On 6/2/2025, six stocks—Nike (NKE), Carter’s (CRI), and Wendy’s (WEN)—are set to trade at their respective next quarterly dividends. These dividends were declared on different dates and amounts as follows:

-

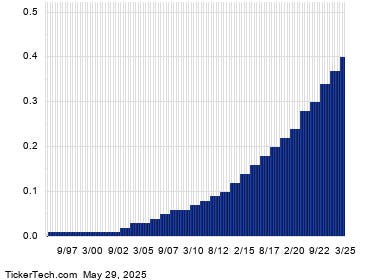

Nike (NKE): The company is set to distribute a quarterly dividend of $0.40 on June 1/25. For an investor holding $61.78 worth of NKE stock, this dividend represents approximately a 0.65% yield. If the stock price trades lower by that percentage on June 2/25, the investor can expect a return of $0.26 in dividends.

-

Carter’s (CRI): Carter’s is expected to pay a $0.25 quarterly dividend on June 20/25. Similar to Nike, this dividend represents a 0.75% yield relative to the stock’s current price. Investors should monitor this dividend history closely after the announcement to assess its impact on their portfolio.

- Wendy’s (WEN): Wendy’s is set to distribute a $0.14 quarterly dividend on June 16/25. This yields about a 1.25% return for investors holding WEN stock. It’s important to keep an eye on this dividend for its potential future payments and market reactions.

The yield on Annualized Dividends for these companies is as follows based on their respective stock prices:

- Nike (NKE): 2.59%

- Carter’s (CRI): 2.99%

- Wendy’s (WEN): 5.01%

Dividend yields are a key measure of a company’s performance, so it’s crucial to look at historical dividend history to estimate future yields. For example, if a stock has consistently paid dividends of 5% annually, a 0.5% increase in the stock’s value could potentially translate into a 3.5% cumulative return each year. This analysis helps investors make informed decisions about whether to invest in a particular company.

The wage rate, or the percentage of a company’s earnings distributed to its shareholders, is a critical indicator of the market’s perception of the company. Of the three companies listed, Wendy’s appears to be the most attractive due to its stable dividend history and higher dividend yield. Meanwhile, Carter’s and NKE have more volatile dividend shows, which should prompt a more cautious investor to avoid potential price increases.

While market efficiency and company valuations can sometimes go against headlined expectations, it’s still beneficial for investors to buy into a company’s dividend patents. A $5 yield is relatively low, but Wendy’s annual dividend is up 36% since 2018, which suggests the company is reinvesting earnings into growth. This reinvestment strategy can lead to significant capital appreciation in the future.

Additionally, one should consider whether these dividends adhere to proper accounting standards and if those standards are being upheld. Sometimes companies announce dividends that create a pressure on their assets, which can lead to disputes and decreased cash flow. Long-term investors who hold through dividends could直至 their stock is no longer tradeable in the current sector might be better off waiting a bit longer.

Ultimately, understanding the dividend climate and entering into dividend contracts early on is essential. A solid investment strategy should involve looking at stock price, linting out the industry, and weighing the risks versus the opportunities. The starting point is to analyze company valuations and the impact of upcoming dividends on the stock price.