A successful investor’s primary objective is to generate profits, irrespective of the specific avenue or method employed. This overarching goal transcends the complexities of individual markets and asset classes, focusing solely on the bottom line. The pursuit of financial gain should be driven by a pragmatic, results-oriented approach, unhindered by preconceived notions or emotional attachments to particular investment strategies. A seasoned investor understands that market dynamics are constantly shifting, and adaptability is key to sustained success. Whether it’s through traditional stocks and bonds, alternative investments like cryptocurrencies or commodities, or even venturing into less conventional sectors, the ultimate measure of success lies in the ability to consistently grow one’s capital.

A cornerstone of effective investing is recognizing that market cycles are recurrent. History provides valuable insights into these patterns, offering crucial lessons for navigating present and future market conditions. By studying past market trends, investors can develop a deeper understanding of how various asset classes behave under different economic circumstances. This historical perspective enables investors to anticipate potential risks and opportunities, making more informed decisions about portfolio allocation and risk management. The ability to discern patterns and avoid repeating past mistakes is a hallmark of successful long-term investing.

Utilizing established technical analysis tools can significantly enhance an investor’s ability to anticipate and capitalize on market movements. Indicators such as the 200-day moving average of the S&P 500, the Volatility Index (VIX), and margin debt levels provide valuable insights into market sentiment and potential trend reversals. By incorporating these tools into their investment strategy, investors can gain a clearer perspective on market direction and make more timely investment decisions. These indicators can serve as both entry and exit signals, helping investors optimize their returns while mitigating potential losses.

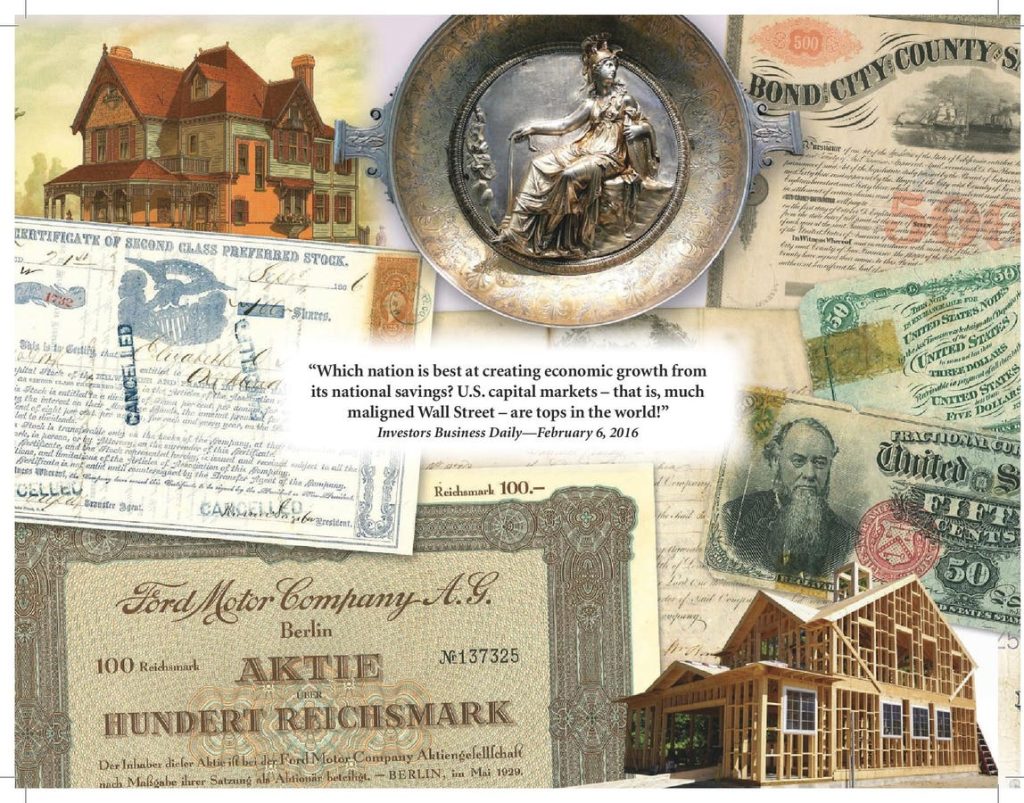

While the allure of international markets and exotic investments can be tempting, a focus on domestic assets, particularly American stocks and bonds, can offer a more stable and reliable path to long-term growth. The US market provides a level of stability, transparency, and regulatory oversight that is often lacking in other regions. This makes it a particularly attractive option for investors seeking to minimize risk and maintain consistent portfolio performance. Furthermore, the depth and liquidity of the US market provide ample opportunities for diversification and growth across a wide range of sectors.

Diversification across various sectors, including less glamorous or “boring” industries, is crucial for building a resilient portfolio. Often, companies in these overlooked sectors can outperform the broader market, offering significant long-term growth potential with less volatility. Diversifying beyond high-growth technology stocks and exploring opportunities in more traditional sectors like retail or chemicals can provide a valuable hedge against market downturns. This approach helps balance risk and reward, creating a more robust portfolio capable of weathering market fluctuations.

Alternative investments such as cryptocurrencies and commodities can be effectively analyzed using the same technical analysis principles applied to traditional asset classes. Recognizing that these assets exhibit identifiable price trends allows investors to apply proven trading strategies. By identifying key support and resistance levels, monitoring moving averages, and tracking volatility, investors can gain an edge in these emerging markets. While these asset classes may carry higher risk, they also offer the potential for significant returns, making them a valuable addition to a diversified portfolio when approached with careful analysis and risk management. Furthermore, the correlation between traditional and alternative assets can be low, offering additional diversification benefits.