The cryptocurrency market, especially the realm encompassing meme coins, has experienced a transformation that shocks the traditional finance sphere. Initially considered a byproduct of whimsical internet culture, cryptocurrencies—particularly meme coins—are now engaging a youthful audience with vast speculative potential. The rise of meme coins reflects a blend of humor, absurdity, and economic despair, creating a market valuing approximately $100 billion. Meanwhile, it also serves as a reflection of a financial nihilism rooted in the realities faced by younger generations, such as overwhelming student debt and stagnant income growth.

Take, for instance, the experience of Oliver Szmul, a 16-year-old college student from London, who, after rapidly turning a meme coin called Jail Cat into a fleeting fortune, expresses a desire to acquire luxury items like a Lamborghini. This coin, emblematic of the meme-centric ethos, was conceived with no tangible utility, existing solely for market speculation. Szmul’s story, alongside others like him, demonstrates how quickly fortunes can be made and lost in this volatile landscape, with Jail Cat’s value plummeting to about $87,000 after peaking. Szmul’s foray into the meme coin market highlights a burgeoning trend where amusement and excess volatility define the behavior of young traders.

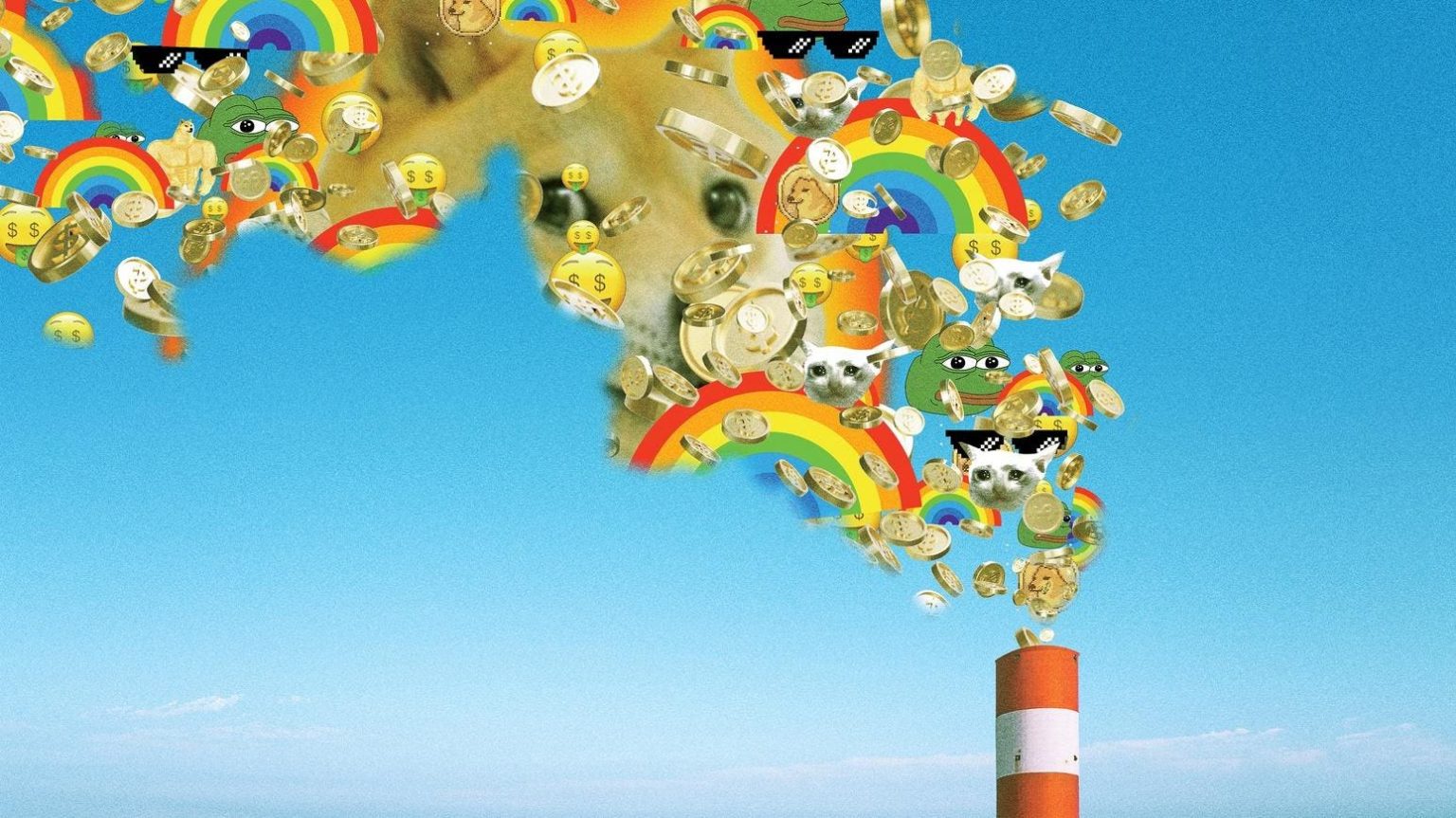

The mechanisms behind meme coin creation have notably shifted from requiring sophisticated technical skills to what is essentially a click-and-produce model. Platforms like Pump.fun have democratized the ability to launch meme coins, simplifying the process to where anyone can create a coin with merely an idea and a digital image. This accessibility has led to an explosion in their creation, with tens of thousands emerging daily. The allure of rapid wealth accumulation, coupled with unusually high trading volumes, captures the attention of speculators, mirroring the dynamics of influencer marketing in the digital space. The explosive growth in popularity and market capitalization of meme coins, with metrics showing a sharp increase relative to established coins like Bitcoin, suggests a cultural shift toward valuing speculative trading over traditional investment logic.

