Goldman Sachs has solidified its commitment to CEO David Solomon’s leadership with a substantial compensation package aimed at retaining his expertise for the next five years. Central to this package is a remarkable $80 million retention bonus structured as restricted stock units, vesting by January 2030, provided Solomon remains with the firm. This considerable sum underscores the board’s confidence in Solomon’s stewardship and its desire to maintain stability during a period of evolving industry dynamics. This strategic move aligns with the bank’s broader talent retention strategy, especially in the face of competition from non-traditional players in the financial sector. The retention package accompanies a significant increase in Solomon’s overall compensation for 2024, reaching $39 million, a 26% rise from the previous year. This total figure encompasses a $2 million base salary, an $8.33 million cash bonus, $25.9 million in performance-based stock units, and $2.78 million allocated to a newly implemented incentive program.

Mirroring the commitment to Solomon, John Waldron, the bank’s president and chief operating officer and a potential successor to the CEO role, has also received an identical $80 million retention bonus in restricted stock. This parallel move emphasizes the board’s focus on securing its top leadership and ensuring a smooth transition should Solomon eventually step down. The substantial retention bonuses for both Solomon and Waldron highlight the premium Goldman Sachs places on experienced leadership within the increasingly competitive financial landscape. The board recognizes the challenges in attracting and retaining top-tier talent, particularly as competition intensifies from alternative asset management companies, a sector where Goldman Sachs is also actively engaged.

The rationale behind these substantial retention packages is rooted in the evolving dynamics of the financial industry. Goldman Sachs acknowledges the escalating “war for talent,” particularly from non-traditional competitors like hedge funds and private equity firms. These entities often offer lucrative compensation structures, including carried interest – a share of the profits earned on investments – which has traditionally been a strong incentive in the private equity world. To remain competitive, Goldman Sachs is leveraging its growing presence in the alternative asset management space, emphasizing its position as a “top 5 alternative asset manager” to attract and retain top executives by offering them the potential to earn carried interest, a perk usually associated with private equity firms. This strategic move allows Goldman Sachs to compete more effectively with other financial institutions vying for the same limited pool of highly skilled professionals.

Solomon’s recent public statements reflect both his commitment to Goldman Sachs and the board’s confidence in his leadership. He acknowledged the inherent volatility of the financial industry, noting that while “things are going well” currently, the situation can change rapidly. However, he emphasized the firm’s commitment to its strategic direction, the strong support from the board, and the strength of the executive team. This confident outlook, coupled with the significant retention package, signals a period of stability and continued focus on the firm’s long-term goals. Solomon’s remarks underscore the collaborative relationship between the CEO and the board, suggesting a unified approach to navigating the challenges and opportunities ahead.

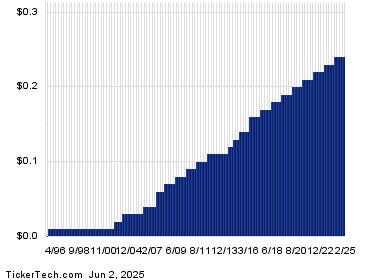

The substantial retention packages for Solomon and Waldron come on the heels of a strong financial performance for Goldman Sachs. The bank’s stock price has surged by 48%, and fourth-quarter profits more than doubled to $4.1 billion, demonstrating the effectiveness of the firm’s current strategies. This robust financial performance likely played a significant role in the board’s decision to reward and retain its key leadership figures. The combination of strong financial results and the commitment to leadership continuity positions Goldman Sachs favorably for continued growth and success in the coming years. The retention bonuses can be seen as an investment in the future, aiming to maintain the leadership that has contributed to the firm’s recent prosperity.

This is not the first time Solomon has received a retention package. In late 2021, he was granted an initial retention award amidst a competitive “war for talent.” This earlier package, currently estimated to be worth at least $50 million, was tied to specific performance targets for the company’s stock, requiring Goldman Sachs to outperform its competitors. A key difference between the 2021 package and the recently announced awards is the absence of performance metrics for the latter. The current $80 million retention bonuses for Solomon and Waldron are not contingent on any specific performance goals, signifying a shift in the board’s approach to incentivizing its top executives. This change potentially reflects the board’s confidence in Solomon and Waldron’s leadership, believing that their continued presence at the helm is crucial for the firm’s long-term success, regardless of short-term market fluctuations. The unconditional nature of the new retention package suggests a long-term perspective focused on stability and sustained leadership rather than solely on immediate performance metrics.