Cisco Systems’ recognition as a Top Socially Responsible Dividend Stock highlights the convergence of financial performance and ethical business practices. This accolade, bestowed by Dividend Channel, underscores Cisco’s strong dividend yield of 2.7% and its commitment to social and environmental responsibility, as recognized by leading asset managers. The company’s inclusion in prominent socially responsible investment (SRI) ETFs further solidifies its position as a leader in this evolving investment landscape. This dual focus on shareholder returns and ethical operations makes Cisco an attractive option for investors seeking both financial growth and alignment with their values.

The evaluation of a company’s social responsibility involves a comprehensive assessment of its environmental and social impact. Environmental criteria encompass factors such as the ecological footprint of the company’s products and services, its energy efficiency, resource consumption, and waste management practices. A company’s commitment to minimizing its environmental impact through sustainable practices and innovation is a key consideration for socially responsible investors. Social criteria encompass a broad range of factors related to human rights, labor practices, community engagement, and ethical business conduct. These include adherence to international labor standards, promoting diversity and inclusion within the workforce, and avoiding involvement in controversial industries such as weapons, gambling, tobacco, and alcohol. A company’s commitment to fair labor practices, diversity, and positive social impact contributes significantly to its social responsibility profile.

Cisco’s inclusion in both the iShares MSCI USA ESG Select ETF (SUSA) and the iShares MSCI KLD 400 Social Index Fund ETF (DSI) provides further evidence of its commitment to ESG principles. These ETFs track indices that screen companies based on environmental, social, and governance (ESG) factors. Cisco’s presence in these funds, with a weighting of 0.65% in SUSA and 0.86% in DSI, indicates that it meets the rigorous criteria set by these indices, which assess companies’ performance across a range of ESG metrics. This inclusion not only validates Cisco’s ESG performance but also offers investors a convenient way to access a diversified portfolio of socially responsible companies.

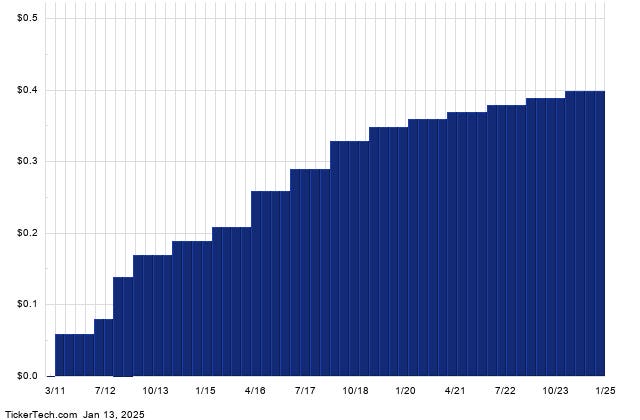

The company’s dividend policy, characterized by a consistent payout and a strong track record, further enhances its appeal to income-seeking investors. With an annualized dividend of $1.6 per share, paid quarterly, Cisco provides a steady stream of income to its shareholders. The DividendRank report emphasizes the importance of analyzing a company’s dividend history to gauge the sustainability of future payouts. Cisco’s long-term dividend history, as illustrated in the chart provided, demonstrates a commitment to returning value to shareholders through consistent and, ideally, growing dividends. This consistent dividend payout, combined with its commitment to social responsibility, makes Cisco an attractive option for investors seeking both financial returns and ethical alignment.

Operating within the Manufacturing sector, alongside industry peers like Qualcomm and Motorola Solutions, Cisco faces the challenge of balancing profitability with responsible manufacturing practices. This sector often faces scrutiny regarding its environmental impact, including resource consumption, waste generation, and supply chain transparency. Cisco’s commitment to social responsibility requires it to address these challenges head-on, implementing sustainable manufacturing processes, minimizing its environmental footprint, and ensuring ethical sourcing of materials. By prioritizing these aspects, Cisco can differentiate itself within the sector and attract investors who prioritize companies with strong ESG performance.

In conclusion, Cisco Systems’ recognition as a Top Socially Responsible Dividend Stock signifies its commitment to balancing financial performance with ethical business practices. Its strong dividend yield, coupled with its inclusion in prominent SRI ETFs, makes it an attractive option for investors seeking both income and alignment with their values. The company’s focus on environmental sustainability, social responsibility, and corporate governance demonstrates its commitment to creating long-term value for all stakeholders. As the investment landscape increasingly emphasizes ESG factors, Cisco’s proactive approach positions it well for continued success and further solidifies its status as a leader in socially responsible investing. The company’s commitment to balancing profitability with ethical considerations provides a compelling investment thesis for those seeking to align their portfolios with their values.