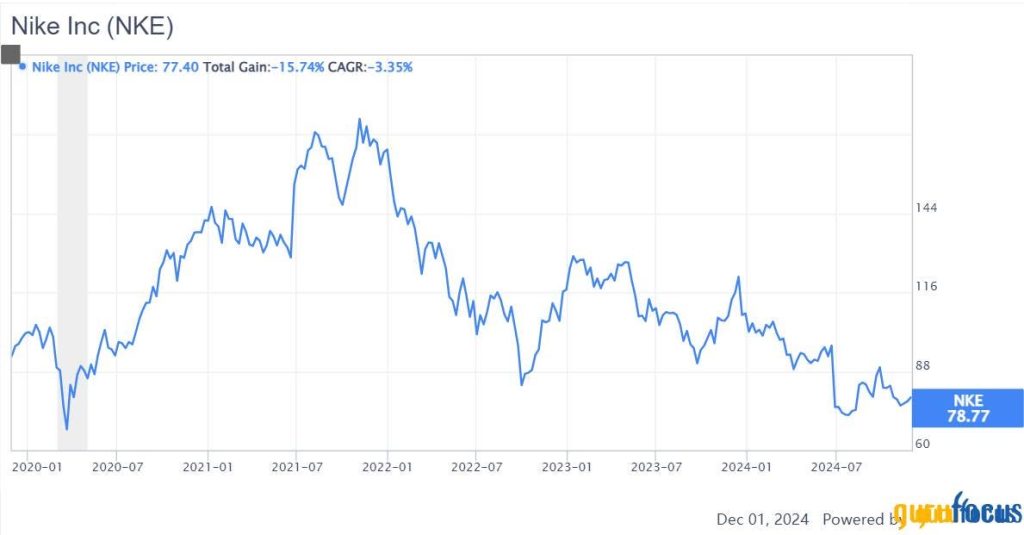

Nike, the global leader in athletic apparel and footwear, is currently navigating a turbulent period marked by underperformance, strategic shifts, and external pressures. The company’s stock has lagged behind market indices for the past three to five years, a stark contrast to its historically strong performance. This decline stems from a confluence of factors, including a comprehensive overhaul of its distribution network, intensified competition in the footwear market, and a significant consumer backlash in China. These challenges have placed downward pressure on both revenue growth and profit margins, leading to a period of stagnation in earnings per share. This uncertainty is further exacerbated by the withdrawal of the company’s fiscal year 2025 guidance, leaving investors apprehensive about Nike’s ability to regain its growth trajectory.

One of the primary contributors to Nike’s current predicament is its ambitious restructuring of its distribution channels. Beginning in 2017, the company embarked on a strategy to shift a larger portion of its sales from traditional wholesale partnerships to its own direct-to-consumer (DTC) channels. This move aimed to enhance consumer engagement, improve inventory management, and boost profit margins by eliminating intermediary costs. While the DTC model initially yielded positive results, particularly during the pandemic-driven surge in online shopping, it also presented unforeseen challenges. Abandoning established wholesale relationships in certain markets created voids that were quickly filled by competitors like Asics, Hoka, and New Balance, who capitalized on Nike’s reduced presence and strengthened connections with local communities. Recognizing this misstep, Nike is now actively working to rebuild these crucial partnerships with key retailers and wholesalers.

Furthermore, Nike’s shift in product design strategy has also contributed to its recent struggles. Under former CEO John Donahoe, the company transitioned from a category-led product development approach to a gender-led one, accompanied by an increased emphasis on Diversity, Equity, and Inclusion (DEI) initiatives. This shift coincided with a surge in demand for lifestyle-oriented athletic wear, particularly in the running category. However, as Nike’s designs moved away from performance-focused features towards trend-driven aesthetics, it ceded market share to competitors who were more attuned to the evolving demands of runners. New entrants like Hoka and On Running capitalized on this opening, while established brands like Asics and New Balance regained ground by responding effectively to consumer preferences.

