Salesforce vs. Oracle: A Comparative Analysis and Investment Outlook

Salesforce (CRM) and Oracle (ORCL) are two prominent players in the enterprise software market, particularly within the rapidly expanding cloud computing and artificial intelligence (AI) sectors. While both companies have experienced significant growth in recent years, a detailed comparison of their financial performance, growth trajectories, and risk profiles reveals key differences that inform investment decisions. This analysis delves into a comprehensive evaluation of both companies, encompassing historical performance, revenue growth drivers, profitability, financial risk, and valuation metrics to determine which stock presents a more compelling investment opportunity over the next three years.

Historical Performance and Stock Returns:

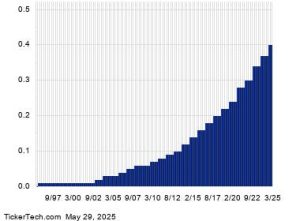

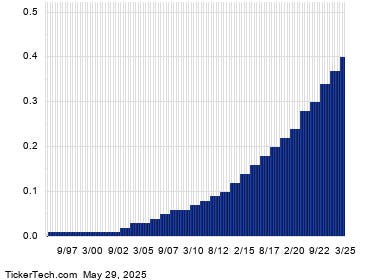

Over the past three years, Oracle’s stock has demonstrably outperformed Salesforce’s, with a staggering 225% gain compared to Salesforce’s 65% increase. This stark contrast in performance can be attributed to Oracle’s consistent outperformance of the broader market, while Salesforce experienced periods of underperformance, particularly in 2021 and 2022. While Oracle consistently delivered impressive returns each year, Salesforce’s performance was more volatile, marked by significant fluctuations. However, past performance is not necessarily indicative of future results, and a forward-looking analysis is crucial for informed investment decisions.

Revenue Growth and Future Prospects:

A critical aspect of evaluating growth potential lies in analyzing revenue trends. Salesforce has consistently outpaced Oracle in terms of revenue growth, boasting an average annual growth rate of 18.1% compared to Oracle’s 9.5%. This robust growth for Salesforce is primarily driven by the increasing demand for its cloud-based solutions, including Sales Cloud, Service Cloud, and Marketing Cloud. Furthermore, Salesforce’s strategic focus on integrating AI and machine learning capabilities across its product portfolio, exemplified by its Agentforce AI system, positions it for continued growth in the burgeoning AI market. Oracle’s revenue growth, while comparatively slower, is also propelled by the increasing adoption of its cloud offerings, with a notable emphasis on generative AI workloads. The company anticipates doubling its revenue within the next five years as more on-site database customers migrate to the cloud. Looking ahead, both companies are poised to capitalize on the expanding demand for cloud and AI solutions, with projected low double-digit average annual growth rates over the next three years.

Profitability and Financial Risk Assessment:

While Salesforce demonstrates superior revenue growth, Oracle boasts higher profitability. Oracle’s adjusted net income margin, albeit declining slightly in recent years, remains significantly higher than Salesforce’s. However, Salesforce’s expanding margins indicate improving profitability. From a financial risk perspective, Salesforce holds a clear advantage. Its lower debt-to-equity ratio and higher cash-to-assets ratio signify a stronger financial position and greater resilience to economic downturns. This lower financial risk, coupled with robust revenue growth, makes Salesforce a compelling investment prospect.

Valuation and Investment Recommendation:

Despite Oracle’s higher profitability, Salesforce’s superior revenue growth, lower financial risk, and more compelling valuation make it a more attractive investment opportunity. While both stocks currently trade at price-to-earnings ratios above their historical averages, Salesforce’s lower P/E ratio, relative to its historical average, suggests a more favorable valuation. Considering the anticipated growth in the AI-powered cloud market, an upward revision in valuation multiples for both companies is plausible. However, the current disparity in valuation multiples between Salesforce and Oracle, with Oracle trading at a significantly higher multiple than its historical average and Salesforce trading at a lower multiple, presents a potential opportunity for Salesforce’s valuation to appreciate. Therefore, while both stocks may offer long-term growth potential, Salesforce (CRM) emerges as the preferred choice for investors seeking a balanced combination of growth, lower financial risk, and attractive valuation.

Investment Considerations and Peer Comparison:

While Salesforce presents a compelling investment thesis, it’s crucial to consider the broader competitive landscape and evaluate Salesforce’s performance relative to its peers. Comparing Salesforce’s key metrics with those of its competitors provides valuable context for assessing its relative strengths and weaknesses. This comparative analysis can further refine investment decisions and ensure a well-rounded portfolio strategy.

Disclaimer: This analysis is intended for informational purposes only and does not constitute investment advice. Investing in the stock market carries inherent risks, and investors should conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The opinions expressed herein are based on the information available at the time of writing and are subject to change without notice. Past performance is not indicative of future results.