Flowers Foods, a prominent player in the food and beverage sector, has earned a distinguished spot on the Dividend Channel’s “S.A.F.E. 25” list, a roster of companies demonstrating exceptional dividend performance. This recognition underscores Flowers Foods’ commitment to returning value to shareholders through consistent and growing dividend payouts. The company boasts a robust 4.3% yield, a testament to its strong dividend payment relative to its stock price, and an impressive track record of consistent dividend increases spanning at least two decades. This combination of high yield and consistent growth makes Flowers Foods an attractive option for income-seeking investors. The “S.A.F.E. 25” designation further highlights the company’s financial stability and its dedication to rewarding investors over the long term.

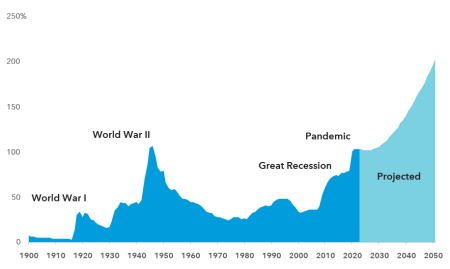

The “S.A.F.E.” acronym encapsulates the key attributes that qualify Flowers Foods for this prestigious list. “S” represents Solid return, encompassing both the attractive yield and the company’s strong DividendRank statistics. DividendRank is a proprietary metric that assesses the quality and sustainability of a company’s dividend, taking into account factors such as payout ratio, earnings growth, and financial health. “A” signifies Accelerating amount, reflecting Flowers Foods’ consistent pattern of increasing its dividend payouts over time. This consistent growth demonstrates the company’s ability to generate increasing profits and its commitment to sharing this success with shareholders. “F” stands for Flawless history, emphasizing the company’s impeccable record of never having missed or reduced a dividend payment. This unwavering commitment to dividend payments, even during challenging economic periods, provides investors with a sense of security and reinforces trust in the company’s financial stability.

The “E” in “S.A.F.E.” represents Enduring, highlighting the longevity of Flowers Foods’ dividend payments, spanning at least two decades. This long-standing history of dividend payouts underscores the company’s financial strength and its enduring commitment to shareholder value. This consistent track record demonstrates the company’s resilience and its ability to navigate various economic cycles while maintaining its dividend policy. For investors seeking long-term income streams, the combination of high yield, consistent growth, and a flawless history makes Flowers Foods an appealing investment proposition. This “S.A.F.E.” designation serves as a valuable indicator for investors seeking reliable and growing income from their investments.

Flowers Foods’ inclusion in prominent exchange-traded funds (ETFs) further validates its financial strength and market recognition. The company is a constituent of the iShares S&P 1500 Index ETF (ITOT), a broad market ETF that tracks the performance of 1500 large-, mid-, and small-cap US stocks. This inclusion indicates that Flowers Foods is considered a significant component of the broader US equity market. Moreover, Flowers Foods is also a holding within the SPDR S&P Dividend ETF (SDY), a fund focused on dividend-paying companies with a long history of increasing dividends. This ETF specifically targets companies with consistent dividend growth, further emphasizing Flowers Foods’ commitment to returning value to shareholders through dividends.

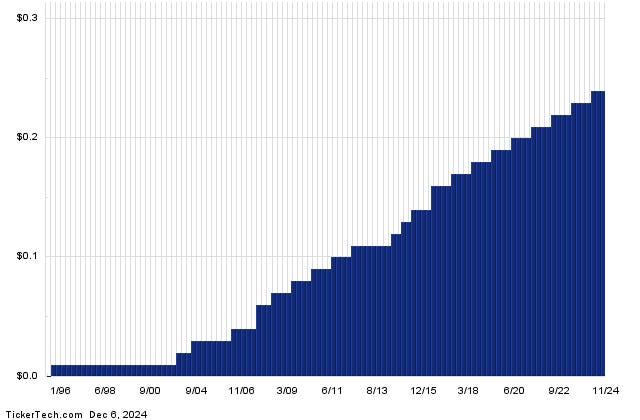

The company’s most recent dividend ex-date was November 29, 2024, with an annualized dividend of $0.96 per share, paid in quarterly installments. This regular distribution of dividends provides investors with a predictable income stream. The provided long-term dividend history chart further illustrates the consistent growth in Flowers Foods’ dividend payouts over time, reinforcing its commitment to rewarding shareholders. This visual representation of the company’s dividend history serves as a powerful testament to its financial strength and its dedication to increasing shareholder value through consistent dividend growth.

Finally, operating within the competitive food and beverage sector, Flowers Foods stands alongside industry giants such as Mondelez International and Kraft Heinz. This sector is characterized by established brands and consumer staples, and Flowers Foods’ ability to maintain its strong dividend performance within this competitive landscape speaks to its operational efficiency and financial stability. The company’s commitment to delivering consistent dividend growth, alongside its peers in the food and beverage industry, positions it as a reliable and attractive investment option for income-seeking investors. The “S.A.F.E. 25” designation further solidifies Flowers Foods’ reputation as a dependable dividend payer, providing investors with confidence in the company’s long-term prospects and its commitment to returning value to shareholders through consistent and growing dividends.