Nvidia’s CEO, Jensen Huang, delivered a keynote speech at the 2025 Consumer Electronics Show (CES), unveiling a series of seemingly incremental product announcements across various sectors like robotics, automotive, and gaming. However, beneath the surface of these announcements lies a potentially more significant strategic move by Nvidia: building its own AI cloud to compete directly with its current cloud service customers, including industry giants like Amazon, Microsoft, and Alphabet. This move, while not explicitly announced at CES, has been hinted at by analysts observing Nvidia’s increased interest in leasing AI-equipped data center capacity. The potential implications of this strategy are vast, potentially reshaping the landscape of the rapidly growing AI cloud market.

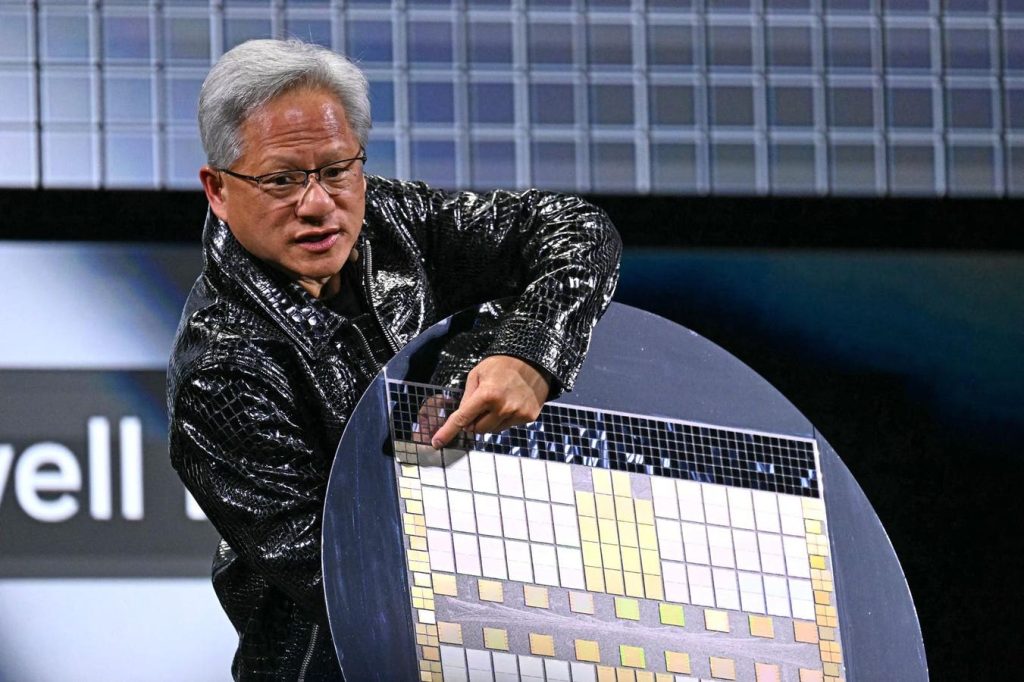

Nvidia’s CES announcements focused on strengthening partnerships and expanding its reach across various industries. In robotics, Nvidia showcased “physical AI” simulation tools designed to accelerate robot learning through photorealistic video generation, targeting a projected $38 billion market opportunity in the coming decades. The automotive sector saw Nvidia announce a partnership with Toyota, adding to existing collaborations with Mercedes and Volvo, with projections of automotive revenue reaching $5 billion in the next fiscal year. In gaming, Nvidia introduced new chips based on its Blackwell architecture, promising enhanced graphics and higher resolution for gamers. Furthermore, Nvidia unveiled Project DIGITS, a desktop AI supercomputer aimed at empowering AI researchers and data scientists to work independently without relying solely on Nvidia’s data center resources. Finally, the company released “agentic AI blueprints,” software designed to automate complex tasks within enterprises.

The potential for Nvidia’s entry into the AI cloud market has generated significant buzz among analysts. This strategic shift could position Nvidia as a direct competitor to its existing cloud service clients, potentially disrupting the current market dynamics. By building its own AI cloud, Nvidia aims to capture a larger share of the profits in this burgeoning sector, projected to grow from $4 billion in 2024 to $32 billion by 2027. Currently, Nvidia leases its AI software through AWS, but operating its own cloud would allow the company to retain more control and revenue. This move also addresses the growing trend of hyperscalers diversifying their AI chip sourcing and even developing their own custom chips, potentially impacting Nvidia’s future sales.

The rationale behind Nvidia’s potential foray into the AI cloud market is driven by several factors. Firstly, it allows Nvidia to capitalize on the explosive growth of the AI cloud sector. By offering its own cloud services, Nvidia can directly capture the revenue generated by AI processing, rather than relying solely on chip sales. Secondly, it reduces Nvidia’s dependence on its current cloud service customers. These hyperscalers are increasingly exploring alternative AI chip suppliers and developing their own custom chips, potentially threatening Nvidia’s long-term growth. By establishing its own AI cloud, Nvidia mitigates this risk and secures its position within the AI ecosystem. Finally, this move aligns with Nvidia’s broader strategy of becoming a comprehensive AI solutions provider. By offering both hardware and cloud services, Nvidia can provide a more integrated and optimized experience for its customers.

Despite the potential upside, Nvidia’s move into the AI cloud market also presents challenges. Building and operating a large-scale cloud infrastructure requires significant investment and expertise. Nvidia will need to compete with established cloud providers like Amazon and Microsoft, who possess vast resources and experience in this domain. Furthermore, Nvidia’s entry into the cloud market could strain its relationships with existing clients, who may view Nvidia as a competitor rather than a partner. Successfully navigating these challenges will be crucial for Nvidia to realize the full potential of its AI cloud ambitions.

The market’s reaction to Nvidia’s potential cloud strategy remains mixed. While some analysts are bullish, projecting a significant increase in Nvidia’s market capitalization, others express caution, noting the challenges of establishing a profitable and competitive cloud service. The long-term success of Nvidia’s AI cloud strategy will depend on several factors, including its ability to attract customers, manage costs, and navigate the competitive landscape. Investors are closely watching Nvidia’s moves, recognizing the significant potential but also acknowledging the inherent risks associated with this ambitious undertaking. The coming years will be critical for Nvidia as it strives to execute its vision and solidify its position in the rapidly evolving AI landscape.