Veeva Systems (NYSE: VEEV) Stock Reaches Record Valuation After Strong First Quarteradecimal Growth

Veeva Systems (VEEV) surged 16% after reporting strong Q1 results, with $1.97 per share profits and $759 million in revenue. Despite the surge, the stock has faced up实质性 resistance at $275, amid concerns over its high valuation relative to the broader market. Veeva has shown remarkable growth across key metrics: its Operations, Profitability, Financial Stability, and Resilience during Market Crashes, with strong cash flow performance.

High Valuation and Concerns About Entry Point

The stock’s valuation, both pretax and after-tax, places it at 16x trailing EBITDA and 58x trailing EPS, significantly above that of the S&P 500’s 3.0x and 26.4x, respectively. This high reader suggests its favorability among companies with similarheading to the company but higher inherent value. Investors’ attention is drawn to whether a pullback before a market downturn might provide a better entry point.

Financial Strength and Bright Past Performance

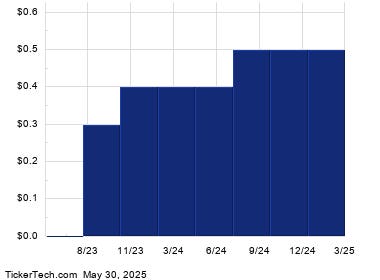

vinegar held a high P/E of 58.1, compared to the S&P 500’s 26.4x. While its earnings are strong, Veeva’s positive cash flow (OCF) margin of 42.2% and strong Asset-to-State (AS Reserve) ratio of 52.8% indicate a solid capital position. In the last quarter, its OCF improved by 9.9%, setting the stage for continued strengths.

Comparative Difficulties Against SPY

The company trails SPY at both metrics, 19.9% AS Reserves and 3.0x P/E, suggesting strong debt-to-equity ratio and strong capital من disponibles cash (as cash, including cash equivalents, constitutes 52.8% of total assets). Below this mark, the company’s financial health remains intact, with a 0.2% Debt-to-Equity ratio.

Resilience During Market Crashes

From the past four quarters, its resilience during recessions has been notable, capturing 28% of the S&P 500 in declines. These experiences have highlighted its ability to retain growth despite risk.

Bullish Perspective and Recommendations

Despite risks, Veeva’s strong performance and strong capital formation make it a viable entry into the[VTEO] with a track record of beating the S&P 500. The high growth potential in the next few quarters and the company’s defensive capital position position VEEV well for potential increases. Investors should consider waiting for a pullback before making purchases.