Palantir Technologies, a prominent data analytics software company, presents a compelling case study in the importance of valuation when considering investment opportunities. Despite the company’s operational strengths and promising long-term prospects, its current stock price reflects excessive market optimism, creating a precarious situation for potential investors. While the company’s innovative software platforms, Gotham and Foundry, cater to essential government and commercial needs, the inflated valuation significantly outweighs the inherent value of the business, potentially exposing investors to substantial losses. The author, a self-proclaimed operational bull on Palantir, emphasizes the necessity of aligning strong fundamentals with reasonable valuations to achieve optimal investment returns. Currently, Palantir’s stock price neither offers long-term growth at a reasonable price nor short-term gains based on undervaluation, making it an unsuitable investment at present.

A key concern revolves around Palantir’s vulnerability to macroeconomic downturns, particularly recessions. While the company’s revenue streams, derived from government contracts and cost-saving commercial solutions, exhibit a degree of recession resilience, the exorbitant valuation amplifies the potential impact of any economic contraction. A moderate slowdown in revenue growth, typical during recessions, could trigger a disproportionately large decline in Palantir’s stock price due to the inflated expectations baked into the current valuation. Historical precedents, such as the dot-com bubble burst and the 2008 financial crisis, demonstrate the severe consequences of overvaluation for companies like Cisco, Amazon, and Google, which experienced dramatic stock price declines when growth expectations moderated or economic conditions deteriorated. The author highlights the probability of a U.S. recession in the coming years, based on forecasts by J.P. Morgan and Deloitte, and suggests that Palantir’s stock price could decline by 50% or more in such a scenario.

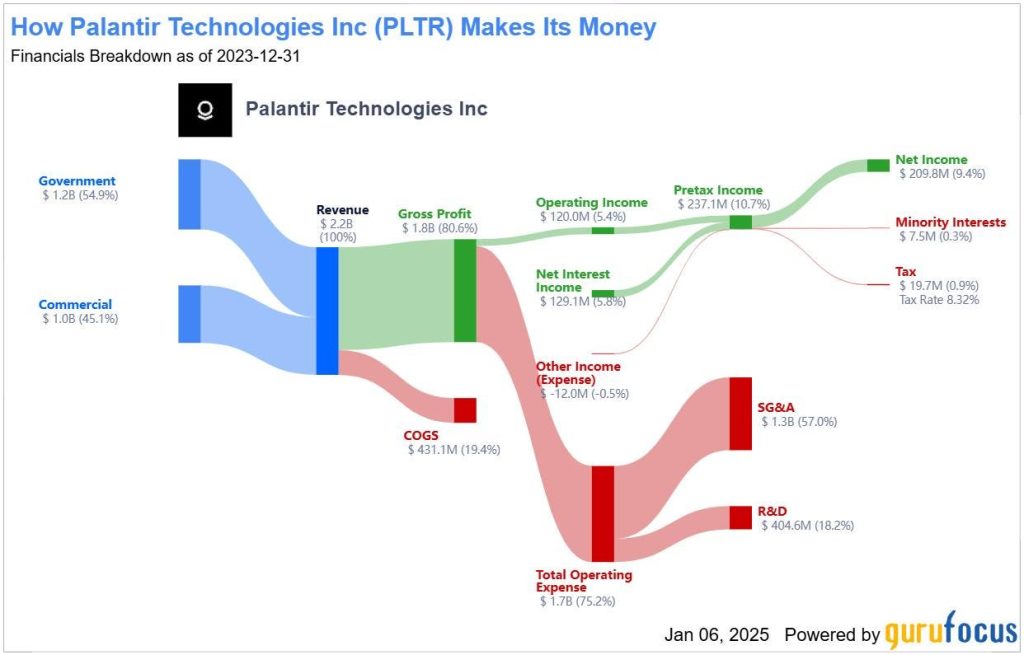

Palantir’s forward price-to-earnings ratio of nearly 160 and its trailing twelve-month EV-to-EBITDA ratio exceeding 300 underscore the extent of its overvaluation. These metrics indicate that the market has already priced in years of future growth, leaving little room for positive surprises and creating substantial downside risk. A realistic valuation model, projecting Palantir’s financial performance over the next five years, paints a less rosy picture. Assuming a 37.5% net income margin and a terminal price-to-earnings ratio of 75, a conservative estimate compared to similar companies like Tesla, the model arrives at a target price of $65.625 per share in 2029. This represents a compound annual decline rate of -4% from the current stock price of $80.55, highlighting the significant overvaluation. Furthermore, discounting this future price target back to the present using Palantir’s weighted average cost of capital reveals a negative margin of safety of -61.74%, further reinforcing the unfavorable risk-reward profile of the investment at current levels.

The author’s investment philosophy emphasizes the importance of patience and discipline, echoing the principles of value investing championed by Warren Buffett. Rather than chasing momentum-driven stocks or speculating on future growth, the author advocates for waiting for significant valuation declines to create attractive entry points. This approach prioritizes capital preservation and seeks to exploit market inefficiencies by acquiring high-quality companies at discounted prices. In the case of Palantir, the author suggests that a 50% contraction in valuation, potentially triggered by a recession, would present a more opportune time to invest. This strategy aligns with the principle of buying low and selling high, maximizing the potential for long-term capital appreciation.

The author’s analysis underscores the critical distinction between a company’s operational performance and its stock valuation. While Palantir undoubtedly possesses strong operational capabilities and a promising future, its current stock price reflects excessive speculation and unwarranted optimism. Investing in such a scenario exposes investors to significant downside risk, particularly in the event of an economic downturn. The author’s valuation model, based on conservative assumptions, suggests a substantial decline in Palantir’s stock price over the next five years, highlighting the importance of waiting for a more reasonable valuation before considering an investment.

The key takeaway from this analysis is the importance of patience and discipline in investment decision-making. While Palantir’s operational strength and long-term prospects are undeniable, the current valuation creates a significant hurdle for potential investors. The author advocates for a value-oriented approach, prioritizing investments in high-quality companies at reasonable prices. In the case of Palantir, waiting for a significant valuation correction, potentially triggered by a recession, would provide a more attractive entry point for long-term investors seeking to capitalize on the company’s true potential. This approach aligns with the principles of value investing and emphasizes the importance of separating the underlying business from the vagaries of market sentiment.