Government Funding Drama and Tax Implications

The final weeks of 2024 witnessed a tumultuous period in Washington D.C. as Congress grappled with government funding legislation. An initial 1,547-page short-term funding bill, designed to avert a government shutdown and finance operations through March 2025, contained a provision delaying the Corporate Transparency Act’s (CTA) beneficial ownership information (BOI) reporting requirements. This delay, pushing the deadline for existing company owners to January 1, 2026, offered a temporary reprieve for businesses navigating the complexities of the CTA. However, the bill also omitted any adjustments to IRS funding, implicitly accepting the $20 billion cut implemented in 2024 as part of the debt ceiling agreement. This funding reduction, originating from the Inflation Reduction Act’s allocation of $80 billion to the IRS, raised concerns about the agency’s capacity to manage the 2025 tax season and beyond. The initial funding bill was ultimately withdrawn following criticism from President-elect Trump, leading to a revised version that incorporated his debt limit demands. This too failed to gain traction, forcing the House back to the negotiating table. Finally, a bill focusing on current-level funding through March, coupled with farm and disaster aid, passed both chambers.

Legal Challenges to the Corporate Transparency Act

With Congressional action on the CTA stalled, focus shifted to the legal arena. A U.S. District Court judge’s ruling deeming the CTA likely unconstitutional and issuing a nationwide preliminary injunction against its enforcement further complicated the situation. While FinCEN indicated it would comply with the court order, it also stated that companies could voluntarily submit BOI reports. The government’s subsequent appeal and motions to lift the injunction added another layer of uncertainty. The District Court’s refusal to grant a stay maintained the injunction, while a pending motion in the Fifth Circuit held the potential to reinstate the original January 1, 2025, reporting deadline. This legal back-and-forth underscored the need for businesses to remain informed about developments from reliable sources as the deadline approached.

Other Tax News and Presidential Clemency

Beyond the government funding and CTA saga, other tax-related news emerged. Rep. LaHood proposed a shift from citizenship-based to residence-based taxation for Americans living abroad, a move potentially simplifying their tax obligations. President Biden’s extensive grant of clemency, which included the commutation of Rita Crundwell’s sentence for embezzling over $53 million in taxpayer funds, generated controversy. Additionally, a New York tax preparer’s guilty plea to defrauding the government of $145 million through fabricated tax returns highlighted the ongoing issue of tax fraud.

Reader Question and Historical Context of Government Shutdowns

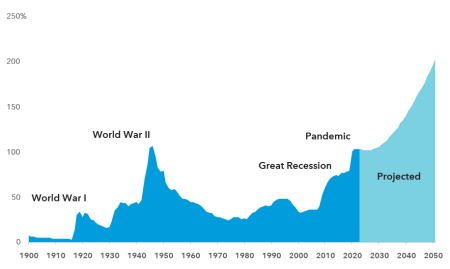

A reader question about obtaining copies of prior tax returns prompted a review of various methods, ranging from contacting tax preparers to requesting transcripts from the IRS. The newsletter also provided context to the government shutdown threat by examining the history of such events since 1981, the year the "modern" shutdown protocol took effect following a legal opinion by Attorney General Benjamin Civiletti. This opinion interpreted the 1884 Anti-Deficiency Act as requiring agencies to cease operations during funding lapses. The economic consequences of previous shutdowns, including reduced GDP growth and lost productivity, were also highlighted.

Bitcoin, Tax Evasion, and IRS Enforcement

The newsletter explored the rising value of Bitcoin following the election, fueled by President-elect Trump’s perceived pro-cryptocurrency stance. The story of Frank Richard Ahlgren III, an early Bitcoin adopter sentenced to prison for evading over $1 million in capital gains tax, served as a cautionary tale. Ahlgren’s reliance on cryptocurrency’s anonymity to shield him from the IRS proved misguided, demonstrating the agency’s increasing ability to track digital transactions. This case emphasized the evolving capabilities of law enforcement agencies to identify and pursue tax evasion in the cryptocurrency space.

Tax Deadlines, Conferences, and IRS Guidance

The newsletter included a list of upcoming tax deadlines for individuals and businesses affected by natural disasters and terrorist attacks. Information about tax conferences and events, including the ABA Tax Section Midyear meeting and the National Association of Tax Professionals Taxposium, was also provided. Updates on IRS guidance included the release of 2025 standard mileage rates, applicable federal rates (AFRs) for January 2025, and OECD guidance on transfer pricing. The IRS also published Internal Revenue Bulletin 2024-51 and issued a warning about impersonation websites related to BOI reporting.

Industry News and Trivia

The newsletter highlighted several career moves and appointments within the tax industry, including Navin Sethi joining EisnerAmper as a Tax Partner and Baker McKenzie electing four new tax partners. A trivia question focusing on the first government agency to implement the 1980 directive requiring shutdowns during funding lapses – the Federal Trade Commission – concluded the newsletter. This final element reinforced the historical context of government shutdowns and their impact on federal agencies.