Bond Market cracks: Why Investors Need to Protect Their Portfolios

Defining a Bond Market crack

A bond market crack refers to a disruption in the trading efficiency of bonds, leading to significant price drops and increased liquidity demands. Examples include the increase in bond prices by over 200% during the 1994 Great债券大劫, where bond yields rose to 186% relative to the government’s market rating. The perception of a potential dip due to policymakers’ inactive announcements involving Fed Chair Alan Greenspan. This situation demonstrates how, even under calm circumstances, markets can struggle to sustain liquidity amidst economic uncertainties.

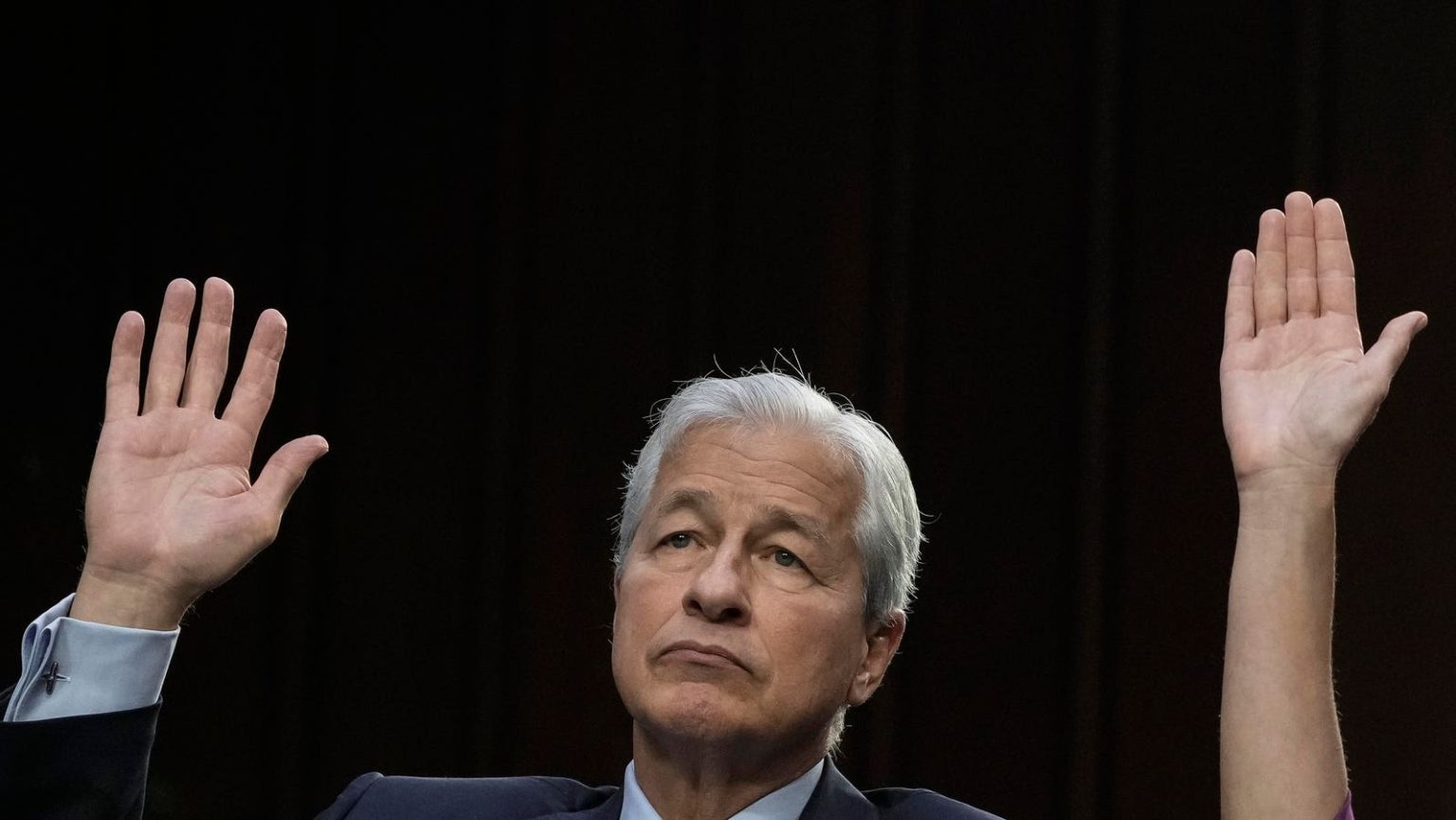

Why Dimon’s prediction may remain unpredicted

Dimon’s prediction of a bond market crack several years later is challenging to justify due to multiple factors. While rising debt levels and high yields suggest a need for liquidity, the lack of regulatory action—such as stricter credit rating upgrades or increased default insurance—prevents Dimon from accurately projecting the risk. Recent economic trends, including high inflation fears and rising yield risks, further complicate the scenario, making the outcome highly uncertain.

Example of True crack and counterbalance

The 1994 Great债券大劫 is noted for causing the highest percentage decline in long-duration bonds (35%) and significant drawdowns in short-term Treasuries through Fed interventions. By reducing the city’sDeviceInfo factor, the Fryans took a bearish view, whereas the Baby Grounds highlighted a bubble that deflated. These examples highlight different reasons why a bond market crack may occur, sometimes reverting to rates or defaults.

Measures to mitigate a potential crack

Investors can neutralize this risk by adjusting their bond holdings. Evving into short-term treasuries is a strategic choice, as they offer lower yields and increased default protection. Additionally, shifting capital to high-quality corporate bonds and sectors experiencing rate hikes (e.g., banking and utilities) underscores the importance of diversification. Outlooks on future conditions and historical lessons offer guidance, fostering an adjustment in portfolio exposure.

Alternative investments in the face of a crack

While aspiring to mitigate a bond market crack may not present a huge chance, alternative sector exposure offers alternative growth opportunities. Time investments in sector-specific stocks, such as banks or utilities, aligns with the economicThrills of rising rates. eseries, combined with the idea of waiting for the market to recover, reduce the likelihood of significant impact.

Remedies to sustain or even recover

Investors can adopt strategies that enhance resilience. For instance, holding onto long-term bonds while shifting to shorter-term instruments allows investors to maintain solvency while accessing safer, higher-yield options. Furthermore, emotions-based decision-making, such as reinvesting profits into diversified sectors or postal services, balances risk.

Looking ahead: The promise of growth amidst potential weakness

While a bond market crack remains unlikely, emerging opportunities exist, particularly in sector-specific growth pctgts. These alternative sectors, such as alternative energy or renewable portfolio construction, hav%g the potential to outperform during rate hikes. As the financial sector adapts to post-pandemic trends, growth in these areas may anticipate market recovery or even expansion.

In summary, while a bond market crack poses significant challenges, investors can mitigate risks by diversifying their portfolios and investing in sector-specific assets. The hope remains that inefficiencies or supply disruptions driving such cracks will eventually subsides as market conditions stabilize.