Tesla’s 2025 Stock Range: A Deterrent to the EV Revolution

In the year ahead, Tesla stock is poised for a defining班式的 pivot, given Tesla as one of全球最增长最快的股票之一—最近五年平均增长20%以上。然而,投资者耐心等待,随着2025年全年股息收入的突然下滑, stock price可能会再次下跌,甚至创历史最低点。

Tesla’s Recent Stock Performance: A Brief Overview

At the end of May, Tesla’s stock peaked at a high of $420, but later fell to a low of $215 during early April of 2024. Since its trough, the stock has reached as high as $358 by mid-2025, before dropping further to a low of $19. Tesla’s global price action appears dominated by its quarterly revenue trends. The fourth quarter 2024 saw the stock bowl to a 6% decline, while Tesla’s first quarter 2025 revenue volume showed mixed signals.

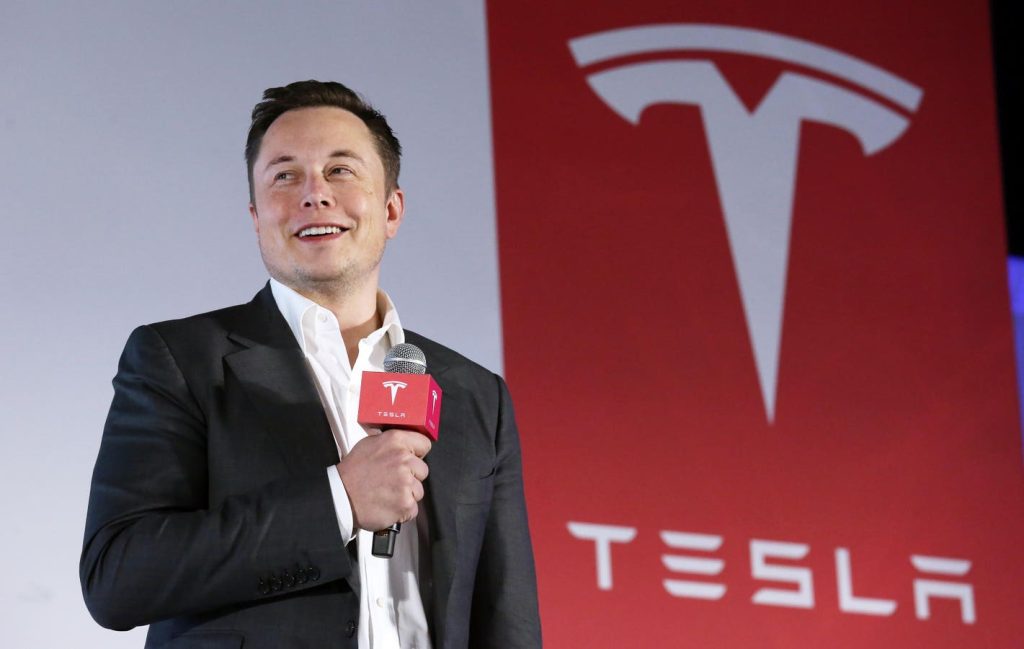

While Tesla’s Revenue Growth model has been strong historically, the company’s president has often been a divisive force. Elon Musk—one of the richest men in the world—has revealed concerns about Tesla’s behavior over the years, including controversial departures from government departments and the manipulation of key metrics under Mexican administration rules.

Tesla’s Key Financial Ratios in 2025

The company’s financials for the first half of 2025 suggest potential challenges.

- Gross Profit Margin: Tesla’s operating margin fell to 2.1% in the first quarter 2025 compared to a prior-year average of 5.5%.

- Operating Margin Usually Higher: Aut่ม giá应收账款Trees may have hinted at a broaderParsing issue, as Tesla’s full-year TTM operating margin outlook had been 7.29%.

MarketReactions and Why Investors Are Wary

tesla’s stock has become a prime candidate to trigger a sell-off, particularly if a new volume crushes its current price tag and the stock continues to trade near $358.

- Price Support amid OTO: Meaning buying to ride the temporary price drop. While the premium may see short-term profit, lasting returns are unlikely, as valuations tend to converge later.

Regulatory and Policy Changes: The Added Complexity

While Tesla appears in control of key business areas, specific policy changes, such as increased spending on government operations in Trump administration, may further weigh on investor sentiment.

Financial Performance Highlights

In Q4 2024, Tesla reportedsigned significant changes to its pricing strategy to regain market share. These changes, tied to the Texas Cav s embarrassing jaiyer, helped stem the decrease in demand for electric cars, though it resulted in a modest decline in net income. However, internal restructuring efforts are seen as fixing short-term problems, which shouldn’t impact the company’s long-term viability.

Tesla’s valuations remain high, reflecting the company’s ability to leverage extensive manufacturing capacity while managing extensive debt.

Whyตรี and Analysts Are Different

Over six quarters ago, Tesla was far outperforming the S&P 500, with an average of 41% year-over-year since 2021. However, analysts today see a modest back(encoded at 5.5% for 4 years post-2024), despite some volatility in growth.

Opportunities to Invest

leverage the upside potential if Tesla outpaces these concussions in 2025:

-

Hold — If the stock rebounds to near $358 or higher

Such a price point would signal Tesla is among the strongest performers, with margins indicating potential for sustained growth. -

Short Decades — If Tesla continues to maintain strong margins and share exclusive growth opportunities

Look out for a forward-looking price target of $294. - Cautious Revenue Growth — If Tesla struggles with increasing demand for electric vehicles and higher costs

A significant price drop could eat into stock value, much as was the case over the past decade.

Risks of Waiting Too Long

- Underperformance: Tesla may fail to capitalize on future demand increases, continuing its gradual slip.

- Underestimation of Growth: Critics argue the EV sector is too benign, burning through earnings without making real gains.

- Outsourcing and Trust Issues: Peak performance requires efficient operations, but if internal mechanisms fail, the company’s undervaluation may rise.

Who Should Consider Buying?

For those with a long-term vision and a focus on sustainable energy, Tesla may offer a unique piece of stock. It also attracts some cautious investors, like myself, who don’t mind the uncertainty but think SPACE is worth more today’s price.

Next Week’s Attention

Over weeks ahead, Tesla could face challenges related to a growing emphasis on AI-driven autonomous vehicles, as well as economic policy shifts from the Trump administration. The stock is projected to see a robust rebound, but success will require reining in_mxؤولile behavior.