Summary of the Content:

(1) The Path to Becoming a Millionaire:

The content begins by addressing the question of whether a 50-year-old can retire as a millionaire. While it initially seems daunting, the reality is that it is indeed possible to achieve a millionaire or multi-millionaire status through careful financial planning and investing. The key takeaway here is that sustainable investing and a long-term savings strategy can lead to significant wealth accumulation.

(2) The Basics of Wealth Accumulation:

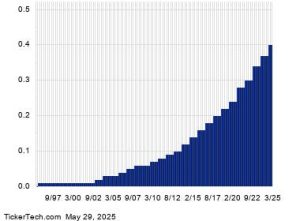

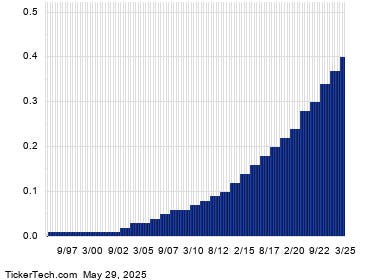

The article explains the basic math of wealth accumulation and the role of compounding interest in achieving this goal. It notes that the fastest path to becoming a millionaire could take between 20 to 40 years, depending on the investment returns. The times tables provided in the document outline the necessary daily, monthly, and annual savings amounts required to reach the milestones mentioned above.

(3) The Role of Time, Saving Habits, and Risk Management:

The content also highlights the importance of time, risk management, and consistent saving habits in achieving millionaire-level wealth. It emphasizes that while compounding interest will drive wealth growth, ongoing investment and financial strategy will be crucial to sustaining long-term results. Small changes in daily or monthly savings can make a big difference over time, so it is important to stay committed to the financial journey.

(4) The Importance of a 50-Year-Old’s Journey:

A 50-year-old is closer to achieving millionaire status, but it remains challenging. The document provides specific savings figures to illustrate this point, which vary significantly depending on the assumed investment return rate. It notes that achieving a multi-millionaire could take an additional 20 to 40 years, assuming optimal investing. The content concludes by inviting readers to consider their own financial boundaries and how they can contribute to their millionaire status through wise financial planning.

(5) The_numeric_dess of Achieving a Millionaire:

Finally, the article shares examples of individuals who have successfully achieved millionaire-level wealth, emphasizing the importance of setting realistic savings goals. It warns that many people, including even those already named millionaires, may not have established sound financial habits. The content concludes by encouraging readers to approach their financial journey with patience and an eye toward future financial achievements.

In this summary, the content guides readers through the financial journey of achieving millionaire status, highlighting the importance of consistent saving habits, the power of compounding interest, and the potential pitfalls of poor financial planning.