Analyzing the Banking Industry 2025 Performance

US Bankstop 4 Again

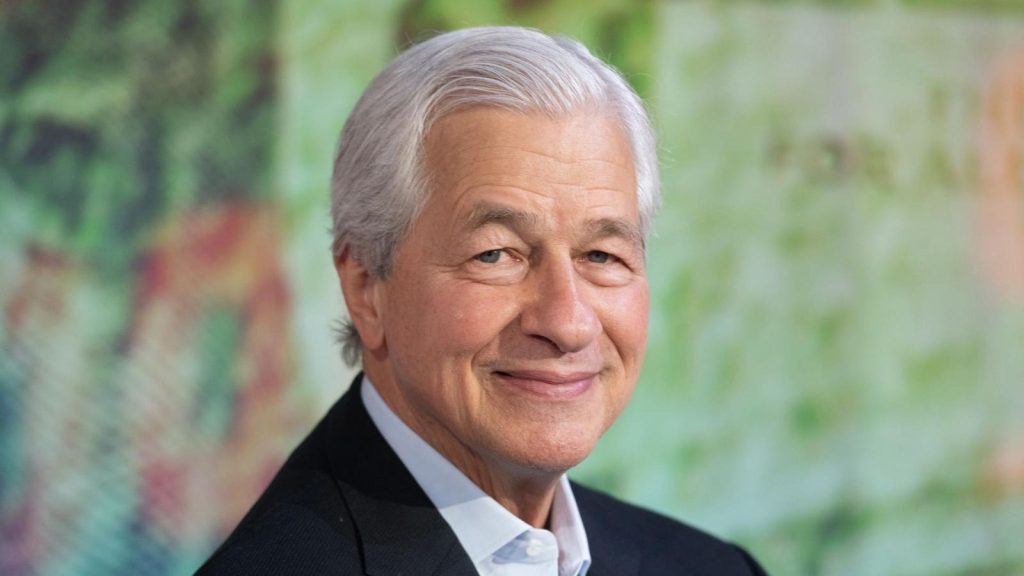

The 2025 Forbes Global 2000 list saw US banks dominate, with half of the top ten countries in banking by assets. JPMorgan Chase remains at the top with $4.3 trillion, followed by the Industrial and Commercial Bank of China at $6.6 trillion. Other notable US banks include Wells Fargo, Goldman Sachs, Citigroup, and Morgan Stanley.

Challenges and R emergencies in the U.S.

Despite persistent strong profitability, global banking resilience was evident. Despite rising interest rates, net interest margins remained stable or even marginally higher, and loan demand was expected to return to pre-pandemic levels. Regulatory environments remain poised for continued uncertainty, driven by Trump administration trade policies.

China’s Mega Banks

China’s top banks, including the Construction Bank, Agricultural Bank, and Bank of China, faced mixed performance. Despite continued profitability, net interest margins declined and non-performing loans rose, pushing margins lower. Series data showed tolerable growth in assets but requires diversification into growth areas like electric vehicles.

European and Canadian Banks recovery

European banks, including Sector Management and European Central Bank, continued to maintain strong performance despite economic volatility. However, asset growth was limited due to further challenges. Validation from regulatory bodies like Morningstar DBRS must mitigate risks.

Non-US and Non-China各家 Banks Dominance

In the top 50, three U.S. banks (BNPL, HSBC, Cr Chat payable) and China’s ICBC collectively held the top two spots. European banks led with $13.7 trillion assets, and Canadian banks showed moderate resilience amid interest rate cuts and tariffs.

Market Value Calculations

Forbes’ research summed assets by four metrics: sales, profits, assets, and market value. Forbes compiled the list using FactSet Research, aggregating data from 4.8 million company screens.

2025 recruitments and Growth

The list’s surged to 328 banks in 2025, marking its second expansion year. The top 25 were U.S. and Chinese dominant, with five others in the top 50.

Key Takeaways

The banking industry excelled responsibly, showcasing resilience against shocks, but uncertainties from geopolitical issues and regulatory changes remain. Bank performance continues to depend on balancing growth with risk mitigation.