The Latino community currently faces a complex economic reality: while overall economic conditions are improving, a persistent wealth gap compared to white families remains a significant challenge, poised to widen further due to the impending “Great Wealth Transfer.” While median Latino family wealth saw a remarkable 252% increase between 2013 and 2022, the average white family still holds five times the wealth of an average Latino family. This disparity underscores the fragile nature of Latino economic progress and highlights the deep-seated structural inequalities that continue to hinder wealth accumulation within the community. The looming intergenerational transfer of wealth threatens to exacerbate this divide, creating a two-tiered system where already affluent families receive a massive influx of capital, while others struggle to gain a foothold.

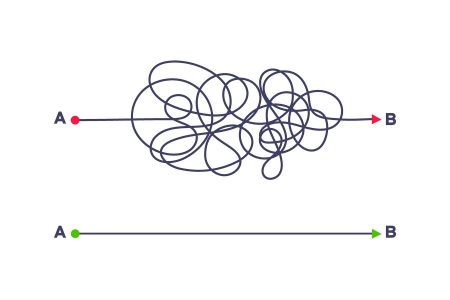

The Great Wealth Transfer, projected to reach a staggering $84 trillion between now and 2045, represents an unprecedented shift of assets from older generations to millennials and Gen Xers. This massive influx of capital, with $16 trillion anticipated in the next decade alone, will profoundly impact the economic landscape. While much of this transfer will occur through inheritance, a growing trend of “giving while living” sees parents and grandparents providing substantial financial support for home purchases, investments, education, and even shared experiences. This practice further reinforces existing advantages, providing a springboard for continued wealth accumulation among those already privileged. While these transfers undoubtedly enhance quality of life and social mobility for the recipients, they simultaneously amplify the challenges faced by those excluded from this wealth stream. Rising costs of living, coupled with systemic inequities, create increasingly insurmountable barriers to wealth building for those without access to such substantial family support.

The racial and ethnic disparities embedded within the Great Wealth Transfer are stark. Data reveals a stark concentration of wealth among white baby boomers, who hold a staggering 90% of their generation’s net worth, compared to less than 2% held by both Latino and Black baby boomers combined. This disparity stems from historical barriers that have prevented underrepresented groups from accessing the same opportunities for wealth accumulation through real estate and stock market investments. The legacy of these discriminatory practices continues to shape the current economic landscape, contributing significantly to the wealth gap. As this vast intergenerational transfer unfolds, it threatens to solidify and even deepen existing inequalities, creating a widening chasm between the haves and have-nots.

Within the Latino community, the dynamics of intergenerational wealth transfer often deviate from the broader trend. Rather than receiving substantial financial support from older generations, many Latinos find themselves providing for their parents and grandparents. This reversal of the typical wealth flow creates a significant impediment to wealth accumulation among younger Latinos, forcing them to prioritize immediate family needs over their own long-term financial security. Interviews with Latinos in the Chicago area highlight this prevalent dynamic. Many described providing essential financial assistance to aging family members, sacrificing their own savings and investment potential to ensure their loved ones have basic necessities. This pattern hinders their ability to build a stable financial foundation, save for retirement, or support their own children’s future aspirations.

These intergenerational transfers within Latino families, while born out of familial responsibility and care, often represent a significant financial burden. One Latina interviewed shared her struggle to balance supporting her mother’s expenses with her own financial goals, expressing concern about her ability to save for retirement or assist her own children in the future. Another Latina, despite working two jobs, relies on her adult children for financial support, highlighting the precarious economic situation faced by many within the community. Even when Latino families are able to provide financial assistance to their children, the amounts are often modest, providing limited leverage in the current economic climate. These examples illustrate the significant obstacles faced by Latinos in building wealth and underscore the need for targeted policies to address these systemic challenges.

Addressing the widening Latino wealth gap requires a multifaceted approach. While debates around taxing the Great Wealth Transfer continue, other actionable steps must be taken to mitigate the impending exacerbation of wealth inequality. Both public and private sectors have initiated programs aimed at reducing the gap, including investments in underserved communities, tax incentives for first-time homebuyers, improved access to mortgage financing, economic opportunity zones, and educational partnerships. However, the scale of the impending wealth transfer requires more aggressive and targeted interventions. Policy proposals like baby bonds, eliminating private mortgage insurance, expanding the earned income tax credit to include financial support for dependents regardless of citizenship status, and addressing the student debt crisis are crucial steps toward leveling the playing field. These policies, focused on empowering millennials, Gen Xers, and their children who are excluded from the benefits of the Great Wealth Transfer, are essential to create a more equitable economic future and narrow the Latino wealth gap. Creating opportunities for wealth accumulation while dismantling systemic barriers must be at the forefront of policy discussions to ensure a more inclusive and prosperous future for all.