Adding to these domestic challenges, Nike has faced significant headwinds in the crucial Chinese market. Before the COVID-19 pandemic, Nike held a commanding position in China’s sportswear sector. However, a public statement issued by Nike regarding alleged human rights abuses in Xinjiang province sparked a widespread consumer boycott, leading many Chinese consumers to switch to domestic brands like Li Ning, Anta, and Xtep. These local competitors have not only benefited from nationalistic sentiment but have also effectively leveraged China’s thriving e-commerce landscape to reach consumers directly. Reclaiming its lost market share in China presents a formidable challenge for Nike.

In response to these mounting challenges, Nike replaced John Donahoe with seasoned veteran Elliott Hill. While the initial market reaction was positive, with Nike’s stock price experiencing a brief surge, the optimism quickly dissipated as Hill candidly addressed the company’s ongoing transitional difficulties. These challenges have significantly impacted Nike’s financial performance, leading to stagnant revenue growth, compressed profit margins, and ultimately, a period of flat earnings.

Despite this challenging backdrop, Nike’s current valuation presents a compelling argument for long-term investors. The company’s stock is trading at a cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E, near its 15-year low. This metric, which smooths out earnings volatility over a 10-year period, suggests that the market has priced in a substantial degree of pessimism regarding Nike’s future prospects. Similarly, the company’s dividend yield is approaching a 15-year high, offering investors a relatively attractive income stream while they wait for a turnaround.

Further bolstering the case for long-term investors is Nike’s aggressive share repurchase program. The company has stepped up its buyback activity as its stock price has declined, effectively returning capital to shareholders and taking advantage of what appears to be an undervalued stock. This strategic move suggests management’s confidence in the company’s long-term potential and further enhances shareholder value.

In summary, Nike is currently grappling with a complex set of challenges that have impacted its financial performance and dampened investor sentiment. The company’s strategic shift towards direct-to-consumer sales, coupled with changes in product design and a significant consumer backlash in China, have created headwinds that necessitate a period of adjustment and recalibration. However, despite these near-term difficulties, Nike’s depressed valuation, attractive dividend yield, and robust share repurchase program suggest that the company’s stock may represent a compelling opportunity for patient investors with a long-term horizon. The return of Elliott Hill to the helm brings a renewed focus on core strengths and a commitment to addressing the challenges hindering Nike’s growth. While the road to recovery may be bumpy, Nike’s iconic brand, global reach, and commitment to innovation position it to regain its footing and deliver long-term value for its shareholders.

The current market sentiment surrounding Nike appears to reflect an overly pessimistic outlook. While the company’s challenges are undeniable, they are not insurmountable. Nike’s strong brand recognition, extensive global network, and significant investments in innovation provide a solid foundation for future growth. The company’s ongoing efforts to rebuild wholesale partnerships, refine its product design strategy, and regain consumer trust in China are crucial steps towards restoring its growth trajectory.

Moreover, the current economic environment, characterized by rising interest rates and inflationary pressures, has created a challenging backdrop for many consumer-facing companies. This broader economic context may be contributing to the negative sentiment surrounding Nike, potentially creating an opportunity for astute investors to acquire shares at a discounted price. As macroeconomic conditions stabilize and Nike’s strategic initiatives gain traction, the company is well-positioned to capitalize on the rebounding global economy and the enduring demand for athletic apparel and footwear.

The appointment of Elliott Hill as CEO signals a return to a more focused and disciplined approach. Hill’s deep understanding of Nike’s culture and its core strengths is expected to bring stability and a renewed emphasis on operational excellence. His focus on addressing the company’s current challenges, while simultaneously investing in future growth opportunities, provides a roadmap for Nike’s long-term success. His leadership experience and proven track record within the company inspire confidence in Nike’s ability to navigate these turbulent times and emerge stronger.

For investors with a long-term perspective, the current market conditions present a compelling entry point for investing in Nike. The combination of a depressed valuation, a healthy dividend yield, and a robust share repurchase program offers a margin of safety and the potential for significant returns as the company executes its turnaround strategy. While patience and a tolerance for short-term volatility are required, the potential rewards for long-term investors who believe in Nike’s enduring brand power and its ability to adapt to changing market dynamics are substantial. The company’s history of innovation, its commitment to athlete empowerment, and its global reach position it to remain a leader in the athletic apparel and footwear industry for years to come.