Warren Buffett’s Berkshire Hathaway has embarked on a significant portfolio shift, reducing its substantial stake in Apple and diverting a portion of the proceeds into Domino’s Pizza. This move has sparked considerable discussion regarding its strategic implications and whether it signals a broader change in Buffett’s investment philosophy. The Apple sell-off, totaling over 615 million shares, was primarily driven by concerns about the tech giant’s overvaluation. Despite Apple’s robust financial performance and dominant market position, its stock price had surged significantly, trading at a premium compared to its intrinsic value. Buffett, renowned for his value investing approach, likely viewed the inflated price as an opportune moment to trim his holdings and lock in substantial gains, especially considering potential future tax increases.

Beyond valuation concerns, the timing of the Apple sale, shortly after the passing of Buffett’s long-time partner, Charlie Munger, suggests a potential shift in investment perspective. Munger was a strong advocate for technology investments, particularly Apple and Alphabet, recognizing their market dominance and consistent outperformance. Buffett, traditionally more cautious with technology companies, might have felt less compelled to maintain such a large Apple position without Munger’s influence. This subtle shift underscores the nuanced dynamics within Berkshire Hathaway’s investment strategy.

The reinvestment of a portion of the Apple sale proceeds into Domino’s Pizza further highlights this evolving strategy. Domino’s, a well-established franchise business with a strong track record of profitability, represents a departure from the high-growth, technology-focused investments that have characterized Berkshire’s portfolio in recent years. This move suggests a renewed focus on value and stability, seeking opportunities in businesses with predictable cash flows and robust competitive advantages. Domino’s, with its dominant market share in the quick-service restaurant pizza sector, and its innovative strategies like the “fortressing” approach and advanced technology integration, presents a compelling investment case for long-term growth.

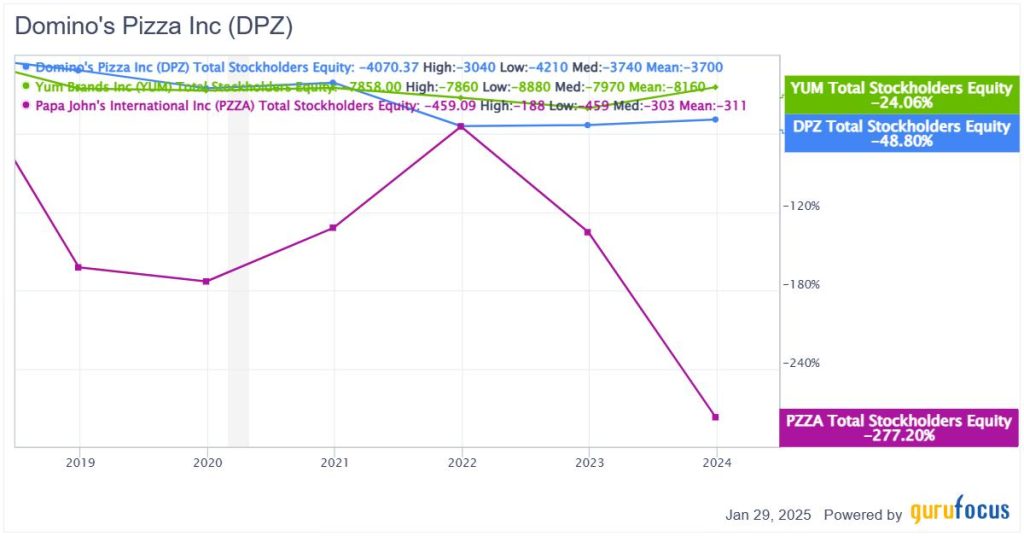

While Domino’s offers a potentially attractive investment opportunity, it’s not without its challenges. The company carries a significant debt burden, a common characteristic in the capital-intensive QSR industry. However, its strong return on invested capital (ROIC) significantly exceeding its weighted average cost of capital (WACC) indicates effective capital allocation and value creation despite the debt. Berkshire Hathaway’s investment, with its substantial cash reserves, could further alleviate investor concerns about Domino’s debt levels. Moreover, Domino’s consistent dividend payouts, coupled with a history of dividend growth, further enhance its appeal as a stable income-generating investment.

Apple, despite the sell-off, remains a significant holding in Berkshire’s portfolio. The company’s long-term prospects remain promising, driven by its innovative product pipeline, including the new iPhone 16, Apple Watch Series 10, and AirPods 4. The development of a proprietary cellular modem, planned for integration into future iPhone models, signifies a strategic move towards vertical integration, potentially boosting margins and enhancing control over its supply chain. Furthermore, the introduction of Apple Intelligence, the company’s latest AI system, is expected to drive further upgrades and maintain its loyal customer base. However, geopolitical risks related to its supply chain in China and Taiwan, coupled with antitrust concerns and weakening consumer spending, pose near-term challenges to Apple’s growth trajectory.

Berkshire Hathaway itself faces its own set of challenges. While the company boasts strong financial health and profitability metrics, recent developments have raised some concerns. Declining operating earnings, driven by lower underwriting income in the insurance business, and a history of rising debt point to potential headwinds. Furthermore, the impending leadership transition following Buffett’s eventual departure adds an element of uncertainty. While Berkshire’s diversified business model and substantial cash reserves provide a cushion against these challenges, concerns about maintaining its historical outperformance under new leadership persist.

In conclusion, Buffett’s strategic shift, marked by the Apple sell-off and the Domino’s investment, reflects a nuanced recalibration of Berkshire Hathaway’s investment approach. The move signifies a renewed emphasis on value investing principles, seeking opportunities in businesses with stable cash flows and strong competitive advantages. While Apple’s long-term prospects remain positive, its overvaluation prompted a strategic reduction in Berkshire’s holdings. Domino’s, with its growth potential and consistent dividend payouts, offers a compelling alternative within a more traditional value investing framework. Both Berkshire Hathaway and Apple face their respective challenges, including leadership transitions and geopolitical risks, underscoring the dynamic nature of the investment landscape. The long-term success of this strategic shift will ultimately depend on how these companies navigate these challenges and capitalize on emerging opportunities.