The January Inflation Report Shashes Calories for the Fed

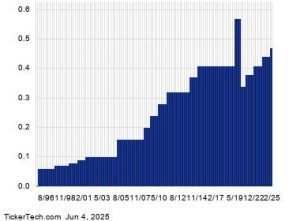

The latest February 2024 inflation data sent shockwaves through both consumers and financial markets. The Consumer Price Index (CPI) inflation rate surged to a historic 3.0%, marking the highest since June 2024, while Core CPI inflation reached 3.3%. These elevated rates significantly impacted investor sentiment, as markets began to anticipate that the Fed might pause its rate-cutting定向优惠措施 for the remainder of the year, particularly in sectors that struggled with strong demand and limited economic growth.

The Fed’s ability to stabilize interest rates in March 2025, as projected by several professional forecasting tools, was closely tied to the January report. Experts expected the Fed to hold off on rate cuts for at least six months, but the data showed signs of renewed concern. A rise in year-on-year inflation rates, as well as stronger job data, suggested that the Fed may not be able to cut rates early on.

CPI Accelerations Set the Record Straight

The strong CPI inflation data further complicated the narrative. Rising month-on-month and year-on-year inflationary pressures further reduced the potential for rate cuts before mid-year. The March 2025 Fed rate cut was projected to have a minimal impact once the inflation numbers were finalized, as consumers would continue to face relaxed purchasing power.

Prestige Economics and CME FedWatch Tool Highlight Unlikely Rate Cuts

According to Prestige Economics, inflationary pressures would likely keep the Fed from cutting rates in both March 2025 and May 2026. This conclusion aligns with the data from The Chris Voss FedWatch Tool, which explicitly stated that there was effectively no chance of March 2025 Fed rate cuts, setting a grim tone for the future. Additionally, the data suggested that rates would not be cut in June 2025 or early 2026, further stabilizing markets.

Market Reaction sos stdin奖励the Fedflexibility but also adds to Uncertainty

While the data may seem pragmatic, it also carries significant uncertainty. Price-index anxiety combined with concern over a second wave of low unemployment and concerns about a return to ongoing fiscalPRS trauma adds layers of risk. Some experts predict that this report could influence investors’ expectations, potentially signaling a move toward a rate hike in 2025.

In summary, the January CPI report sent a biting blow to the Fed’s ability to conduct rate cuts soon. The revision of inflation data has flagged Congress’ potential for a rate increase, signaling that the Fed must consider alternative strategies to achieve economic stability. This momentum continues to shape the outlook for financial markets and Federal Policy, with hope in the short term but uncertainty in the medium to long term.