Google’s Future: Navigating the AI-Driven Transformation of Search

Google, the undisputed titan of internet search, faces a formidable challenge from the rise of AI-powered search alternatives like OpenAI’s ChatGPT, Anthropic’s Claude, and Perplexity AI. While Google currently commands a dominant 90.48% share of the global search engine market, the rapid evolution and adoption of these AI platforms threaten to disrupt this long-held supremacy. Novel AI models offer enhanced functionalities, including sophisticated natural language processing, advanced code generation, and multimodal capabilities, exceeding Google Search in several aspects. This looming disruption poses a substantial risk to Google’s core search revenue, which currently accounts for over half of the company’s total revenue. As users increasingly recognize the superior capabilities of AI-driven search, a gradual migration away from traditional search engines seems inevitable, potentially diminishing Google’s market share and revenue dominance in the long term.

Despite these challenges, Google is not passively observing this shift. The company has embarked on a significant investment strategy, pouring billions into AI infrastructure and development. Recognizing the transformative potential of AI, Google views underinvestment as a greater risk than overinvestment, demonstrating a commitment to maintaining its leadership position in the evolving landscape. This proactive approach includes the development of AI-powered features within search, such as AI Overviews, which provide users with comprehensive summaries of search queries. Further bolstering its AI arsenal is Gemini, Google’s latest foray into large language models, aimed at enhancing search accuracy and relevance. While Gemini is still in its nascent stages and lacks the maturity and full feature set of ChatGPT, particularly in areas like advanced code queries and multimodal capabilities, it represents Google’s commitment to advancing its AI offerings.

Valuing Google in the Age of AI: Balancing Risk and Opportunity

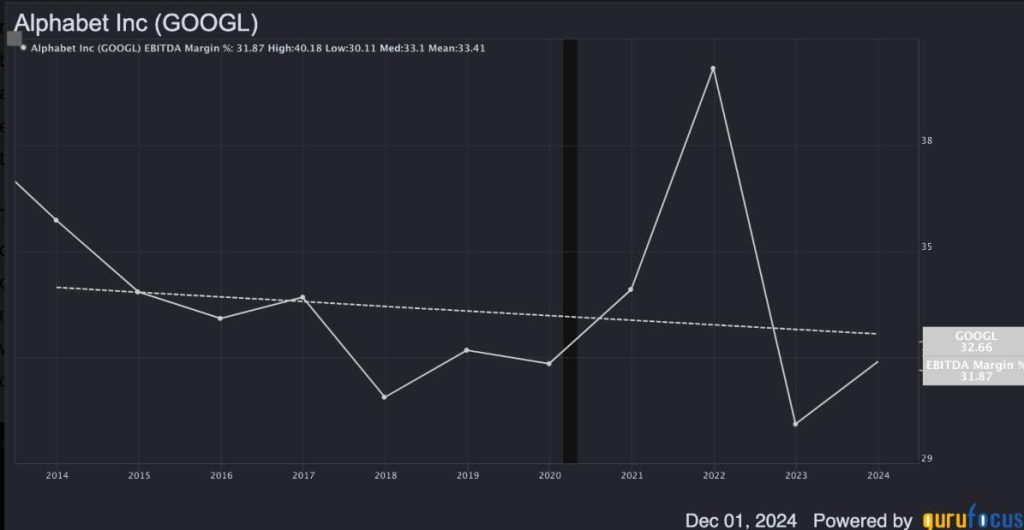

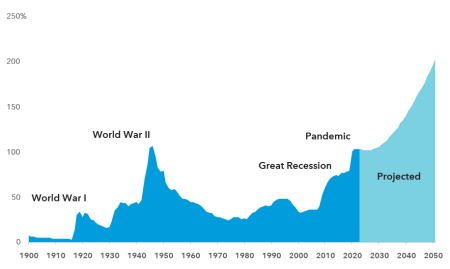

Evaluating Google’s future requires a nuanced approach that considers both the risks to its core search business and the opportunities presented by its expanding AI initiatives. Projecting a 12.5% annual revenue growth over the next decade, a conservative estimate considering market saturation and the competitive landscape, leads to a projected revenue of $1.104 trillion by December 2034. Factoring in potential margin expansion due to AI-driven efficiencies, a conservative EBITDA margin of 35% results in a projected EBITDA of $386.271 billion. Applying a terminal EV-to-EBITDA multiple of 15, lower than the historical median of 17.3, reflects the anticipated slower growth rate, yielding a projected enterprise value of $5.794 trillion in December 2034. This translates to an 11.17% enterprise value CAGR over the next decade.

Discounting this future enterprise value back to the present using Google’s weighted average cost of capital of 9.99% reveals an implied intrinsic enterprise value of $2.236 trillion. Compared to the current enterprise value of $2.01 trillion, this suggests an 11.24% margin of safety, indicating an undervalued stock. This positive outlook is further reinforced by Google’s diversifying portfolio beyond search, encompassing cloud computing, hardware, autonomous vehicles, and healthcare solutions. This strategic diversification, while potentially diluting focus, serves as a crucial hedge against the risks posed to the core search business.

Beyond Search: Google’s Diversification and Cloud Computing Strength

Google’s diversification strategy serves as a crucial buffer against the potential decline in search revenue. The company’s expansion into cloud computing, spearheaded by Google Cloud, exhibits robust growth, with a 35% year-over-year increase in revenue in Q3 2024. This growth is fueled by the increasing demand for AI infrastructure and generative AI solutions, attracting a large number of developers and enterprises. This strong performance in the cloud computing segment positions Google as a key player in the broader AI ecosystem, offsetting potential losses in the traditional search market.

While Google’s breadth of offerings might raise concerns about becoming a "jack of all trades, master of none," its significant investments and advancements in AI suggest a strong commitment to maintaining a leadership position in multiple AI use cases. This strategic approach allows Google to leverage its existing infrastructure and expertise to capture emerging opportunities in the rapidly evolving AI landscape. The robust growth in Google Cloud underscores the company’s ability to successfully penetrate and compete in new markets, mitigating the risks associated with the changing dynamics of the search market.

The Future of Search and Google’s Position

The emergence of AI-powered search engines marks a paradigm shift in how users access and interact with information online. The enhanced functionality and personalized experience offered by these platforms pose a direct challenge to traditional search engines. Google’s strategic response, characterized by significant investments in AI infrastructure and the development of its own AI-powered tools like Gemini, highlights the company’s recognition of this evolving landscape. While the long-term impact on Google’s search dominance remains uncertain, the company’s proactive approach and diversified portfolio position it to navigate this transition and maintain its relevance in the age of AI.

Despite the looming threat to its core search revenue, Google’s strategic diversification, robust growth in cloud computing, and significant investments in AI paint a positive picture for the company’s long-term prospects. The projected 11% margin of safety, based on conservative estimates, further reinforces the attractiveness of Google as an investment. While the future of search remains uncertain, Google’s proactive approach and commitment to innovation position it well to navigate this transition and maintain its position as a leader in the technology landscape.