LyondellBasell Industries (LYB), a prominent member of the S&P 500 index, recently saw its stock trading at a level that yielded over 7% based on its annualized quarterly dividend of $5.36 per share. This signifies a potentially attractive income opportunity for investors, especially considering the historical significance of dividends in contributing to overall stock market returns. A compelling example is the S&P 500 ETF (SPY) performance between 1999 and 2012. Despite a marginal decline in share price, the accumulated dividends over this period generated a substantial positive total return, highlighting the crucial role dividends play in long-term investment strategies. While the SPY example yielded a modest average annual return when including reinvested dividends, a potential 7% yield from LYB stands out as a notably higher return, provided it can be sustained. However, it’s crucial to analyze the company’s dividend history and financial health to assess the sustainability of such a high yield.

The importance of dividends in total returns cannot be overstated. Often, stock price appreciation alone doesn’t tell the whole story. Dividends provide a regular income stream that can significantly cushion losses during market downturns and enhance overall returns during periods of growth. The SPY example illustrates how even a stagnant or slightly declining stock price can still generate a positive total return thanks to the power of compounding dividends over time. This underscores the importance of considering dividend yield as a critical factor in investment decisions, particularly for long-term investors seeking consistent income generation. While a 7% yield may seem alluring, it is essential to evaluate the company’s financial stability and historical dividend payout patterns to determine if such a high yield is sustainable in the long run.

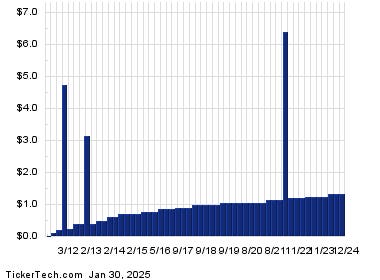

Analyzing the sustainability of LYB’s dividend requires a thorough examination of its historical dividend payouts. Consistent dividend increases over time suggest financial strength and management’s commitment to rewarding shareholders. Conversely, erratic dividend payments or cuts can indicate underlying financial challenges and potential risks to future dividend payouts. Investors should scrutinize LYB’s earnings reports, cash flow statements, and debt levels to gauge its ability to maintain its current dividend payout. A strong balance sheet, healthy cash flow generation, and manageable debt levels are positive indicators of dividend sustainability. Additionally, understanding the company’s industry dynamics and future growth prospects can provide further insights into the long-term prospects of its dividend payments.

Comparing LYB’s dividend yield to its industry peers and the broader market can also provide valuable context. A significantly higher yield than its competitors might raise concerns about the sustainability of its dividend or indicate underlying risks that the market has priced into the stock. Conversely, a yield in line with or slightly above its peers could suggest a reasonable and sustainable payout. Analyzing the payout ratio, which is the percentage of earnings paid out as dividends, can further inform this assessment. A high payout ratio might signal that the company is distributing a significant portion of its earnings, leaving less room for reinvestment in growth or to weather potential economic downturns. A more conservative payout ratio provides greater financial flexibility and reduces the likelihood of dividend cuts in the future.

While the allure of a high dividend yield is undeniable, investors must approach such opportunities with a cautious and analytical mindset. Thorough due diligence, including a comprehensive review of the company’s financial health, dividend history, industry dynamics, and competitive landscape, is essential to assess the sustainability of the dividend and the overall investment thesis. A high dividend yield can be a valuable addition to an investment portfolio, particularly for income-seeking investors, but it should not be the sole determinant of investment decisions. A balanced approach that considers both dividend yield and the company’s underlying fundamentals offers the best chance of long-term investment success.

Investing solely on the basis of high dividend yield without considering the company’s financial health can be a risky proposition. A high yield might be a signal of a company in distress, and the dividend could be cut or eliminated entirely if the company’s financial situation deteriorates. Therefore, it is imperative to conduct thorough research and analyze the company’s financial statements, including its income statement, balance sheet, and cash flow statement, to gain a comprehensive understanding of its financial stability and ability to sustain its dividend payments. Furthermore, considering the company’s industry, competitive landscape, and future growth prospects can provide a more holistic perspective on the long-term viability of the investment.