The Tariff Tempest: A Market Rollercoaster and Investment Strategies

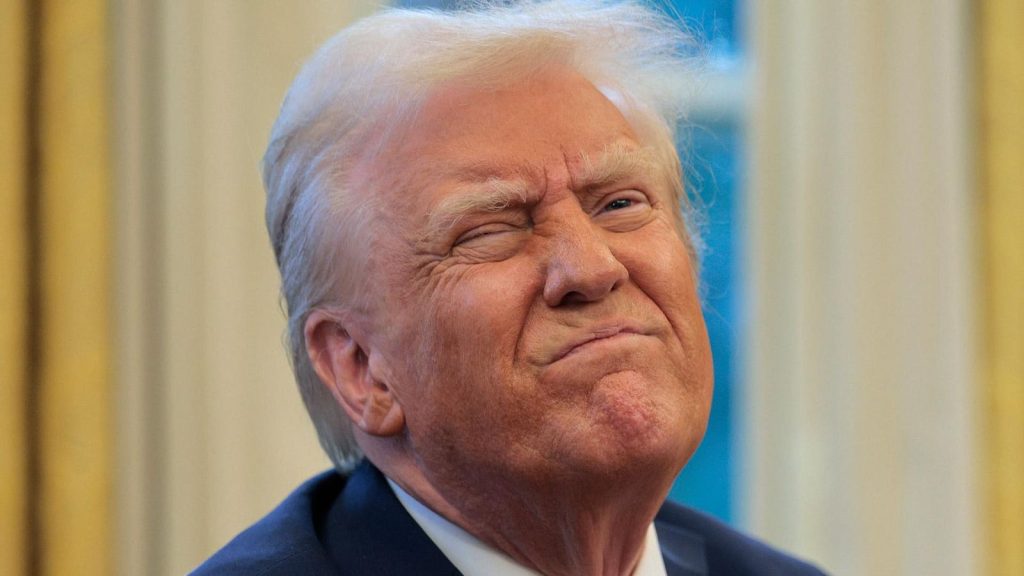

The financial markets experienced a turbulent Monday as investors grappled with the implications of President Trump’s tariff threats against Mexico, Canada, and China. While a last-minute reprieve on tariffs for Mexico and Canada brought a sigh of relief and a market rebound, the looming 10% levy on Chinese goods kept investors on edge. The initial market reaction was swift and negative, with the S&P 500 dropping 2% at the opening bell. However, Trump’s agreement to suspend tariffs on Mexican imports, contingent on increased border security measures, prompted a significant recovery. A similar agreement with Canada later in the day further solidified the market’s rebound, underscoring the powerful influence of trade policy on investor sentiment. While the immediate crisis was averted, the episode highlighted the potential for continued market volatility stemming from the administration’s trade policies.

Despite the temporary calm achieved through negotiations with Mexico and Canada, the specter of tariffs on Chinese goods continues to loom large. This persistent threat, coupled with the president’s suggestion of future tariffs on the European Union, reinforces the perception of trade policy as a potent negotiating tactic. This creates uncertainty in the market, as investors attempt to anticipate the next move in this ongoing trade war. Experts suggest that this approach may become a recurring theme, requiring investors to adapt their strategies accordingly. One recommended approach is to focus on domestic-oriented small and mid-sized companies, which are less vulnerable to international trade disruptions.

Amidst the trade war anxieties, investment strategists offer varying perspectives. Some believe that President Trump recognizes the detrimental effects of a full-blown trade war and will ultimately seek compromises. This view suggests that the president will likely capitalize on any concessions from trading partners to declare victory, thereby mitigating the negative economic impact. Other experts, however, are less optimistic, anticipating that the president’s aggressive stance on trade will persist. This divergence in opinion underscores the prevailing uncertainty surrounding the administration’s trade policy.

Navigating this uncertain landscape requires a strategic investment approach. Experts recommend focusing on sectors that demonstrate resilience and growth potential, such as communication services, financials, healthcare, and materials. Within these sectors, companies with strong domestic footprints and limited exposure to international trade disruptions are particularly attractive. Examples include companies like O’Reilly Automotive, pharmaceutical firms like Boston Scientific and Quest Diagnostics, and industrial REITs like Prologis. These companies are less likely to be negatively impacted by tariffs and trade wars, offering investors a degree of protection.

The automotive sector presents a unique challenge, given the complex global supply chains and interdependencies between countries. While Canada and Mexico are crucial trading partners for US automakers, the impact of tariffs varies across the industry. Investors are advised to focus on companies with minimal reliance on imports from these countries. Gentex Corp., a manufacturer of automotive electronic equipment, is cited as an example of a company with relatively low exposure to Canadian and Mexican imports. However, even companies with limited direct exposure are still susceptible to broader market downturns if tariffs lead to decreased consumer demand.

For investors seeking to capitalize on the potential for domestic manufacturing growth, small-cap companies offer an attractive opportunity. These companies typically generate a significant portion of their revenue domestically and are currently trading at a discount compared to large-cap stocks. The trend of reshoring manufacturing operations, potentially driven by tariff pressures, could further benefit these smaller companies. This presents a compelling investment case for investors seeking undervalued opportunities with growth potential. For those who prefer a passive investment strategy, small-cap value index funds provide a diversified approach to capturing this potential upside. These funds offer exposure to a broad range of small-cap companies, mitigating the risks associated with individual stock picking.