Life Insurance Now: Mastering Your Financial Tool for Comfort, Protection, and Freedom

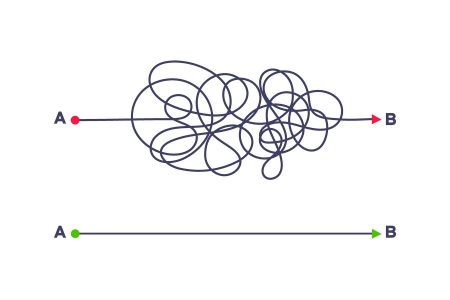

The world of life insurance is one of the most powerful financial tools available, but many people fail to grasp its full potential. This article delves into key insights about choosing the right policy, avoiding common pitfalls, and maximizing its value as a financial asset. Whether you’re evaluating your current coverage or considering a new plan, this guide will help you make informed decisions for your loved ones.

Understanding Common Eggs in Life Insurance

Life insurance isn’t just about protection—it’s also about marketing and deception. When you buy what looks like an affordable policy, the陷阱 isn’t so obvious. For instance, universal life insurance, which is sometimes mistaken for life insurance, offers flexible premiums and growth opportunities but can become expensive over time. Similarly, employer-sponsored life insurance may seem like a great deal, but the problem lies in its lack of portability. If you leave your job, your coverage typically doesn’t follow you, leaving you uninsured.

Variable Universal Life (VUL) and Indexed Universal Life (IUL)

VUL and IUL are the latest advances in life insurance. VUL allows investment in a subaccount, while IUL ties cash value growth to a stock market index. While these options offer potential for growth and a sense of security, they come with risks. guarantees against asset downturns, but they also carry caps on upside gains. When evaluating these policies, always read the prospectus carefully and make sure the policy aligns with your financial goals.

Budget Life Insurance: A Tool for Stability

Even the most straightforward group policies can seem like a great deal. However, budget life insurance requires careful consideration. The challenge lies in selecting a policy that meets your specific needs and goals, not just your budget. Understanding the premiums, death benefits, and duration of coverage is crucial.

The Fear of Life Insurance: Common Pitfalls

Uninformed purchases are natural. For example, some may buy life insurance thinking it’s for death, when it’s actually a coverage for their family. Knowing what you’re buying is essential; it can save you money and leave you covered for the future.

Employer-Sponsored Life Insurance: A Distra Fortune

While group life insurance through an employer seems tempting at first glance, employers often fail to provide the same level of coverage and security. For instance, a widow whose husband had employer-sponsored life insurance may find herselfizing the death of their family, which was supposed to provide a temporary protection but fell short significantly.

Budget Life Insurance: Cutting Costs Potentially at Risks

When it comes to selecting the right policy, everyone’s financial situation is different. Budget life insurance can fit perfectly, but it’s not a one-size-fits-all solution. Some policies may be cheaper initially, but the benefits they claim later can diminish your peace of mind. Before choosing a policy, always calculate how it will affect your future needs.

Choosing theRight Advisor: Getting Personal

Not all professionals are created equal. Even if you’re looking for life insurance, it’s essential to select a policy that aligns with your specific financial goals. Professional guidance is a must—ask for references and read about reputable carriers. Ensure your financial advisor has experience with life insurance and is committed to ongoing education.

Conclusions

Life insurance is a valuable financial tool that offers peace of mind, but it’s everything you do with it that makes it truly useful. Misunderstanding the policy types, missing potential benefits, and underestimating risks all can lead to serious problems. Always research carefully, consider your needs, and work with a knowledgeable professional. With the right policy, you’ll be financially secure for generations to come.