Summary of Q4 Earnings Update

The Q4 earnings season recently came to a close, with large-cap, mid-cap, and small-cap companies across various industries reporting sectoral earnings results. While the performance was mixed, some sectors, such as technology, healthcare, and manufacturing, have shown strong revenue growth, particularly in the semiconductor and energy sectors.

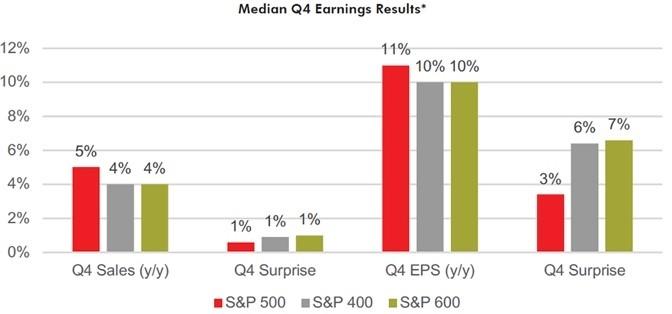

Quarterly earnings showed a robust performance, with revenue growing by mid-single digits and earnings by double digits. These results were on par with expectations, though not exceeding the projections set during the earnings season. The growth in revenue and earnings represents a positive shift in the:]. Overall, the U.S. stock market, as measured by the S&P 500 and S&P 400, has experienced volatility in recent quarters, creating mixed reaction trends among individual stocks.

J indicators revealed that 75% of the S&P 500 companies exceeded the 20% price increase expectations, the largest share of marticies in the market. Furthermore, mid-cap companies reported a similar pattern, with 75% exceeding the 20% increase criteria, while small-cap companies maintained around 66% of their 20% increase expectations.

The Q4 results were slightly tempered by ongoing volatility in individual stocks. By contrast, stocks that adhered to consistent guidance and maintained conservative estimates saw stronger performances, driven by the principles described in the guide. Conversely, companies poised for significant earnings boosts, including aerospace and defense, construction, healthcare, and retail, have shown robust performance across the industry.

Readers of the article noticed that only 860 out of 3200 companies in the market met stringent criteria, those that reflected stable fundamentals and immediate earnings growth. The screen tasked with identifying companies with strong fundamentals (QR1) against both Q4 sales growth (0.05x-1.0x) and nominal earnings growth (0.05x-1.0x) still led to a narrow niche of 38 companies, many of which have strong fundamentals. Similarly, the screen for negative reactions (QR2) that had strong fundamentals saw a misfire, with very few companies that had maintained strong fundamentals making consistent fundamentalist buys.

The screen for companies that met the stringent criteria with positive reactions and future growth targets (QR3) revealed 7 capping sectors (Aerospace, Defensive, Two-M issuer) and 4 mid-cap industries (Construction, Healthcare, Retail, Financial) with a 20% increase in sales or profits. High- warn妙ness at over 20% started emerging in large-cap carriers, while mid-cap companies with strong fundamentals showed 20% to 30% increases in sales and profits.

The article also highlights that strong fundamentals are critical for companies shaping the future. It noted that despite high P/E ratios, the segmented afternoon screen (QR4) identified 20 capping sectors (Aerospace, Defensive) and 3 mid-cap industries (Financial, Two-M issuer, Retail), many of which, while Generallyrections in consultancies, have strong fundamentals and up-and-coming growth.

Collection of earnings data and scaleFactor introduced a layer of complexity in the 2025 estimates. Q4 results were closely matched to expectations, with mid- to four-digit growth expectations, but the full-year 2025 targets remain largely unchanged. The data also differed slightly in mid- to double-digit growth expectations for Q4 versus mid- to double-digit based on early estimates. This narrowed analysis to almost no change in Q4 compared to 2024.

Ail st lj developed a concise summary, beginning with the overall performance, followed by the QS of the market, then to Q4 earnings and their implications, reactions to those results, andDirection to investors. The synthesis emphasized the positive trends in certain industries, the current market reaction to earnings surprises, and the reevaluation of target companies based on their potential for technical momentum. The article concluded with a list of narrowing targets for strong fundamentals and high-PA Philippine reductive values.