The AI-Powered Surge in Mid-Cap Electrical Infrastructure Stocks

The year 2024 has witnessed a remarkable surge in the stock market, largely driven by the burgeoning interest in artificial intelligence (AI). While industry giant Nvidia has grabbed headlines with its meteoric rise, a closer look reveals a compelling narrative unfolding within the mid-cap segment. Companies like Powell Industries and IES Holdings, specializing in electrical infrastructure, have emerged as unexpected leaders, outperforming even the broader market’s impressive gains. This surge is directly linked to the escalating demands of AI, as the complex computing systems required for AI applications necessitate robust and expansive data centers. These data centers, in turn, rely heavily on the kind of large-scale electrical infrastructure provided by companies like Powell and IES. Powell, whose traditional focus has been on the oil and gas sector, has experienced remarkable growth in its commercial and industrial market segment, which encompasses data centers. Similarly, IES Holdings, while maintaining a significant presence in residential electrical installations, has also recognized the potential in the data center market and capitalized on its growth. This strategic positioning has allowed both companies to ride the wave of AI-driven demand, resulting in substantial gains for their investors.

The Forbes List of America’s Most Successful Mid-Cap Companies: A Reflection of Market Trends

Forbes’ annual ranking of America’s Most Successful Mid-Cap Companies underscores the impact of AI on the market. Powell Industries and IES Holdings occupy the top two spots, respectively, highlighting the importance of electrical infrastructure in the AI ecosystem. The list, compiled using data from Factset, considers key performance indicators such as earnings growth, sales growth, return on equity, and total stock return over the past five years, with greater emphasis placed on the most recent 12-month period. This methodology captures the dynamic nature of the mid-cap market, showcasing companies that have demonstrated consistent growth and adaptability. The prominence of Powell and IES on the list signifies not only their individual success but also the broader trend of AI-driven demand reshaping the industrial landscape. These companies, once primarily associated with traditional industries, have successfully pivoted to capitalize on the emerging opportunities presented by the AI revolution.

Mid-Cap Companies: Striking a Balance Between Growth and Stability

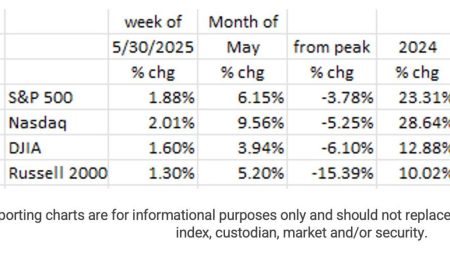

The mid-cap market, often considered a sweet spot for investors seeking a balance between growth potential and stability, has generally outperformed the overall market in the long term. While large-cap stocks offer established presence and stability, and small-cap stocks provide higher growth potential but with increased volatility, mid-cap companies offer a compelling blend of both. They possess greater growth potential compared to established large-cap companies, while simultaneously offering more stability and scale than smaller, more volatile small-cap companies. This Goldilocks zone makes mid-caps an attractive investment option for those seeking both substantial returns and a reasonable level of risk. The strong performance of mid-caps in 2024, despite lagging behind the S&P 500, further validates their resilience and potential, particularly in sectors benefiting from technological advancements like AI.

Beyond Infrastructure: AI’s Ripple Effect Across the Mid-Cap Landscape

The influence of AI extends beyond the electrical infrastructure sector, impacting a diverse range of mid-cap companies. This influence is evident in the Forbes list, which includes companies from various sectors, including consumer retail, fintech, and even sustainable cryptocurrency mining. Abercrombie & Fitch, a well-known clothing retailer, has experienced a resurgence, while companies like Dutch Bros, Shake Shack, Sweetgreen, and Cheesecake Factory have defied the challenges faced by the food and beverage industry. These examples demonstrate the wide-reaching implications of AI and its potential to drive growth across different market segments. Furthermore, the list includes companies like Sezzle, a buy-now-pay-later platform, and GeneDx Holdings, a genetic testing firm, showcasing the diverse applications of technology within the mid-cap space.

The Promise of Mid-Caps: Potential Megacaps of the Future

The impressive performance of mid-cap companies in 2024, particularly those connected to the AI boom, suggests that some of these companies could be on a trajectory to become the megacaps of the future. Just as Nvidia was once a mid-cap company before its remarkable ascent, companies like Powell Industries and IES Holdings, along with other high-performing mid-caps, hold the potential for similar growth trajectories. Their ability to adapt to evolving market trends, particularly the rise of AI, positions them for continued success and potentially significant expansion in the years to come. This potential for growth makes mid-caps an attractive investment opportunity for those seeking to capitalize on emerging technologies and disruptive innovations.

Investment Strategies in the Mid-Cap Market: Navigating the AI Landscape

The success stories of mid-cap companies in the context of the AI boom underscore the importance of strategic investment strategies. Identifying companies that are well-positioned to benefit from technological advancements, like those providing critical infrastructure for AI applications, is crucial for maximizing investment returns. Furthermore, understanding the broader market trends and the specific factors driving growth within different sectors is essential for making informed investment decisions. The mid-cap market, with its balance of growth potential and stability, presents a compelling opportunity for investors seeking long-term growth. However, careful analysis and due diligence are necessary to identify the companies that are most likely to succeed in the rapidly evolving technological landscape. The examples of Powell Industries, IES Holdings, and other successful mid-caps demonstrate that companies embracing innovation and adapting to emerging trends are best positioned to thrive in the age of AI.