The Corporate Transparency Act (CTA), designed to combat financial crimes by shedding light on the true owners of shell corporations, has become entangled in a complex web of legal challenges, leaving businesses in a state of uncertainty regarding their compliance obligations. At the heart of this legal battle lies the question of nationwide injunctions and the authority of district courts to issue them, a debate that has reached the highest court in the land. The Supreme Court’s recent intervention in Texas Top Cop Shop, Inc. v. McHenry, while seemingly a victory for the government, has not fully resolved the issue, leaving the CTA’s beneficial ownership reporting requirements in a precarious limbo.

The saga began with a Texas federal judge issuing a nationwide injunction against the CTA’s reporting requirements, effectively halting their enforcement. This injunction stemmed from a lawsuit filed by Texas Top Cop Shop, Inc., challenging the constitutionality of the CTA. The government, seeking to uphold the law, appealed to the Supreme Court, which granted a stay on the injunction. This stay, however, is not a final decision on the merits of the case, but rather a temporary measure allowing the government to proceed with enforcement while the legal challenges continue. Justice Gorsuch’s concurrence, while supporting the stay, highlighted a critical underlying issue: the need for clarity on the scope of district courts’ power to issue nationwide injunctions. This echoes concerns raised in previous cases and suggests a broader debate on the balance of power within the judicial system.

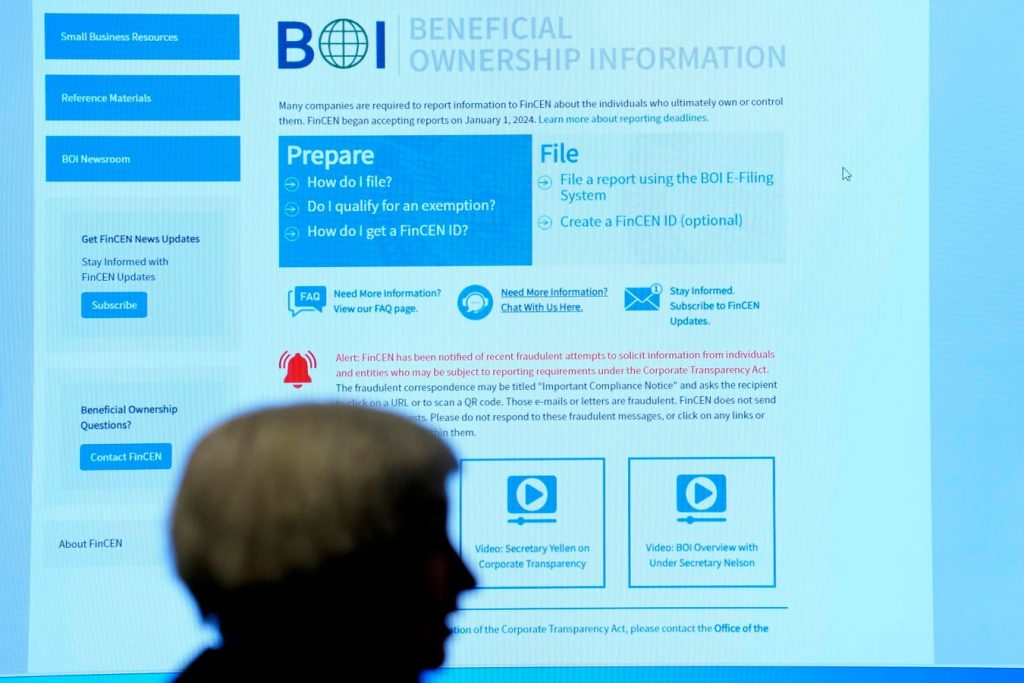

Adding further complexity to the situation is a separate case, Smith v. U.S. Department of the Treasury, also originating in Texas, where another federal judge issued a nationwide injunction against the CTA’s reporting requirements. This separate injunction remains in effect, effectively overriding the Supreme Court’s stay in the Texas Top Cop Shop case. Consequently, despite the Supreme Court’s intervention, businesses are currently not obligated to comply with the CTA’s beneficial ownership reporting requirements. This legal entanglement creates a confusing landscape for businesses, leaving them to grapple with conflicting court orders and uncertain future obligations.

Justice Jackson’s dissenting opinion in the Texas Top Cop Shop case adds another layer of analysis to the legal debate. She argued that the government’s request for emergency relief was unwarranted, given the expedited appeal process already underway in the Fifth Circuit. This dissent raises questions about the appropriateness of the Supreme Court’s intervention and the potential for undermining the established appellate process. It also underscores the differing judicial philosophies regarding the use of emergency powers and the importance of adhering to established legal procedures.

The current state of affairs presents a complex legal puzzle with significant implications for businesses. While the Supreme Court’s stay in Texas Top Cop Shop signaled a potential shift towards enforcement, the continued effectiveness of the injunction in Smith v. U.S. Department of the Treasury maintains the current pause on compliance. This precarious balance leaves businesses in a state of legal limbo, unsure of their immediate obligations and facing the possibility of future retroactive compliance requirements. The conflicting court orders and ongoing legal challenges create a volatile regulatory environment, emphasizing the need for businesses to stay informed and prepared for potential changes.

Looking ahead, the ultimate fate of the CTA’s reporting requirements remains uncertain. If the Supreme Court eventually overturns the district court’s ruling in Texas Top Cop Shop, the reporting requirements will likely be reinstated, requiring companies to quickly gather and submit the necessary information. Conversely, if the Supreme Court upholds the district court’s ruling, the injunction will remain in place, continuing the pause on enforcement. In either scenario, the Supreme Court’s eventual decision will have far-reaching consequences, not only for the CTA but also for the broader question of nationwide injunctions and the power of district courts. In the meantime, businesses are advised to prepare for both eventualities, either by voluntarily complying with the reporting requirements or by proactively collecting the necessary information to ensure they can comply promptly should the requirements be reinstated. This proactive approach will mitigate the risk of future penalties and ensure a smoother transition regardless of the final legal outcome.