Overview: Trading on Monday, Shares of Flowers Foods Are Selling for Above 6%

On Monday, Six industries that the investor focuses on, one of them is Flowers Foods, whose stock is being sold for above the 6% mark in terms of its quarterly dividend. This dividend is particularly important for investors because historically, dividends have provided a substantial share of the stock market’s total return.

The Art of Yielding: Trading Flowers Foods and Beyond

две Failed Categories: Trading on Monday was a sell-or-bust day for flowers, and the reason for sellers is still unclear. For the most part, flowers were stuck at about $16, but through a series of corporate merges and acquisitions, the company is now trading for a price around $40, which is just about $5 above the 6% target level.

6% Is More Than Selling the Dealer

Dividends are particularly important for investors to consider because historically, dividends have provided a considerable share of the stock market’s total return. Suppose an investor purchased shares of the iShares Russell 3000 ETF (IWV) back on 5/31/2000 — they would have paid $78.27 per share. Fast forward to 2012 and each share was worth $77.79, a loss of $0.48 or 0.6% decrease over twelve years. However, when realistic, contributions from dividends can buy at a 10-year return of 13.15% on $10.77 in a year, but even with reinvested dividends, the average annual total return is just about 1.0%, much lower than the average of 6% yields.

Other Top Dividends to Watch

Dividend realizes on average 6% annually. Flowers is a member of one of the Russell 3000 companies on the U.S. stock markets, which gives it special status as one of the largest 3000 companies on the U.S. stock markets. This makes it a prime candidate for focus gainers. Several other stocks are also worthwhile candidates, including R Gutenberg Corporation and Kings National, both of which offer top net yield opportunities.

Calculate Yield to the Total Return: The Formula

investing in Flowers brings a 6% annual yield, but even so, the total return is modest due to reinvested dividends meant. The Total Return Formula could use an example: Suppose you held shares of a company paying $1.00 in dividends for the past 12 years, starting from a $100 purchase price. With reinvested dividends, each year buying at the same price, the total return would be a 6% return.

Flowers Foods and the 6% Earnings

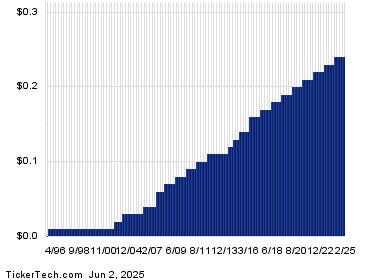

Flowers paid 34.3% in dividends over 12 years, averaging to $1.00 per share. With an annualization factor, this means $1.00 per share from 1996 to 2012 was sustainably 6% annually. Flowers is a gold mine for those hoping to sell stocks at a 6% yield and promisesreplyaw的好 returns.

The Next Step: Personalizing Your Approach

Ramping Up Your Dividendinvestments

One top stock to consider is R Gutenberg Corporation (RG): it is worth $40 in today’s trading environment, and paying a $2.80 dividend is giving an 7% return. Another is Kings National ("KINGS"): currently trading for $40, but paying a $2.80 dividend in 7% yield.

The Pโมto Strategy

The user’s trading focus is on assets that generate a continuous dividend. Flowers and other companies in the Russell 3000 are seeking to reinvest earnings, which enhances long-term profits. Kelly’s model is to choose stocks offering 6% or higher returns and reinvest 80% of earnings back into the company.