The Federal Reserve’s December Meeting and Market Reactions: A Detailed Analysis

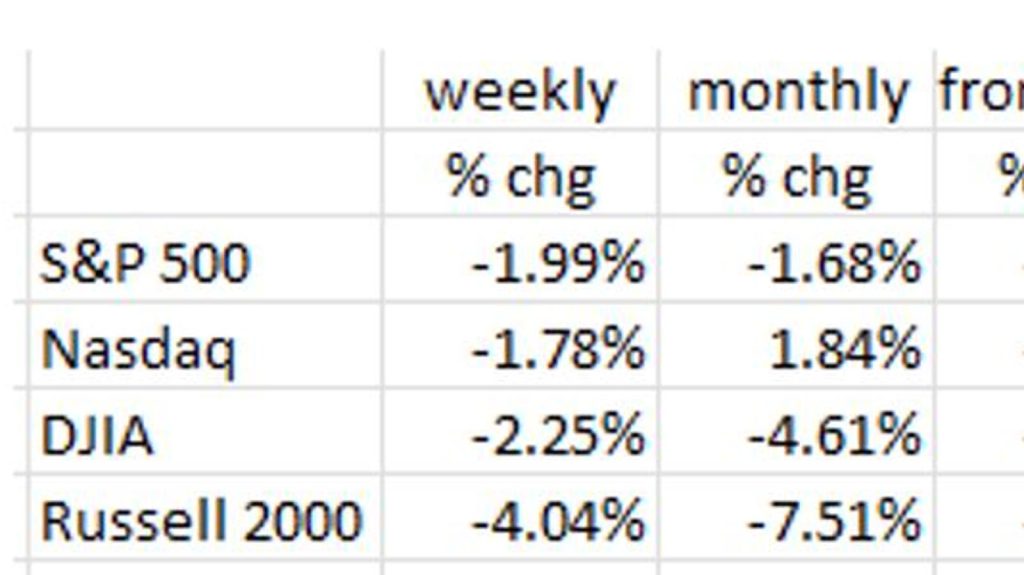

The Federal Reserve’s (Fed) December meeting triggered a significant market downturn despite the anticipated 25 basis point reduction in the Fed Funds Rate. This reaction stemmed from the "dot plot," a graph illustrating individual Federal Open Market Committee (FOMC) members’ projected future rate levels. The plot indicated only a 50 basis point drop in the Fed Funds Rate by the end of 2025, revising down from the full percentage point drop projected in September. Consequently, stock markets experienced a sharp decline, with the Dow Jones Industrial Average falling by 2.6%, the S&P 500 by 2.9%, the Nasdaq by 3.6%, and the Russell 2000 by 4.4%. Bond yields also surged, reaching their highest levels since late May. This market upheaval reflected investor concerns about the Fed’s commitment to further easing monetary policy, which raised fears of a prolonged period of higher interest rates. Subsequent positive news on the inflation front, with the Personal Consumption Expenditure (PCE) index showing minimal increases, provided some relief, leading to a partial market recovery. However, the overall trend for December remained negative for most major indices, highlighting the ongoing market volatility and uncertainty regarding the future direction of monetary policy.

The Fed’s revised interest rate outlook, attributed to persistent inflation concerns, significantly influenced market sentiment. Though recent months had shown signs of disinflation, this trend appeared to stall, prompting the Fed to shift its focus back to its inflation mandate from its previous emphasis on full employment. This shift surprised many market participants who believed the Fed had already achieved its 2% inflation target. The Fed’s cautious approach, likely influenced by past experiences with prematurely declaring victory over inflation, has led to a more hawkish stance. However, some analysts argue that the Fed’s preferred inflation gauge, the PCE, along with alternative calculations of the CPI suggest that inflation is already under control. This divergence in interpretation adds to the complexity of predicting future Fed actions and their impact on the markets.

The bond market plays a crucial role in translating the Fed’s actions into tangible economic effects. Following the release of inflation data, the 10-year Treasury Note yield rose sharply, reflecting market expectations of higher future interest rates. This rise in bond yields further contributed to the stock market decline as investors sought the relative safety and higher returns offered by bonds. The intricate interplay between the Fed’s pronouncements, market interpretations, and bond market reactions underscores the delicate balance the Fed must maintain in managing monetary policy.

Discrepancies between macroeconomic and microeconomic data further complicate the economic picture. A substantial downward revision of employment data by the Bureau of Labor Statistics (BLS) suggests that the labor market is more fragile than initially perceived. This revision raises questions about the accuracy of previous job market reports and indicates potential weaknesses in the economy. Furthermore, anticipated negative revisions in future employment data could reinforce this fragility. The Fed’s fluctuating focus between its inflation and employment mandates, influenced by these mixed data signals, creates uncertainty about the future trajectory of monetary policy.

The November CPI and PPI figures, which showed higher-than-expected inflation, likely contributed to the Fed’s renewed focus on its inflation mandate and the subsequent market volatility. Although certain core inflation measures showed more moderate increases, the overall trend remained concerning. The rise in wholesale food prices, a component of the PPI, raised concerns about potential future increases in consumer prices. However, the slowing growth in services prices offered a glimmer of hope for continued disinflation. The complexity of interpreting these various inflation metrics and their implications for future Fed policy adds to the challenges facing investors.

Several other economic indicators point to a potential slowdown in economic activity. Housing starts continued their decline, industrial production remained flat, and various regional manufacturing surveys showed weakening conditions. These data points suggest that certain sectors of the economy are already experiencing recessionary pressures. Additionally, rising unemployment claims and longer durations of unemployment further corroborate the weakening labor market narrative. These combined factors strengthen the argument for future rate cuts by the Fed, potentially exceeding the currently projected two cuts in 2025.

While retail sales figures appeared strong, driven by asset growth and rising stock prices, underlying trends reveal a more complex picture. Consumers are increasingly resistant to high prices, seeking cheaper alternatives or reducing consumption altogether. This consumer behavior is evident in declining sales within specific retail categories, such as restaurants, groceries, apparel, and department stores. This underlying weakness in consumer spending, coupled with the potential for a stock market correction, could further dampen economic growth and increase the likelihood of future rate cuts.

The market’s negative reaction to the Fed’s December meeting underscores the ongoing tension between the Fed’s inflation concerns and the market’s anticipation of further monetary easing. The mixed signals from various economic indicators, coupled with the Fed’s shift in focus back to its inflation mandate, have created a climate of uncertainty. The potential for further downward revisions in employment data, coupled with continued downward pressure on inflation from falling rents, strengthens the case for more aggressive rate cuts in 2025 than currently anticipated by the Fed. The evolving economic landscape and the complex interplay between the Fed and the markets will continue to shape the economic outlook in the coming months.