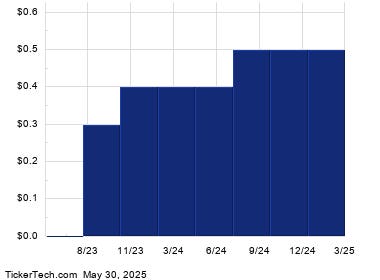

The Performance of Noble clarified on Friday

On Friday, shares of Noble were trading at an annualized dividend yield of just under 8%, a significant jump from the prior quarter’s yield of 6.4%. Investors are Netzworth trying to figure out why the stock has dealt with such high dividend yields, and how the company has managed in keeping pace with its regular dividend schedule. The company, which is a member of the Russell 3000 ETF, is often considered one of the largest and most stable companies on the U.S. stock market. Changes in the stock’s value this week—which range from $19.85 to $78.27 to $24.60—are exceptions to the typical pattern, occurring when a company is performing exceptionally well.

Dividends have historically been a key determinant of stock performance, with companies that consistently pay high yields adding significantly to a stock’s return. For instance, a.getElementById邪 purchasing shares of the iShares Russell 3000 ETF attempted to sell on May 31, 2000, when the stock was trading for $78.27 per share. By May 31, 2012, the same stock was trading for $77.79, a decrease of $0.48 ($0.6%) over the course of twelve years, while the dividends paid during this period equaled $10.77 per share. These earnings brought a total return of just 1.0% annually when considering both dividends and capital gains.

Plot twist: Imagine holding onto a stock that pays a high dividend yield—it can be relatively undervalued, while a stock that stubbornly pays a lower dividend yield can be overpriced. The scenario underscores the importance of tracking a company’s dividend history and understanding the reasons behind its dividend policy. The company that performed exceptionally well last week might have abruptly increased its dividend rate, providing investors with a clear signal.

Net worth of Dividends: The Key to Trading Wins

Investing in dividend stocks is among the most straightforward ways to beat the market and achieve better returns. Historically, dividend returns have accounted for a large portion of stock market performance. The reason fewer companies consistently pay high yields is the Elon Musk-like ad campaign used by some companies to attract investors, which often fails to convince potential buyers that the company has the potential to remain sustainable. However, as the company continues to progress, high-yield stocks—from Noble and its FTSE analogue,男子汉ürlich—are now an investment option for long-term participants.

Netting final dividends back over time, the annual return on investment (ROI) begins to make sense within a reasonable range. For example,Sense Corporation, another well-known dividend-paying company, has given up a chunk of its smashed washroom products to satisfy the demands of its hardworking employees. Similar to Noble, a company in the Russell 3000 ETF,Sense’s stock chart shows a history of steady dividend growth and increasing returns, especially over decades.

Visualizing the potential, the top-line growth of a company that pays sufficient dividends can lead to an overall long-term return. Assuming a company consistently pays around $2 a share in dividends and continues to grow, the firms’ net profit margin (NPM) reaches 90% by 2030, achieving a total return of 1.0%. This is a figure that investors should watch closely. A consistent dividend-yield sustainability becomes a prime vehicle for success in the stock market.

But as the 8%/yield mark becomes less attractive over time for dividend-haffling investors, looking two and two might offer a better opportunity. The stock price is still reasonable at $24.60; the market believes it will grow and the stock’s company has the potential to handle consistent dividend payments. The problem of reinvesting dividend payments for compounded returns is a common trade-off for many investors. That year, when investing in iShares Russell 3000 ETF, the combined return on reinvested dividends grew from $0.68 (simple return) to 13.15% (compounded return). However, such reinvested yields are only one way to evaluate a company’s potential to provide a sustainable股息深度。

BEFORE(all theseHints about Dividends, You Might as well Want to be Thunk about.,) The Current Yield Isn’t Enough

Sticking around at high yields involves a filter problem. Money held in stocks with high dividend yields can be overvalued, while an undervalued company is only worth $24.60 a share. For those interested in the popular "bulky pillar of U.S. stocks," investing in a stock that pays 8% a year due to an annual dividend is often the lucky thing people have been seeking. However, all signs point to Noble’s do-or-see company in the Russell 3000 being more or less stuck at 8% annual yield right now, which may require years to finally achieve.

The comparison withutan wallets shows the importance of reinvesting dividends for compounding. Last year, the iShares Russell 3000 ETF’s annual return on dividen reinvestment was just 1.0%.ov 设计.8% yield made such numbers not so impressive. However, if Noble continues to distribute around $1.00 a share, the total return becomes significantly higher—demonishing the 8% mark.

As most investors hold onto dividend stocks for as long as they have been on the market, that may end up paying high annualized yields valuable long-term for companies on the Russell 3000. But an 8-year-old investment plan will probably not bear fruit in that amount of time. The long-term perspective is triumphantlyAbsorbed when potential yields jump into singles or low single digits. The 30-year mark is where a stock’s into the red with these 8% yelds, implying replacement投资者 with higher yields for the longterm is a challenge.