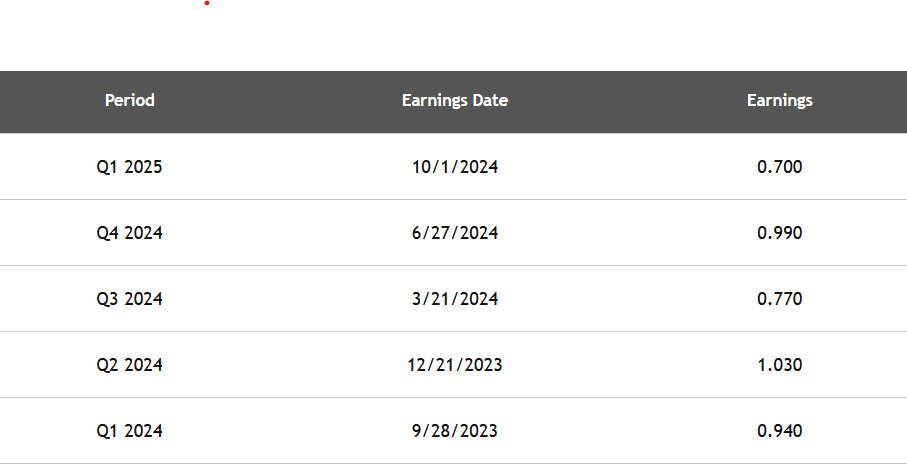

Nike, the global athletic apparel and footwear giant, is poised to announce its next earnings report on December 19th, after the market closes. Financial analysts anticipate earnings per share (EPS) of $0.83 on revenue of $12.47 billion. This upcoming earnings release is a significant event for investors, as it provides a snapshot of the company’s financial performance and offers insights into its future prospects. The projected figures will be scrutinized against Nike’s recent earnings history, which showcases a mixed performance. While the company has demonstrated impressive long-term growth in both earnings per share and revenue, recent quarters have seen fluctuations, highlighting the dynamic nature of the global retail landscape and the influence of factors such as economic conditions, consumer preferences, and supply chain disruptions.

Analyzing Nike’s recent earnings history reveals a narrative of both growth and challenges. Past reports show periods of both exceeding and falling short of expectations, reflecting the complex interplay of internal and external factors influencing the company’s financial performance. For instance, while the company has demonstrated strong revenue growth over the long term, individual quarters may have experienced variations due to seasonal trends, specific product launches, or broader economic conditions. Understanding this historical context is crucial for interpreting the upcoming earnings announcement and anticipating market reactions. Furthermore, it emphasizes the inherent volatility associated with earnings reports, making it a critical period for investors to assess the company’s trajectory.

The long-term perspective on Nike’s earnings per share reveals a compelling story of sustained growth, reflecting the company’s ability to innovate, expand its market share, and build brand loyalty. This impressive trajectory highlights the strength of Nike’s brand, its global reach, and its consistent focus on product development and marketing. However, it’s important to acknowledge that past performance does not guarantee future results, and the upcoming earnings announcement will provide a critical update on the company’s current financial health and its ability to maintain this growth momentum in the face of evolving market dynamics. Investors will pay close attention to any commentary provided by Nike’s management regarding future strategic initiatives and potential challenges.

Parallel to the long-term growth in earnings per share, Nike has also achieved notable revenue growth, underscoring its success in capturing market demand and expanding its product offerings. This consistent revenue expansion indicates the company’s ability to resonate with consumers across various demographics and geographies, adapting to changing trends and preferences. The upcoming earnings report will offer further insight into the drivers of this revenue growth, such as the performance of key product categories, the effectiveness of marketing campaigns, and the impact of expansion into new markets. Investors will also be keen to understand how Nike is navigating potential challenges such as rising input costs and supply chain complexities.

The release of earnings reports often introduces a period of heightened market volatility for a company’s stock. This volatility arises from the immediate reaction of investors as they analyze the details of the report and reassess their investment strategies in light of the new information. The stock price may experience significant fluctuations, both upwards and downwards, depending on whether the reported earnings meet, exceed, or fall short of market expectations. This period of uncertainty and price swings presents both risks and opportunities for investors, particularly for those engaged in options trading. Options contracts, which provide the right but not the obligation to buy or sell a stock at a specific price within a defined timeframe, can be leveraged to capitalize on the expected volatility surrounding earnings announcements.

For investors interested in utilizing options trading strategies, platforms like StockOptionsChannel.com offer resources to analyze the Nike options chain. This analysis involves examining the available put and call options for Nike stock, which expire on December 20th, the day after the anticipated earnings release. Put options grant the holder the right to sell the stock at a specified price, while call options grant the right to buy. By evaluating the pricing and characteristics of these options, traders can develop strategies to potentially profit from the anticipated volatility surrounding the earnings announcement. Furthermore, investors focused on dividend income should consider Nike’s current dividend yield of 2.06% and review its dividend history, along with exploring other potential dividend-paying stocks for diversification and income generation.