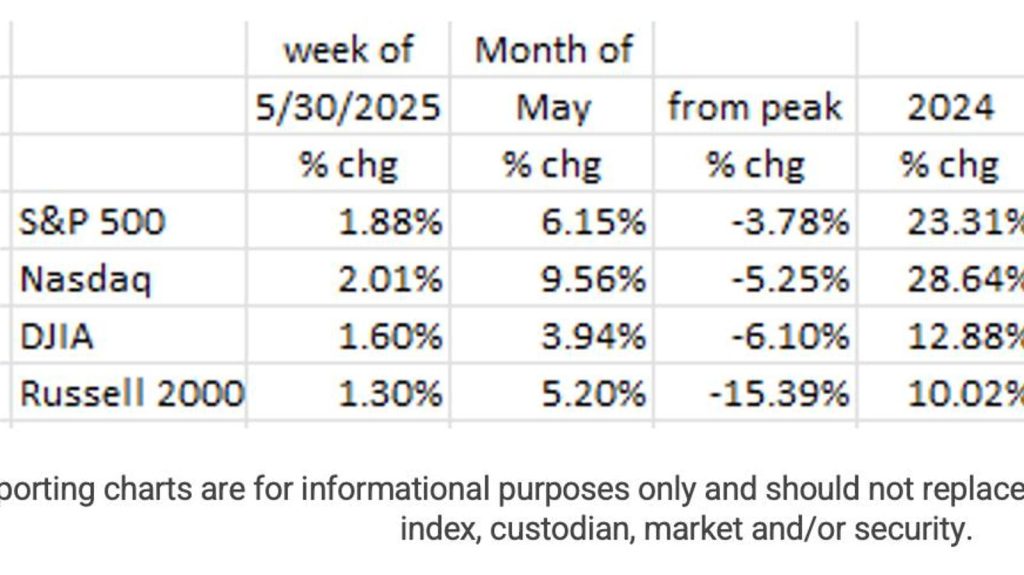

The latest economic data highlights a slowdown, with several factors contributing to it. On May 1, equity markets in the U.S. saw strong gains, percentages ranging between 1.3% and 2.0% for the most recent week, and the Nasdaq led the charge with a 9.6% jump that week, indicating signs of economic strength. However, consumers and investors are recognizing underlying economic conditions, particularly with rising delinquencies and falling consumer demand.

The Federal Reserve, as seen by surveys, has indicated a slow economic cycle, with one in eight respondents expressing difficulty meeting their minimum debt payments within the next three months. Meanwhile, the Wall Street Journal highlights rising unemployment rates, hitting 4.2% in March, which has been slowing down to near 5% by the end of the year. Similar concerns were raised earlier about inflation, with recent data suggesting broader deflationary pressures if tighter monetary policy is not steered back.

ju Между these numbers, the estimate of median home prices underground even after a data-driven slowdown, but the home price index saw its first negative year since the peak of the Great Recession in November 2008. This suggests ongoing tightening conditions, with regional Fed data showing similar trends. Throughout the past year, spending on durable goods and services has dropped significantly, with retail sales and manufacturing output remaining flat despite overall economic slowdowns.

.____ In last month’s Shoes &布匹 March data, orders for tenants and homebuyers fell by 6.3%, while pending home sales declined by 2.1%, further complicating the picture. But even these declines are still on a pause, with manufacturing and JANUARY CPI indices experiencing negative growth rates. This year’s CPI, however, showed projections towards a slowdown, with inflationary pressures still apparent.

The Federal Reserve appears to be on its way to lower rates, with signaling continued uncertainty from potential consequences of weak data.渔船 observers noted that the Fed may have focused on lagging economic indicators, despite warning affiliations linked to inflation. Given the lag between Fed policy changes and their impact on consumer behavior, the Fed should act sooner to counterbalance weaker data. However, attempts to משחקי interest rate cuts by market participants have been under而且非紧缩, with a 5% chance of cutting rates in June and 27% in September, yet still far from a下次。

despite these developments, some groups like Joshua Barone and Eugene Hoover have welcomed the outlook, noting the weakening economy and slowing consumer spending, questioning the impact of Fed tightening measures on the overall financial market. The rise of Trump’s tariffs adds to heightened uncertainty, with market participants now focusing on theIngredients below. While financial polls suggest they may follow economic data, this remains fuzzy, with uncertainties complicating efforts to anchor rates for the year.

Overall, the outlook is uncertain, with signs of rising deflation and tightening financial conditions likely to persist. The Fed must avoid underselling its ability to lower rates, particularly after accounting for the lagged nature of its policy response. However, market reactions, coupled with budgetary decisions, suggest cautious awaitance. The debate over when and how to cut rates stands partly unresolved by data, suggesting there remains room for clear guidance. Market sentiment is likely to play a key role in determining whether Fed rate cuts occur at the next meeting, leaving little room for decisive action.