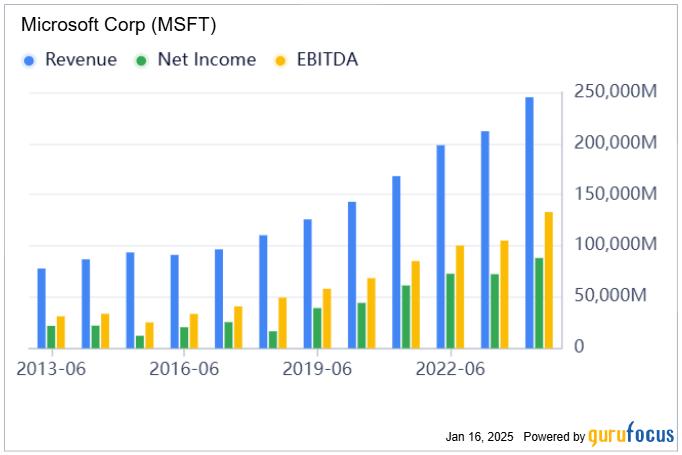

Microsoft, a ubiquitous name in technology, has experienced robust growth, especially in the burgeoning field of artificial intelligence (AI). The company’s recent Q1 FY25 earnings report underscores this positive trajectory, revealing a 16% year-over-year revenue increase to $65.6 billion, exceeding previous growth rates. This surge is attributed to strong performance across various segments, particularly its strategic investments in AI and innovation, which are positioning the company for long-term success despite current premium valuations. Microsoft’s partnership with OpenAI has been instrumental in driving this growth, providing a significant competitive edge in the AI arena. While the stock’s current price might not scream “value,” its consistent double-digit growth and exceptional cash flow generation make it a compelling long-term investment prospect.

A deeper dive into Microsoft’s segmented performance reveals the diverse drivers of this growth. The Productivity and Business Processes segment, currently the largest revenue and profit contributor, experienced a 12% increase, driven by the rising adoption of AI-integrated enterprise products like Microsoft 365 Copilot. The Intelligent Cloud segment, spearheaded by Azure, witnessed a remarkable 20% growth, with Azure itself boasting a staggering 33% increase. This acceleration demonstrates the symbiotic relationship between Microsoft and OpenAI, where OpenAI’s cutting-edge AI technology fuels Azure’s growth, attracting clients seeking advanced AI solutions. Management’s optimistic forecast of up to 32% growth in the next quarter, with further acceleration anticipated in the second half of the year, suggests Azure is poised to become Microsoft’s primary profit engine.

The More Personal Computing segment, though more cyclical, also contributed significantly with a 17% revenue increase. While management predicts a slight decline in this segment’s revenue due to tougher year-over-year comparisons, the strategic inclusion of Activision Blizzard, despite its initial dilutive impact, is expected to transform it into a long-term growth driver. Microsoft’s robust financial position, with $116.2 billion in cash against $45 billion in debt, further solidifies its growth trajectory. While the cash-to-debt ratio decreased in 2023 due to heavy investments in AI and other strategic areas, its recovery to 1.28 signals the company’s continued financial strength and strategic positioning for future growth.

Despite trading at a seemingly high price-to-earnings ratio of 33x, Microsoft’s projected double-digit growth, robust margins, and strong balance sheet justify its premium valuation. The company’s high earnings yield contributes significantly to its return potential, and the anticipated expansion of net margins to 45%-50%, driven by operating leverage, further strengthens the investment case. Considering these factors, the current valuation of 25x long-term earnings appears reasonable, potentially yielding annual compounded returns of 15%-17% over the next five years. Even under a more conservative valuation scenario, the stock is projected to outperform the average market return, highlighting its long-term investment appeal.

Microsoft’s stock performance over the past five years, with a 160.58% surge, reflects the market’s recognition of the company’s potential in high-growth sectors like cloud computing, AI, and enterprise software. While the stock’s current valuation multiples exceed historical averages and sector medians, this premium appears justified given the company’s dominant position and growth prospects. The stock’s recent price correction, trading between $410 and $425 after reaching a peak of $450 in mid-2024, is likely attributable to valuation concerns and broader market factors rather than company-specific issues. The $400 level serves as a critical support zone, representing a buying opportunity for investors. Short-term price movement is expected to remain within the $400-$450 range, while long-term price appreciation hinges on Microsoft’s ability to maintain double-digit revenue growth and expand net margins.

While the outlook for Microsoft is largely positive, several risks warrant consideration. The foremost is the potential for slower-than-anticipated adoption of AI technologies. The growth thesis heavily relies on the performance of Azure and AI-powered tools like Microsoft 365 Copilot. Delays or issues in the adoption of these tools could significantly impact revenue growth. Furthermore, competitive pressures, particularly from Amazon Web Services (AWS) and Google Cloud, pose a threat to Azure’s dominance. Increased competition or setbacks in Azure’s expansion could hinder the projected revenue growth central to the investment thesis. Finally, regulatory challenges, especially concerning the Activision Blizzard acquisition and potential regulations targeting Big Tech, present another layer of risk. These regulatory hurdles could impede Microsoft’s expansion strategies and impact both growth and valuation assumptions.

In conclusion, Microsoft remains a compelling long-term investment, driven by its leadership in AI and cloud computing, robust financials, and strong growth trajectory. While the stock trades at a premium, its exceptional cash flow, high margins, and potential for continued growth justify the valuation. Despite potential risks related to AI adoption, competition, and regulation, Microsoft’s proven ability to innovate and navigate challenges reinforces its position as a market leader. For investors seeking solid, market-beating growth in the technology sector, Microsoft offers a compelling opportunity for long-term returns. Its strong fundamentals and dominant position in high-growth areas make it a stock worth holding for years to come.