Highnote, a San Francisco-based fintech startup founded in 2020, has secured $90 million in Series B funding, catapulting its valuation to over $750 million. This latest investment, led by Adams Street Partners, with participation from Oak HC/FT, Costanoa, Westcap, and Pinegrove Capital Partners, underscores the growing interest in Highnote’s innovative approach to the payments landscape. The company’s initial focus was on card-issuing software, enabling businesses to swiftly deploy customizable debit, credit, virtual, charge, and loyalty cards, mirroring the services provided by companies like Marqeta. This new infusion of capital will fuel Highnote’s expansion into a new frontier: online payment acceptance, commonly known as acquiring. This strategic move positions Highnote to manage both ends of card transactions, creating a unified platform that streamlines the often fragmented payment process.

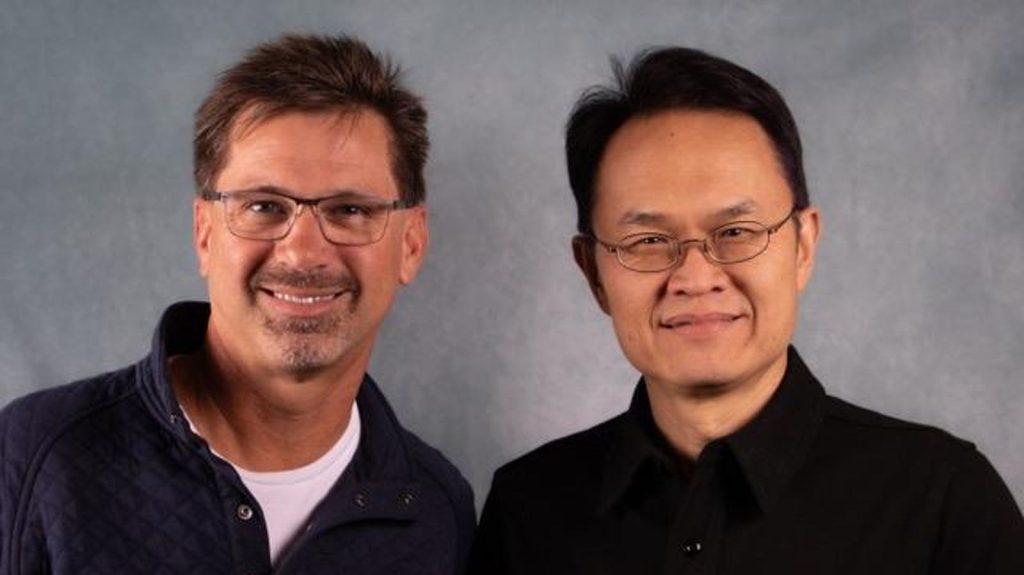

The driving force behind Highnote is CEO John MacIlwaine, a seasoned veteran with over 25 years of experience in the financial services and fintech sectors. His tenure at companies like Visa, Greendot, and LendingClub, coupled with his role as general manager of PayPal-owned Braintree, provided him with invaluable insights into the complexities and evolving nature of the payments industry. MacIlwaine recognized a significant gap in the market: the lack of integrated solutions for both issuing and acquiring payments. He envisioned a platform that would empower businesses to handle both functions seamlessly, eliminating the need for multiple vendors, reducing costs, and enhancing operational efficiency. This vision, coupled with the technical expertise of co-founder Kin Kee, formerly Braintree’s director of architecture, laid the foundation for Highnote.

Highnote’s core proposition is its unified platform, which addresses the fragmentation that characterizes many payment processing solutions. Traditionally, businesses have had to rely on separate providers for issuing cards and processing payments, leading to increased costs, complex integrations, and a lack of cohesive data insights. Highnote aims to disrupt this status quo by offering a single, integrated platform that handles both aspects of the transaction. This integrated approach not only simplifies operations but also provides businesses with a more holistic view of their payment flows, enabling better decision-making and enhanced customer experiences. While companies like Stripe also offer both acquiring and issuing, MacIlwaine contends that Highnote’s advantage stems from its early integration of both functions into its core infrastructure, creating a more streamlined and cohesive system.

Despite its impressive growth trajectory, with an annualized gross revenue of $81 million by the end of 2023, Highnote is not yet profitable. However, its growing customer base, which includes payments firm Netevia, and its robust team of 124 employees demonstrate the market’s appetite for its integrated platform. Highnote’s revenue model is based on software fees and a share of the interchange fees merchants pay when credit and debit cards are used. This dual revenue stream allows Highnote to align its interests with its customers’ success, fostering a mutually beneficial partnership.

Highnote’s entry into the competitive payments arena positions it against established players like Marqeta and Lithic. Marqeta, a prominent card issuer, experienced a tumultuous journey in the public markets, highlighting the challenges and volatility inherent in the fintech sector. Lithic, a decade-old company specializing in payment processing and card issuing, further intensifies the competition. Navigating this complex ecosystem requires strategic agility and a deep understanding of the evolving regulatory landscape. The increasing scrutiny of banking-as-a-service companies, particularly following the collapse of Synapse, underscores the importance of robust infrastructure and regulatory compliance.

Highnote’s leadership is confident in its ability to navigate these challenges. MacIlwaine emphasizes the company’s significant investments in infrastructure, including its general ledger, employee training, and strategic hiring practices. He asserts that Highnote has been minimally affected by the regulatory changes impacting the industry, unlike some of its competitors. This resilience, combined with its commitment to assisting customers in navigating the complex regulatory environment, positions Highnote as a reliable and forward-thinking partner for businesses seeking innovative payment solutions. The company’s focus on building a robust and compliant platform from the outset is a key differentiator in a market increasingly sensitive to regulatory risks.