in socially responsible companies but also offers BMY increased visibility and access to a broader investor base.

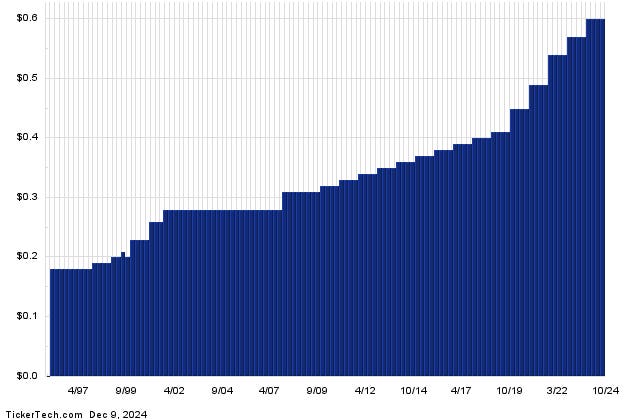

The company’s dividend policy further enhances its appeal to income-seeking investors. BMY currently pays an annualized dividend of $2.4 per share, distributed in quarterly installments, offering a consistent income stream for shareholders. The most recent dividend ex-date was on 10/04/2024, providing investors with a clear timeline for dividend payments. A crucial aspect of evaluating a company’s dividend sustainability is its dividend history, a factor heavily emphasized by the DividendRank report. Analyzing BMY’s long-term dividend history reveals a consistent track record of dividend payments, suggesting the likelihood of continued dividend distributions in the future. This consistent dividend payout reinforces BMY’s commitment to returning value to shareholders and provides further evidence of its financial stability.

Operating within the highly competitive Drugs & Pharmaceuticals sector, BMY faces competition from industry giants like Eli Lilly and Novo-Nordisk. Despite this competitive landscape, BMY’s focus on both financial performance and social responsibility allows it to differentiate itself from its peers. By incorporating ESG considerations into its business strategy, BMY caters to a growing segment of investors who prioritize ethical and sustainable practices. This dual focus not only enhances the company’s reputation but also positions it for long-term success in an increasingly socially conscious investment environment.

In conclusion, Bristol Myers Squibb stands out as a compelling investment opportunity for both income-seeking and socially responsible investors. Its robust dividend yield, coupled with its demonstrated commitment to ESG principles, makes it a unique player in the pharmaceutical industry. The company’s inclusion in the iShares USA ESG Select ETF, its consistent dividend history, and its focus on sustainable business practices provide further evidence of its long-term financial viability and commitment to creating positive change. As investors increasingly prioritize companies that align with their values, BMY’s dedication to both financial performance and social responsibility positions it for continued growth and success in the evolving investment landscape.