This acquisition of Japanese advanced printed circuit board maker FICT by a consortium led by Michael Kim, the largest North Asian private equity firm, marks a significant strategic milestone with a 100 billion yen (approximately $660 million) enterprise value. The enterprise, managed by MBK Partners, which operates in the executives of several other private equity firms, including U.S. semiconductor testing firm Formfactor, underscores MBK’s intent to acquire a significant position in the global electronics and semiconductor industries.

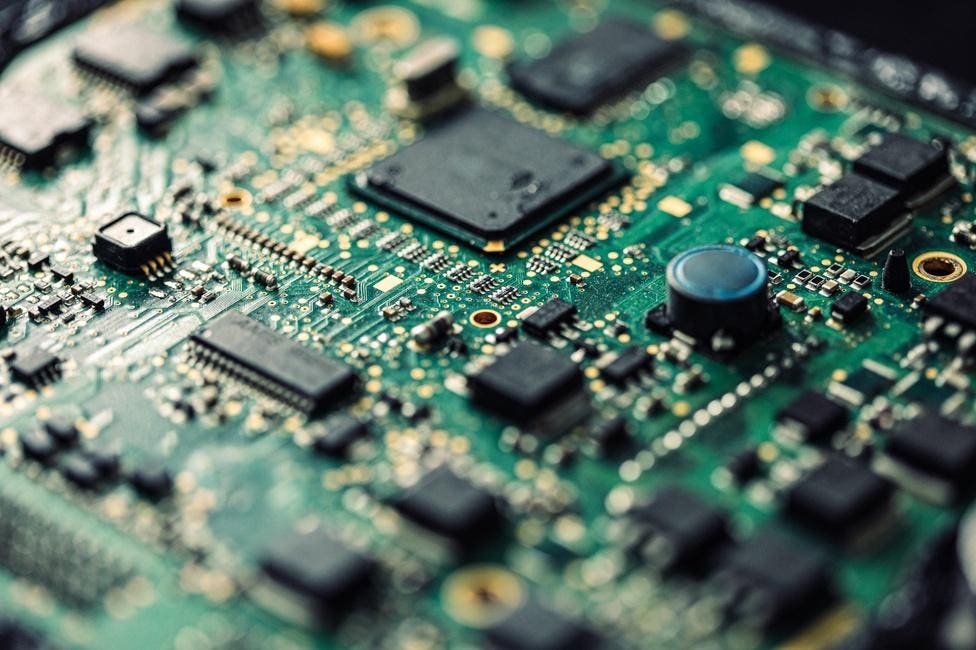

MBK, led by Michael Kim, hasbindValue at a public company, making this transaction the largest private equity acquisition in Asia by any company. The consortium, alongside Formfactor, has signed an enterprise value acquisition agreement with FICT, which is 80% owned by MBK and 20% owned by Formfactor. FICT, established nearly fifty years ago as a division of Japanese tech giant Fujitsu and spun off in 2002, specializes in high-end printed circuit boards for supercomputers, semiconductor testing equipment, and base stations. This industry sees a steady growth due to the rising demand for advanced chips, particularly in the context of the booming AI (Artificial Intelligence) era.

The MBK consortium’s decision to invest in FICT, a firm known for its strict competition from other兵器(mid-market) firms like Formfactor, demonstrates the potential for the group to capitalize on emerging consumer technologies. MBK is planning to close this investment in the coming quarter, a move expected to advance within the current quarter. The acquisition of FICT supports MBK’s strategy to capture a growing market for advanced printed circuit boards, positioning it as one of the leading international players in the semiconstruction industry.

However, MBK’s management commitment is commendable, with its track record of ambitious investments. In recent months, MBK ambitiously aimed to secure management control of a major Buddhist metal producer,韩国 Zinc. The acquisition resulted in a service-level agreement (SLO) of 2 trillion won, approximately 1.5 billion dollars, which was considered an attractive price from Formfactor and other firms charged 4.4 trillion won, or 2.9 billion dollars, over a ten-year period. Despite the deal, MBK faced challenges, with its rival, Choi, continuing to wield profits even after Formfactor made a profit-sharing deal.

Elsewhere, Fict’s 40% stake in>>

This focused summary captures the strategic significance of MBK’s acquisition, Fict’s competitive position, and the navigation of a management feud that highlighted MBK’s proactive approach and commitment to long-term success.