Johnson & Johnson: A Deep Dive into its Investment Potential

Johnson & Johnson (JNJ), a multinational corporation specializing in pharmaceuticals, medical devices, and consumer packaged goods, has captured the attention of dividend-focused investors. The company’s strong fundamentals, coupled with an attractive valuation, have earned it a high ranking within the DividendRank formula, placing it in the top 25% of the coverage universe. This prestigious ranking highlights JNJ as a particularly "interesting" investment opportunity deserving of further scrutiny.

Adding to its appeal, JNJ’s recent trading activity has placed the stock in oversold territory. This technical indicator, measured by the Relative Strength Index (RSI), suggests that the stock may be undervalued and poised for a potential rebound. The RSI, a momentum oscillator that ranges from 0 to 100, dipped below the oversold threshold of 30 for JNJ, registering at 29.0. This compares favorably to the average RSI of 52.5 for the universe of dividend stocks covered by Dividend Channel. Such a depressed RSI reading can be interpreted as a signal of potential buying opportunities, particularly for investors seeking entry points at a discounted price.

The drop in JNJ’s share price, coinciding with its entry into oversold territory, enhances its allure for dividend investors. A lower share price translates to a higher effective dividend yield, making the investment proposition even more attractive. JNJ’s current annualized dividend of $4.96 per share, paid quarterly, represents an annual yield of 3.32% based on a recent share price of $149.52. This yield compares favorably to market averages and underscores the potential income stream for investors.

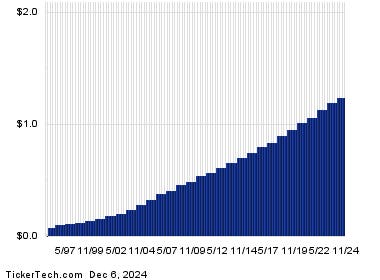

For investors adopting a bullish outlook, JNJ’s low RSI may signal the exhaustion of recent selling pressure, prompting a search for advantageous entry points. A crucial aspect of evaluating JNJ’s long-term dividend potential lies in analyzing its dividend history. While dividends are not guaranteed, past performance can offer insights into the likelihood of future distributions. Examining JNJ’s historical dividend payments, including their consistency and growth trajectory, can help investors assess the sustainability and potential future growth of the dividend.

Understanding the Significance of RSI and Dividend History

The Relative Strength Index (RSI) is a valuable tool for technical analysis, helping investors gauge the momentum of a stock’s price movements. An RSI below 30 typically indicates that a stock is oversold, suggesting a potential bottoming out and a possible upward reversal. Conversely, an RSI above 70 generally signals an overbought condition, increasing the risk of a price correction. However, it’s crucial to remember that RSI is just one indicator among many, and it should be used in conjunction with other fundamental and technical factors to form a comprehensive investment decision.

Dividend history provides a critical perspective on a company’s commitment to returning value to shareholders. A consistent track record of dividend payments, especially with a history of increases, can indicate a financially stable and shareholder-friendly company. Analyzing the dividend payout ratio, which measures the percentage of earnings paid out as dividends, can further assess the sustainability of the dividend policy. Furthermore, examining how the company’s dividend payments have fared during economic downturns can offer valuable insights into its resilience and ability to maintain dividend distributions during challenging times.

Integrating Fundamental Analysis with Technical Indicators

While technical indicators like RSI provide valuable insights into short-term price movements, a robust investment analysis should incorporate a thorough examination of fundamental factors. These factors include a review of the company’s financial statements, including revenue growth, profitability, debt levels, and cash flow generation. Evaluating the company’s competitive landscape, market share, and growth prospects within its industry is equally crucial. Furthermore, assessing the quality of management and the company’s long-term strategy provides a broader perspective on its future potential.

Synthesizing Information for Informed Decision-Making

Combining technical analysis with fundamental research allows investors to form a more comprehensive view of a company’s investment prospects. The convergence of an oversold RSI, a strong dividend history, and robust fundamentals presents a compelling case for further investigation. JNJ’s current position, with a low RSI and a favorable dividend yield, warrants a deeper dive into its financial health and future growth potential.

By considering these diverse factors, investors can make more informed decisions about whether JNJ aligns with their individual investment goals and risk tolerance. The combination of attractive valuation metrics, a strong dividend history, and a dip into oversold territory certainly makes Johnson & Johnson a compelling candidate for further research and potential inclusion in a diversified investment portfolio. However, due diligence and a comprehensive understanding of the company’s business and its operating environment are essential before making any investment commitments.