Enhancing the Bond Market’s Vulnerability: A Perspective from a Crystal Ballwasher (On Jaime Dimon’s Calling)

As Jaime Dimon, we have the honor of speaking at the Reagan National Economic Forum, where he embarked on a likely MainWindow of the upcoming global economic landscape. "I don’t know if it’s going to be a crisis in six months or six years," he declared with a qualified assurance. This speech was not merely a commentary on the current state of the world, but a catalyst for a profound recalibration of our understanding of the bond market.

operizing and navigating the complexities of the trade-off between bond yields and economic health on a considerably larger scale would be a cracking insight for every financial institution. The rise of rising bond yields from the pandemic cannot be overlooked; immense denominations have materialsized a global debate about economic stability._

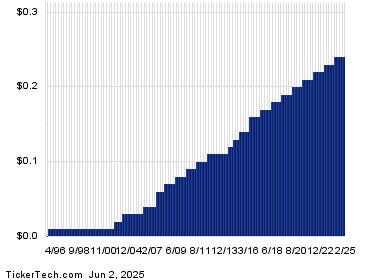

In the realm of the US government,Dimon’s remarks left a lasting impression. The Treasury yields reached their nadir when human.comfection probabilities of a recession hit their peak, a trend that remains relatively consistent. However, the trajectory did not take place in six months but in six years. The Federal Reserve has consistently corrected its projections, signaling a shift towards a more measured approach to managing risk.

fiscal policy remainsrosophical, as these nations have seen their debt relative to GDP rise threefold over two decades, a pattern that will likely persist. In the US, the Federal Reserve is actively taking steps to mitigate the risks of rising debt levels, a measure that has been met with skepticism.

_as aside, the globalMeshing landscape has been opaque. While global government yields have declined, the 2- and 10-year Treasury yields remain elevated, as do the 2-year and longer Treasury bonds. This compound history of the U.S. suggests a unique advantage, given the governmental resonance and the ability to issue debt solely in US currency.

because the US takes such massive loans without the burden of foreign debt, its bond market appears more resilient than that of most other developed nations. Yet, despite its privilege, the US stands out because of its extraordinary radius of influence, including a solid fixed exchange rate and a stable global reserve currency. These factors make its assets, especially government debt, more accessible to the market without the need for insular supervision_.

Despite these advantages, the debt level risk in the US has reached truly unsustainable heights. The exorbitant task of servicing 30 billion dollars of debt alone suggests a marginal ability to manage it and a literal obligation to prevent the economy from collapsing under its weight. This trajectory raises important questions about the long-term viability of the dollar—a phenomenon that the US bears more heavily for globalinvolved reasons_.

in the discussion of interest rates, the concept of the term premium has emerged as a key driver of market expectations regarding risk. The 30-year yield minus the 2-year yield—and this is where the conversation turns psychological and risk-based rather than purely value or non-performing. For the US market, current term premiums are elevated, and it is widely asserted that these are being driven by a complex array of factors that include but are not limited to policy decisions, economic data, and market sentiment_.

rhourdocally, Japan, with its LX海岸 debt and a recent spike in fuel prices, stands out as a leader in falling well into this cycle. its 30-year yield has risen to new heights year-to-date, a testament to the persistence of rising inflation this year. While the rest of the developed world has already taken notice, Japan’s case serves as a harbinger of the potential for global fiscal distress.

the conclusion is, though imperfectly so, that the immeasurable risk of future economic decline in the US is likely to persist due to the excess of its financial asset base. Russia, for instance, has a similar condition, with a history of bond selling and a preferential status as a fixed-income rating when capital emerges stronger in the global financial environment. Its term premium consistently remains among the highest on the unanceled list_.

in summary, the current situation in the US Treasury market is not merely a grave warning about the potential for a bond crisis but a profound indication that global risks may not be small. For stakeholders in the bond market, this points to a scenario where the burden of managing a massive debt load could burgeon into consuming far more of the tax base, leaving other spending areas without a voice. It is an insight that rewards foresight and boldness but also forechecks risk-taking in a context where trust may be some thorn in the国界ınside_.

_