The landscape of partnership taxation underwent a significant transformation with the enactment of the Bipartisan Budget Act of 2015 (BBA), impacting how partnerships handle audits and amend returns. This legislation, implemented for tax years 2018 and beyond, introduced the centralized partnership audit regime, shifting away from the previous TEFRA rules that had governed partnership audits since 1982. A key component of this new regime is the Administrative Adjustment Request (AAR) process, which replaces the traditional method of amending returns and presents both opportunities and complexities for partnerships.

The BBA’s centralized audit regime applies to all partnerships unless they qualify for and elect out. This opt-out provision is available only to partnerships with 100 or fewer eligible partners. Eligible partners are defined as individuals, C corporations, S corporations, and estates of deceased partners. Notably, partnerships and trusts are excluded from this definition, limiting the availability of the opt-out for numerous partnerships. This complexity requires careful consideration of the partnership’s structure and composition before deciding on the best course of action. For those partnerships subject to the BBA regime, understanding the nuances of the AAR process is crucial.

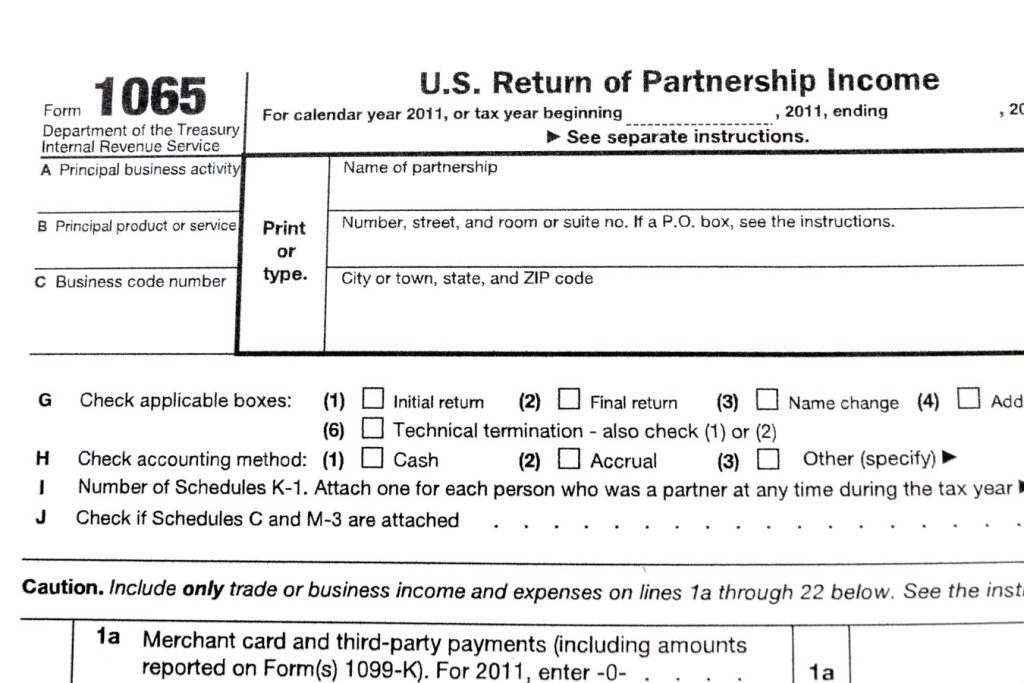

One of the most significant changes introduced by the BBA is the requirement for partnerships to file an AAR instead of a traditional amended return (Form 1065-X) when correcting errors or making adjustments to previously filed returns. This new process involves specific forms and procedures, depending on the filing method. Electronic filers must submit a Form 1065 along with Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request, and check Box G(5) on Form 1065 to indicate an amended return. Paper filers, on the other hand, are required to use Form 1065-X, Amended Return or Administrative Adjustment Request (AAR). Further complicating the process, the IRS is moving toward mandatory electronic filing for partnerships filing 10 or more returns of any type, including information, income tax, and employment tax returns, starting in 2024. This transition will necessitate adjustments for many partnerships in their filing procedures and may require investment in electronic filing capabilities.

The complexities of the AAR process extend beyond the forms themselves. The BBA introduced the concept of an “imputed underpayment,” which represents the tax liability arising from an AAR adjustment that increases partnership income. If an AAR results in an imputed underpayment, the partnership is generally responsible for paying the associated tax. However, the BBA provides an alternative – the “push-out” election. This election allows the partnership to shift the tax burden to the “reviewed-year partners,” the partners during the year the adjustment relates to. This election requires additional forms: Form 8985, Pass-Through Statement – Transmittal/Partnership Adjustment Tracking Report, and Form 8986, Partner’s Share of Adjustment(s) to Partnership-Related Items. The partnership must provide Form 8986 to each reviewed-year partner. Even if an AAR doesn’t result in an imputed underpayment or results in a zero imputed underpayment, IRS guidance mandates that the partnership must still calculate and report the imputed underpayment. This requirement adds another layer of complexity to the AAR process.

The implications of filing an AAR extend beyond the immediate filing requirements and potential tax payments. An AAR filing can trigger an extended statute of limitations, potentially allowing the IRS to examine the partnership return for up to three years after the AAR is filed. This extended period exposes the partnership to potential audits even on items unrelated to the original AAR. Furthermore, the ability to file an AAR is not unlimited. A partnership cannot file an AAR after the IRS has initiated an examination of the same return. The time limit for filing an AAR is generally three years from the later of the partnership return filing date or its due date (without extensions). These restrictions underscore the importance of careful planning and timely action in addressing any necessary adjustments to partnership returns.

Navigating the AAR process effectively requires careful consideration of various factors, including the potential for imputed underpayments, the implications of a push-out election, the extended statute of limitations, and the restrictive timelines for filing. Partnerships, along with their tax professionals, must diligently prepare the necessary forms, accurately calculate imputed underpayments, and consider the potential impact on both the partnership and its partners. Understanding the intricacies of the BBA audit rules and the AAR process is essential for ensuring compliance and mitigating potential risks. The increased complexity and administrative burden necessitate a proactive approach to partnership tax planning and compliance, involving careful documentation and communication between the partnership and its partners.