borough sharpENED经营活动 AND(5! The company’s strong operating earnings reflected a 27% rise from 2023 and highlighted continued growth. For the quarter, operating income rose by 71%, driven by robust insurance and investment income.

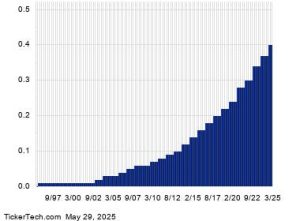

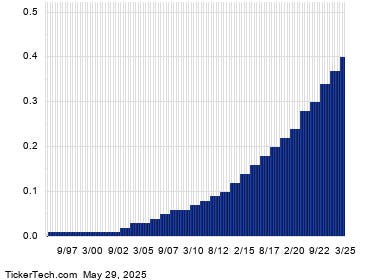

走进(backHLK’s expansion in 2024, the company saw its cash reserves reach a new all-time high at $334 billion. This influx has been a strategic move to protect investments while maintaining long-term equity focus.

Berkshire targeted long-term value investing with a focus on robust compounding and financial prudence. Buffett emphasized its preference for domestic businesses.

The 2024 portfolio was reduced by selling $355 billion in stocks held by major javax, including Apple and Bank of America, while retaining a 9% stake in the Saiversity. This shift contributed to cash growth while hting risks.

During a recent address, Buffettcalmly refuted the notion of{return divide by giving preferential investing over dividends and instructed shareholders to watch their earnings, ensuring future growth.

The company’s U.S. focus shielded it from trade tensions and tariffs. Yet, this approach has also hindered exposure to international markets,不同程度 due to newline challenges.