The dilemma of allocating funds towards home improvements versus investing in financial markets is a common one, especially for homeowners in high-value areas. Upgrading a home offers tangible benefits like increased property value and enhanced living conditions, while market investments promise potentially higher financial returns, liquidity, and diversification. Making an informed decision requires carefully weighing these competing advantages, considering individual circumstances, and recognizing the inherent trade-offs.

Home improvements can significantly enhance property value, particularly renovations focusing on kitchens and bathrooms. Studies indicate a strong return on investment (ROI) for these upgrades, with minor kitchen remodels often exceeding 80% ROI and major kitchen or bathroom remodels averaging around 55%. While these improvements contribute to a home’s market appeal and potential resale value, the actual return depends on factors such as project scope, location, and market conditions. Beyond the monetary gains, home improvements also significantly enhance personal enjoyment and lifestyle. Renovations can create more functional and aesthetically pleasing spaces, leading to increased comfort, satisfaction, and potentially even promoting healthier habits like home cooking. Furthermore, certain energy-efficient upgrades may qualify for tax deductions or credits, offering additional financial incentives. While the initial outlay for renovations can be substantial, the long-term benefits of increased home value, enhanced livability, and potential tax advantages should be considered.

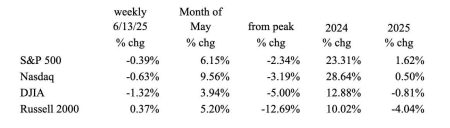

In contrast, investing in financial markets presents a different set of advantages, primarily focused on higher potential returns and greater financial flexibility. Historically, market returns, as exemplified by the S&P 500, have consistently outpaced the appreciation of home values. While real estate investments offer a degree of stability, market investments, particularly in diversified portfolios, can offer greater growth potential over the long term. This higher earning potential is driven by the ability to participate in the growth of numerous companies and sectors, capturing broader economic trends and potentially outperforming the relatively slower pace of real estate appreciation. Moreover, financial markets offer significantly greater liquidity compared to real estate. Investments can be easily bought or sold, providing access to funds when needed, a flexibility not readily available with real estate assets.

Diversification is another key benefit of market investments. Holding a portfolio of various assets, such as stocks, bonds, and other securities, spreads risk across different sectors and companies, mitigating the impact of any single investment’s performance. This diversification strategy reduces the vulnerability to localized or industry-specific downturns, which can significantly impact real estate values. A single property is susceptible to localized risks like environmental changes, economic downturns in the specific area, or even neighborhood-specific issues. A diversified portfolio, however, is less susceptible to these localized pressures, offering greater resilience and potentially more consistent returns over time.

While market investments offer compelling financial advantages, it’s crucial to acknowledge the inherent risks involved. Market volatility can lead to fluctuations in portfolio value, and while long-term returns tend to be positive, short-term losses are possible. This requires a long-term investment horizon and a tolerance for market fluctuations. Furthermore, managing a diversified portfolio requires knowledge and expertise, or potentially the cost of professional financial advice. Unlike the tangible benefits of a renovated kitchen or bathroom, the rewards of market investments are often realized over longer periods and require patience and discipline.

The decision of whether to upgrade a home or invest in financial markets is a highly personal one, dependent on individual circumstances, financial goals, and risk tolerance. Factors such as current financial stability, the age and condition of the home, and long-term financial objectives should all be considered. For individuals with limited savings and pressing needs for improved living conditions, home upgrades might take precedence, especially if those upgrades significantly enhance functionality and comfort. If the home is already in good condition and long-term financial growth is a priority, investing in financial markets may be more advantageous, offering the potential for higher returns and greater financial flexibility.

Ultimately, the optimal strategy might involve a balanced approach. Allocating a portion of available funds to necessary home improvements while simultaneously contributing to a diversified investment portfolio can offer both the immediate benefits of an improved living space and the long-term potential of market growth. Seeking professional financial advice can provide personalized guidance, helping individuals navigate the complexities of these decisions and develop a strategy aligned with their unique circumstances and goals. The key is to carefully assess personal needs, financial resources, and long-term objectives, weighing the tangible benefits of home improvements against the potential financial rewards and risks of market investments.