Despite the apparent excitement, investing in meme coins entails significant risks. Market volatility is intensified, with meme coins reportedly being 50 times more volatile than Bitcoin. Approximately 70% of them are associated with scams, including pump-and-dump schemes and rug pulls—where developers vanish with investors’ money. As young traders like 23-year-old K Crypto acknowledge, this environment resembles that of a casino, where fortunes can vanish just as quickly as they appear. Yet, the lack of regulation and oversight creates a Wild West atmosphere, where the rules governing traditional investing seem to dissipate, leaving many fleeing for safety amidst financial carnage.

Companies like Pump.fun exemplify the new mechanics of meme coin trading, operating without traditional liquidity pools. Their algorithm-driven market mechanisms create the illusion of value without any actual backing, allowing new tokens to flourish out of thin air. This model supports a daily trading volume over $100 million, with industries built around the hype of meme coin exchanges. As interested individuals explore meme coin creation through platforms they perceive as easy and exciting, they may overlook the cautionary tales inherent to a landscape rife with risk. Developers and influencers manipulate market sentiment, leading unsuspecting traders into speculative and often unfulfilled dreams.

Underlying this emerging economy of absurdity is a generational sentiment finely captured by figures such as Murad Mahmudov, also known as “Meme Coin Jesus.” He posits that the embrace of meme coins reflects broader social and economic disillusionment among young people confronting job instability, educational debt, and existential threats like climate change. Many feel the existing financial systems offer little hope for prosperity, resulting in a trend where young adults find themselves betting everything on meme coins to achieve outsized returns. Innovators in this space are capitalizing on these sentiments, creating meme coins designed to appeal to this hunt for alternative wealth routes.

Contemplating the rise of meme coins, it becomes clear they represent more than a fleeting trend but rather an existential response to the challenges facing young people today. Coins like SPX6900 highlight this sentiment, targeting disenfranchised potential investors seeking a radical departure from the traditional financial views epitomized by leading indices. Meme coins may seem trivial at first glance, yet their popularity challenges conventional notions of value and investment while reflecting a deeper societal malaise. In the face of looming financial struggles, absurdity and humor manifest in a form that fuels speculative engagement, transforming the cryptocurrency landscape into a reflection of the zeitgeist.